Background

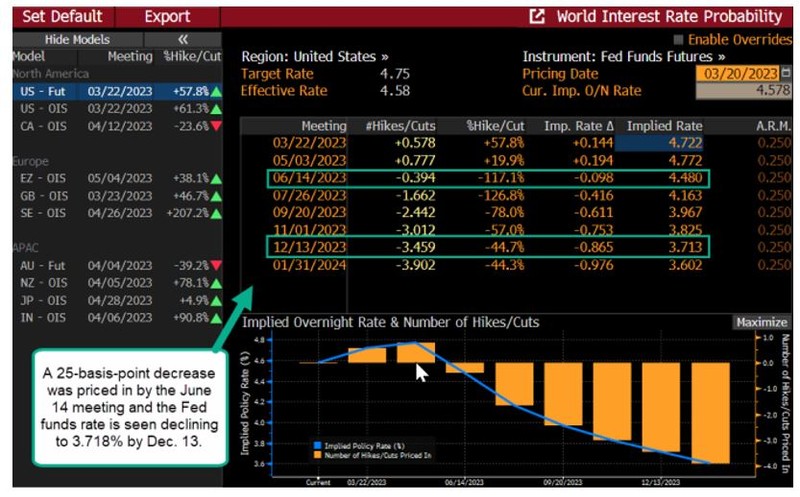

On March 22, Federal Reserve Chair Jerome Powell announced a rate hike of 25 basis points for the federal funds rate, setting a target range of 4.75% to 5%. Ahead of the decision, futures traders priced in a March increase while expecting a rate decrease in June.

The rate increase was the ninth straight by the Fed and occurs less than two weeks after the collapse of Silicon Valley Bank, which was the second-biggest bank failure in U.S. history. Due to “unusual and exigent” circumstances, the Fed launched an emergency cash facility for banks to help limit contagion from SVB’s downfall. These events left many questioning the effect on the Fed’s desired financial tightening.

During a news conference, Powell assured that the banking system is stable and emphasized the measures taken to provide liquidity. However, he acknowledged uncertainty about how banking disruptions will affect lending conditions and the economy.

Separately, Treasury Secretary Janet Yellen testified before Congress that providing “blanket” deposit insurance to stabilize the banking system is off the table.

The issue

The Fed’s projected year-end interest rate remained unchanged at 5.1%. However, with the updated dot plot, some officials are showing a slightly more hawkish stance.

Stocks rose at the start of Powell’s news conference, though a reversal occurred as the Fed hinted at further hikes. Yellen’s comments also contributed to a selloff in equities, leading to declines by all 22 stocks in the KBW Bank Index. The S&P 500 closed down 1.7%, reflecting a wider stock retreat.

Tracking

Use Bloomberg’s WIRP, DOTS, ECFC and TDSQ tools to track the latest moves in markets and rates expectations. Run NSUB FFMSTORY to subscribe to functions-focused articles.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.