PRESS ANNOUNCEMENT

Environmental Finance: Extracting maximum value from ESG data

Bloomberg’s Global Head of Enterprise Data Content, Leila Sadiq, and Global Head of Sustainable Finance Data Solutions, Nadia Humphreys, outline top ESG data trends and what firms should know to keep pace in Environmental Finance’s annual ESG Data Guide.

Leila Sadiq (L), Nadia Humphreys (R)

Environmental Finance: What do you feel like people most misunderstand about ESG data?

Leila Sadiq: The value of integrated ESG data with foundational reference data and other datasets. When ESG data is viewed in isolation, it is not nearly as insightful or powerful as when ESG data points are pulled into a firm’s existing data architecture. Interoperability and linkage of ESG to datasets such as corporate structure is key for firms to gain a holistic understanding.

Bloomberg, with its strong foundation in data excellence for 40+ years, has always been very thoughtful about the quality and structure of our ESG data. We provide clear transparency metrics so clients understand the inputs and outputs, and build our data products in such a way that they can more easily be combined with our other industry leading foundational data for comprehensive insights to support investment decisions and regulatory reporting needs.

EF: What is one thing firms can do to better action their ESG data?

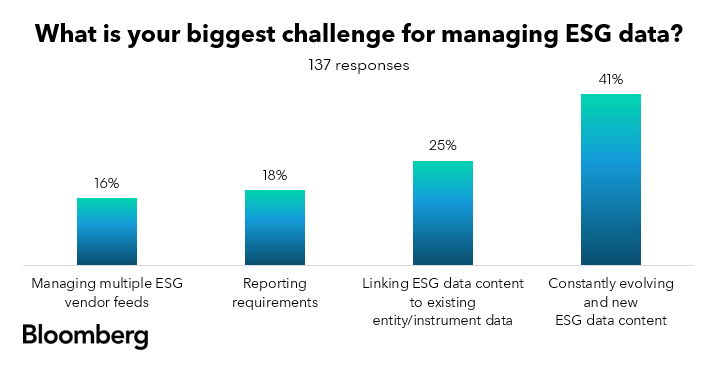

Leila Sadiq: We have seen rising frustration with growing volumes of ESG data and managing disparate ESG data solutions across providers. For example, our 2024 European ESG data survey revealed the leading ESG data management challenge was handling constantly evolving and new data (41%) followed by linking ESG data to existing data (25%). This is partly due to how time and resource intensive it can be to onboard new ESG data so firms may only do it once or twice a year.

Results from Bloomberg’s 2024 European ESG data survey

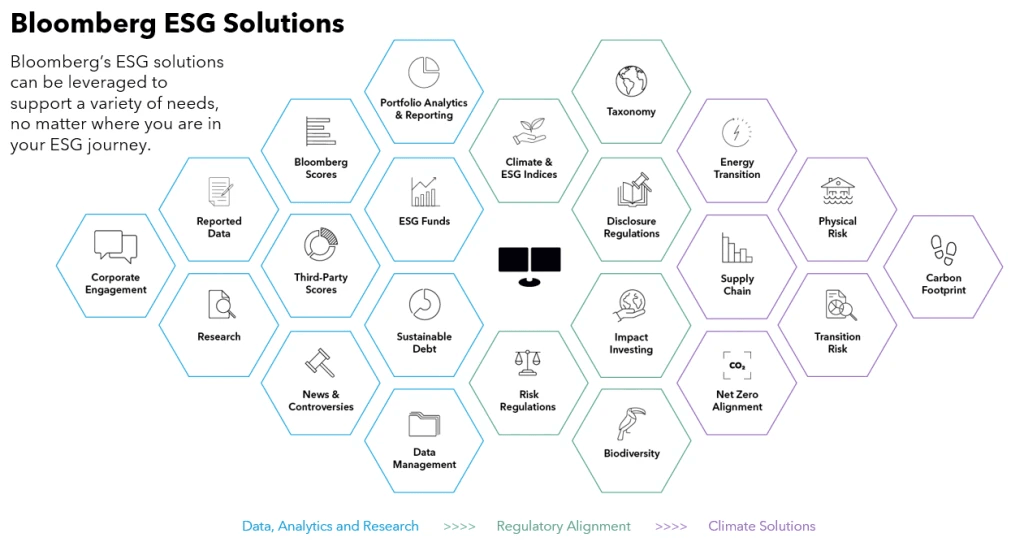

When contending with ESG data volumes and evolving content, quality and usability are critical factors. While Bloomberg is constantly enhancing its ESG & Climate data to meet clients needs, such as our recently launched CSRD solution, biodiversity offering, and sustainable investment data solutions to simplify screening processes, we are laser focused on ensuring our solutions fit seamlessly into firms’ workflows.

Additionally, firms can use powerful data management solutions, such as Bloomberg’s DL+ ESG Manager. This solution acquires, aggregates, organizes and links a customer’s Bloomberg Data License datasets, including Bloomberg’s ESG data, with other vendors’ ESG data into a single Unified Data Model.

EF: ESG regulations have been a big focus this year especially in preparation of CSRD reporting. What should firms know about complying?

Nadia Humphreys: CSRD brings welcome clarity and consistency to ESG reporting in and outside of Europe. However, who reports and what they report will change significantly from 2025. This presents investment opportunities but also operational challenges.

The first requirement is to have a trusted source of all CSRD disclosed data, and the ability to scale alongside the regulation to collect and manage that data.

The second is adjusting existing data management tools and investment processes to account for the new disclosed data. Earlier reported data may be inconsistent with CSRD obligations, or no longer be reported.

Bloomberg has observed that only ~20% of the quantitative metrics asked in CSRD are a direct match to the commonly reported ESG data we see in the market today so the scale of change management will be significant.

As the breadth and depth of disclosure changes, Bloomberg’s new CSRD data solution is positioned to help.

EF: Climate impact has also come up frequently this year. How should investment firms be thinking about it?

Nadia Humphreys: Climate change is a complex and interconnected landscape of data, and there is clear investor appetite to both protect long-term returns and invest in ways that have positive impact. Measuring this can be difficult. For example, understanding the link between an investment, its value chain and the consequences on biodiversity, is a daunting data undertaking.

Bloomberg has a vast network of supply chain relationships and geospatial data to show whether sustainability claims made on the sourcing of raw materials can be verified. Bloomberg has also partnered with the Natural History Museum to provide a time series of ecosystem health. When mapping that dataset to Bloomberg’s 1.1 million physical assets, we can demonstrate the positive or negative impact on ecosystem health.

Above all, to maximize sustainability outcomes, firms need information they can trust.

To learn more about Bloomberg’s suite of ESG data solutions available for enterprise-wide use, visit our website here or view Bloomberg’s Environmental Finance ESG Data Guide entry here.

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.