Bloomberg Intelligence

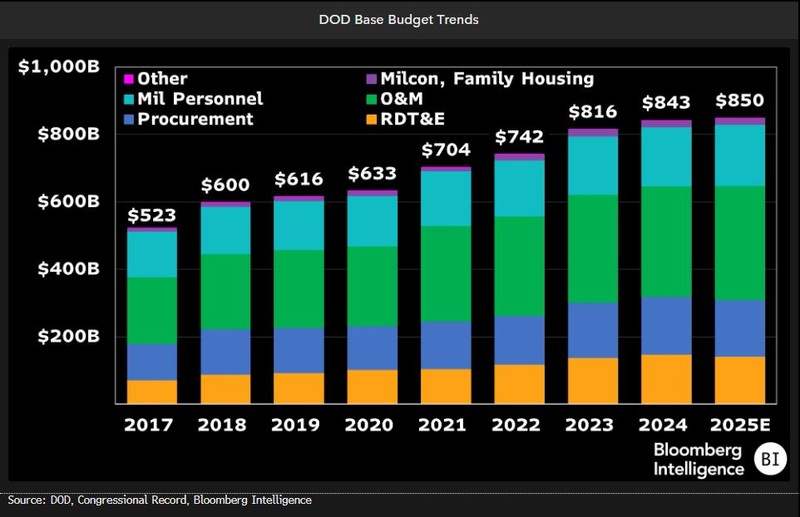

US defense discretionary spending is projected to rise 0.9% to $850 billion in fiscal 2025, conforming to limits under the Fiscal Responsibility Act of 2023, though this level may be a 1.5% reduction in real terms, given consensus for inflation. The 2025 budget prioritizes readiness, the ability to fight near term and personnel vs. modernization efforts, suggesting the need to boost investment in future capabilities.

US Fiscal 2025 Defense Budget edges up nominally

The Biden administration seeks a fiscal 2025 defense budget of $850 billion, up 0.9% nominally and adhering to the limits imposed by the Fiscal Responsibility Act of 2023. The request is down $13 billion, or 1.5%, we calculate, when accounting for consensus’ inflation assumption of 2.4% in 2025. The Defense Department prioritizes readiness, the ability to fight near term and military personnel over modernization and longer-dated capabilities amid fiscal constraints. It pushed out investments in fifth- and sixth-generation fighters, trimming procurement quantities and funding for the F-35, and development work on the Air Force’s NGAD and the Navy’s F/A-XX. However, future budgets will need to step up modernization efforts.

Congress offered their versions, which shifted funding but kept the total budget largely in line.

Headline number optically big, but share of GDP shrinks

Though the Pentagon’s discretionary budget moves closer to the $1 trillion mark, defense outlays as a percentage of US GDP continue to trend lower, shrinking to 3% in the fiscal 2025 budget request from 11.4% in 1953 at the end of the Korean War. Rising costs for Social Security (outlays of $1.55 trillion, 5.3% of GDP), Medicare ($936 billion, 3.2%) and Medicaid ($589 billion, 2%) are crowding out funding for discretionary programs since raising taxes and the debt ceiling are politically unpalatable. The Office of Management and Budget projects US receipts will average 19.7% of GDP in 2025-34, nearly consumed by mandatory outlays (15.3%) and net interest (3.4%).

This leaves little to no capacity to increase the defense budget without expanding the deficit, unless Congress addresses entitlements and national debt.

