Three takeaways from the Emerging Market Outlook

This analysis is by Bloomberg Intelligence Economist Ziad Daoud and Bloomberg Intelligence Economist Adriana Dupita. It appeared first on the Bloomberg Terminal.

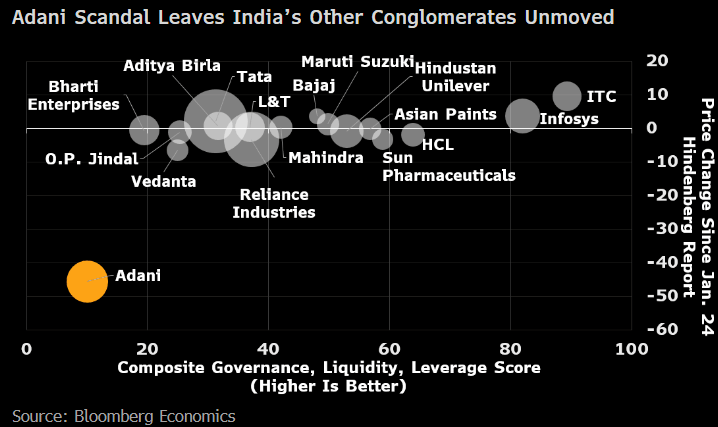

Financial risks in emerging markets have eased, with most currencies up this year. For most economies that is a good sign, but there are a couple of outliers — Russia and Turkey sold foreign assets to prop up their exchange rate. As financial threats abated, political and governance risks have risen. A presidential assault on central-bank independence in Brazil and a stock-market rout at India’s Adani Group provide recent examples.

Our big takeaways from last month:

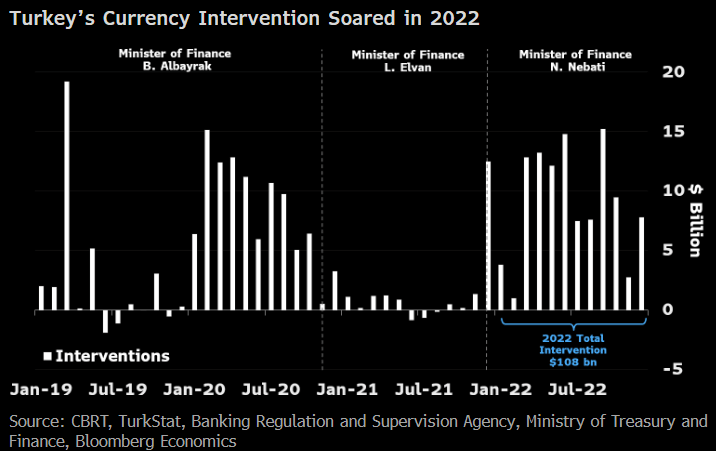

1. Foreign-exchange interventions are still occurring. Emerging markets experienced a respite in the last two months, but that didn’t stop some nations from trying to prop up their currencies. Russia is selling yuan holdings to offset the effect of reduced oil and gas revenues on the ruble. In Turkey, we estimate the central bank’s interventions totaled $108 billion in 2022 to limit the impact of excessively easy monetary policy.

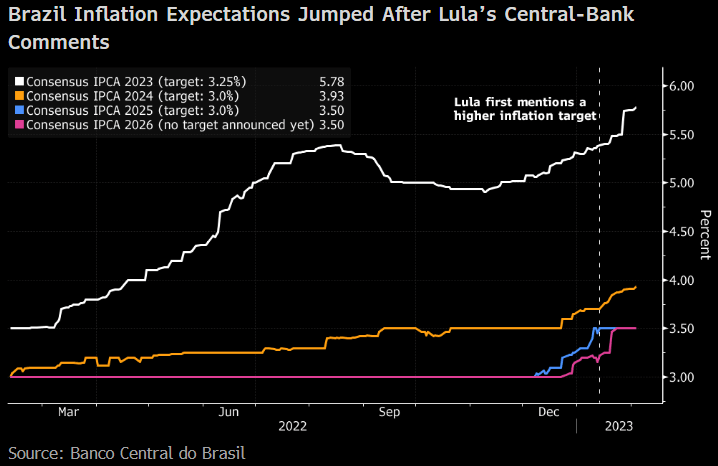

2. Political risks are shaping economic outcomes. Protests in Peru are costing the economy 2% of GDP. In Brazil, politicians are cutting the currency rally short. The storming of government buildings by supporters of former president Jair Bolsonaro spooked investors. Now that these have ended, President Luiz Inacio Lula da Silva’s repeated criticism of central bank independence is taking a toll on markets.

3. Governance risks are a rising — but not yet major — concern. The stock-market rout at Adani Group has raised questions about corporate governance in India. But our analysis shows Adani’s poor governance, liquidity and leverage conditions are outliers among the country’s large businesses. Indian firms will also benefit from the out-performance of the country’s real GDP growth relative to the rest of the world. In Brazil, the discovery of massive accounting inconsistencies at Americanas — a large retailer — has added to corporate credit concerns amid pressure from high interest rates.