Bloomberg Professional Services

This article was written by Sean Murphy, Equity Indices Product Manager at Bloomberg.

REITs have allowed investors of varying means to access a segment of the market that was largely reserved for the wealthy: real estate. REITs, or Real Estate Investment Trusts, were permitted into law as an investment vehicle in 1960, with the objective of allowing broader access to invest in real estate in a diversified fashion. Although a REIT is from a sole issuer, their portfolio may consist of many properties across regions and industries. The overwhelming majority of the US real estate sector is now structured as REITs, with over 95% of the newly launched Bloomberg REIT & Real Estate Aggregate Index (USAGRT) classified as such.

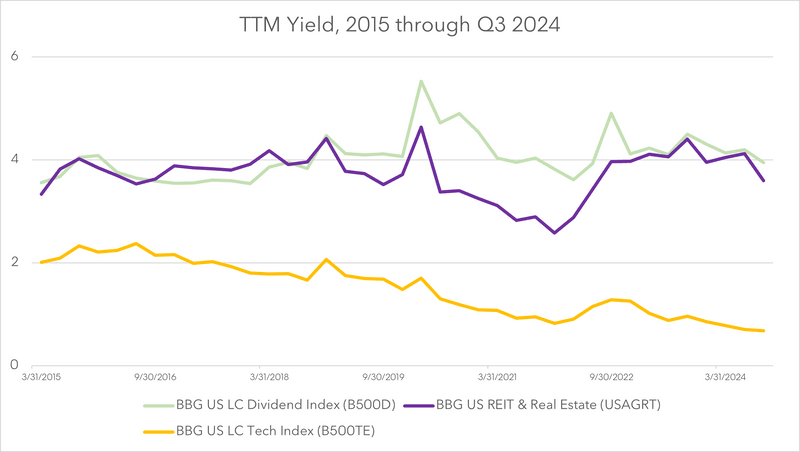

REITs are a unique corporate structure available to only companies that generate a large portion of gross income from real estate or the real estate lending market (banks are not eligible). This includes companies that generate profits from rent or leases on many different property types like retail stores, office space, or residential properties. Investors can buy shares of REITs in the same way they can for other publicly traded companies or ETFs. Unlike traditional corporations, REITs can avoid paying income tax at the corporate level. To take advantage of this, a REIT must distribute at least 90% of earnings as dividends to shareholders. For this reason, income-oriented investors have often found REITs attractive due to their high dividend yield.

The evolution of the REIT space

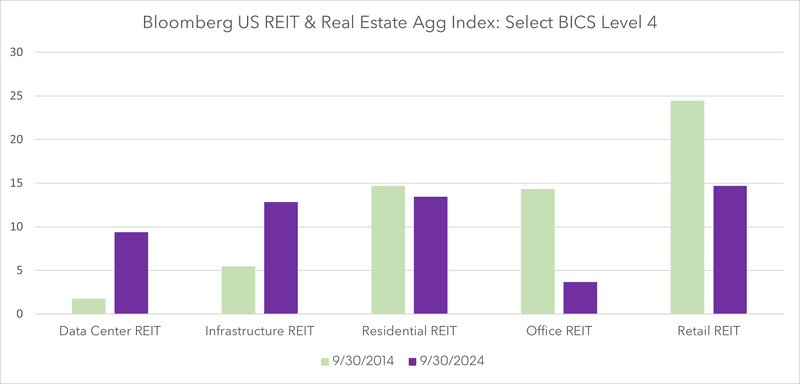

Many investors associate the REIT space with traditional real estate operations such as residential, office, and retail. But just as the tech sector has reshaped equity markets, it has also reshaped the real estate sector. In comparing today’s Bloomberg US Aggregate REIT & Real Estate Index (USAGRT) to that of 10 years ago, this evolution becomes clear. What were once niche or specialized segments of the real estate sector are now major components.