Modernization billpayer amid fiscal constraints

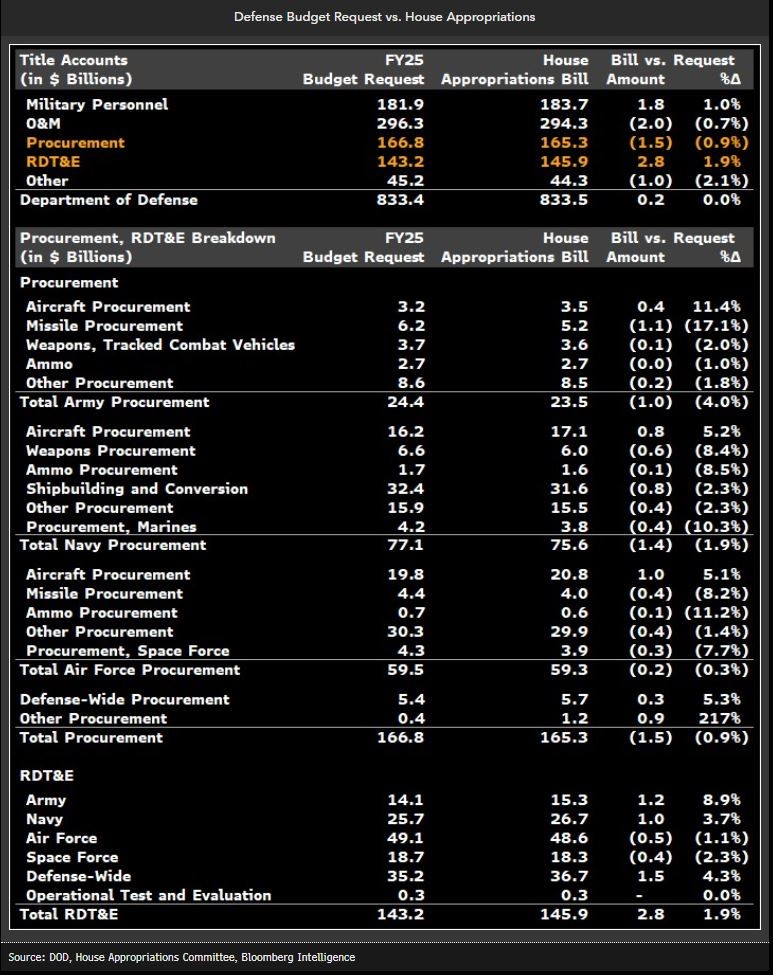

The Pentagon’s modernization efforts could decline 3% to $311 billion in fiscal 2025 as the military prioritizes readiness, the ability to fight and personnel amid a fiscally constrained backdrop. Modernization comprises procurement and research, development, test and evaluation (RDT&E), and represents a critical source for defense contractors. Both accounts are expected to slide, by 2.6% to $168 billion and 3.5% to $143 billion, respectively, as the Pentagon defers funding on programs that won’t deliver capabilities until the 2030s, including the Navy’s F/A-XX, the Air Force’s NGAD and the Space Force’s demonstration and experimentation tranche.

Operations and maintenance, a proxy for readiness and key source for government services, is projected to gain 3.4% to $338 billion. Personnel funding is up 3.2% to $182 billion.

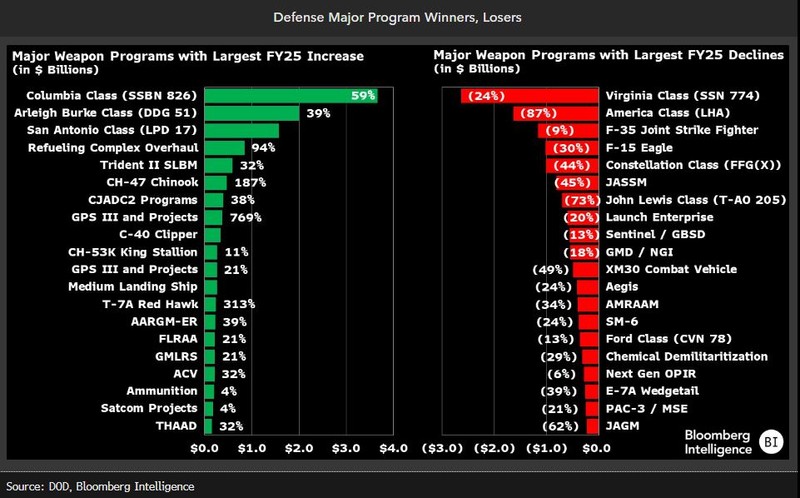

Navy has mixed success in budget request

Navy shipbuilding tops both winners and losers in the fiscal 2025 budget request, with the F-35 and F-15 also acting as billpayers. Columbia Class funding is poised to jump 59% to $9.9 billion and includes investments in the submarine industrial base. The Navy will fund one San Antonio Class warship in 2025, the Marines’ top unfunded priority and a positive for HII. Offsets include cutting one Virginia Class from its steady two-a-year ordering cadence as General Dynamics, HII and the supply chain struggle with production targets and a two-year ordering delay on the next Ford Class carrier (CVN 82), which could set back HII and the shipbuilding industry.

F-35 procurement is 68 jets in 2025 vs. 83 in the prior year’s request, and the Air Force will cut six F-15EXs, with the total program tally pared by four to 90 fighters.

House Appropriations Defense Bill shuffles funding

House appropriators marked up its fiscal 2025 defense spending bill, keeping the top line intact but shuffling funding. RDT&E gains are $2.8 billion above request on higher defense-wide, Army and Navy funding, while procurement will be cut by $1.5 billion, pressured by the FFG frigate, long-range hypersonic weapon and medium landing ship. RDT&E winners include Defense Innovation Unit fielding, up $600 million with funds available for Replicator tranche 2, and the Navy’s classified Chalk Coral, up $413 million and above INDOPACOM’s unfunded priority. Northrop’s Sentinel funding is down $324 million and under scrutiny given the Nunn-McCurdy breach.

There’s also provision for more Lockheed aircraft, with $690 million for eight additional F-35s, $522 million for another four C-130Js and $81 million on one more CH-53K helicopter.