Source: Bloomberg. Chart reflects exposure of Bloomberg REIT & Real Estate Index (Ticker USAGRT)

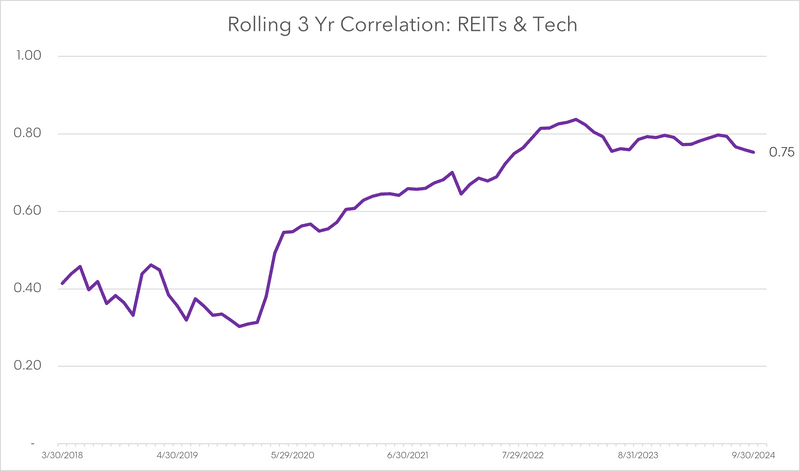

While the retail segment remains the largest sub-industry, its weight has declined over the past decade. Office REITs have had an even greater reduction in weight on a relative basis, now sitting as one of the smallest segments in the US REIT market. The continued expansion of online retail coupled with the new work-from-home dynamic have had a major role in these reductions. Some of the key beneficiaries of these trends have been other REIT categories, as the infrastructure needed to bring about these changes is rooted in the real estate market as well. For example, Equinix operates interconnected data centers, with a focus on developing a network and cloud-neutral data center platform. American Tower owns, operates, and develops wireless communications and broadcast towers in the United States. Both companies are integral components of the evolution of business, and both names operate as REITs. Equinix is categorized as a data center REIT, while American Tower is an Infrastructure REIT. These segments, as the above chart shows, have grown in both market capitalization and weight in the broader Bloomberg REIT index. As a result of this change in composition, the broad REIT universe has increased in correlation to the Tech sector, as these segments are closely linked to many of the innovative themes we see in the market, such as A.I.

Source: Bloomberg. Chart reflects rolling 3-year correlation (3/30/2018 – 9/30/2024) of Bloomberg REIT & Real Estate Index (Ticker USAGRT) and Bloomberg 3000 Tech Index (Ticker B3000TE)

Many investors remain wary of the real estate and REIT space, as the shift in makeup was in part the result of the struggles experienced in the retail and office subsectors. In addition, the sector requires a high degree of leverage, resulting in a sensitivity to rising rates. Nonetheless, performance has begun to shift, and investors have taken note. In the US, investors have poured approximately $4.5 billion into REIT and real estate focused ETFs in the past 3 months, more so than any other sector. This investor interest may stem from several characteristics of the REIT space, as well as changes on the macro front. For starters, while the sector is vulnerable to moves higher in rates, it stands to benefit from a move lower. As the Fed has begun to cut interest rates, the cost of capital for the sector may improve, especially in a soft-landing scenario. In addition, lower rates in fixed income could make higher dividend sectors more appealing to income investors.

Portfolio implementation

Despite the compelling levels of income offered by REITs, dividend investors may have little exposure to the space. In examining US equity dividend ETFs, more than a third have no exposure to real estate. Taking a closer look at just the 10 largest such funds, the average weight to real estate is only 1%. REITs are ineligible for inclusion in many dividend indices, as the dividends they distribute are largely ineligible for qualified dividend income tax rate. As a result, taxable investors should expect to pay ordinary income rates on these distributions regardless of their holding period. Nonetheless, REITs offer attractive levels of income even on an after-tax basis. In addition, many equity income investors have the unintended consequence of being underweight the technology space. This is in large part due to the relatively low yield the sector tends to distribute when compared to others like utilities and energy. As a result, many US dividend strategies have struggled to keep pace with the performance of the broad market, which has been led by high flying, low yielding tech names. Including REITs into an equity income portfolio may help investors gain exposure to technological innovation without a meaningful sacrifice in yield.

Source: Bloomberg. Chart reflects trailing 12-month yield of indexes shown (3/31/2015-9/30/2024)

The creation of the REIT structure brought about a revolution in real estate investing. As the space has evolved, so have REIT indices. As new segments have grown in size and influence, the broad REIT space looks vastly different than it once was, but still offers compelling levels of income. The real estate sector is more diversified, with varying drivers of risk and return for the different components. Bloomberg has launched a REIT index family across developed markets, with indices spanning broad regions and countries. This will be followed soon by more granular indices at the industry and sub-industry level. While investing broadly in the REIT space has its benefits, examining specific segments can allow for greater insights and more precise and intentional investing.