Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Analyst Andrew Galler, with contributing analysis by Ann-Hunter Van Kirk. It appeared first on the Bloomberg Terminal.

New pet treatments for cancer, osteoarthritis and cardiorenal disease can increase drug sales by double digits through 2032, and we find that longer life spans suggest that forecasts for over $5 billion in growth may be conservative since such indications are linked to age. Expensive therapies like monoclonal antibodies can bolster Zoetis and other leaders.

Can human health provide a road map?

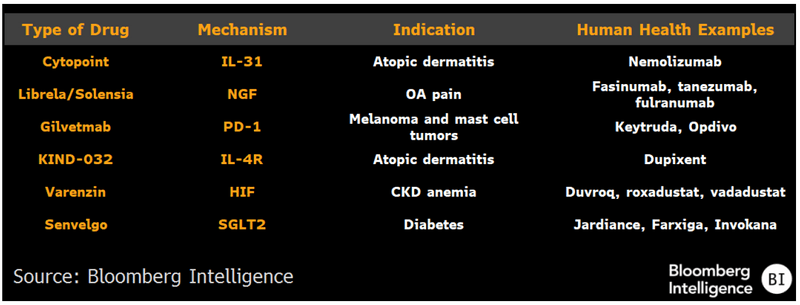

As the animal health industry moves into therapeutic areas that are shared with humans and where underlying pathologies are similar, human treatment pipelines provide a wealth of targets to test. We believe the approach will be particularly common as the pet health industry continues to embrace biologics, since there is little difference in metabolism for systemically administered drugs. This especially makes sense for diseases for which there are established human health products or pipelines, such as oncology or immunology.

Among the potentially big-selling animal health products approved in recent years, many have mechanisms that either have been or are being tested in humans for similar conditions.

Animal, Human Health Products

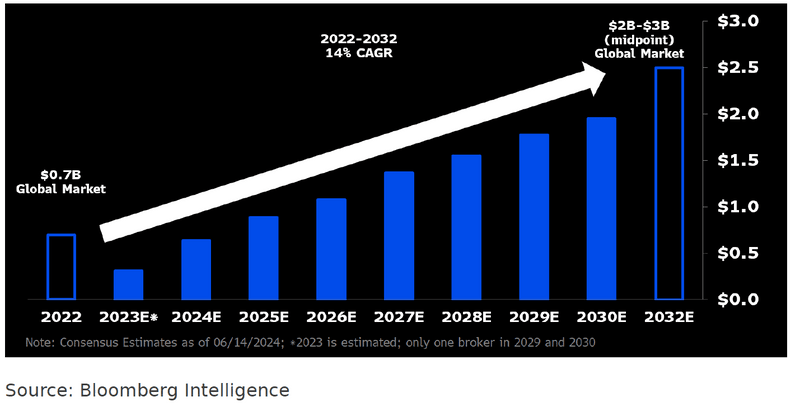

New drugs drive Zoetis’ osteoarthritis outlook

Zoetis’ expectation for $2-$3 billion in revenue from the osteoarthritis pain market by 2032 implies 14% annual growth, but we believe that may be conservative as consensus sees the company’s monoclonal antibody treatments Librela and Solensia eclipsing $1 billion in annual sales as early as 2026. Osteoarthritis pain had been treated with nonsteroidal anti inflammatory drugs, including Previcox and Rimadyl, which log about $400 million a year. Zoetis estimates that it generates 39% of today’s roughly $700 million global osteoarthritis pain market.

Recent media reports have raised concerns around the Librela and Solensia safety profile. But many of the reported adverse events already are on the label from a European field trial and Zoetis is confident in their safety, which is reflected in high veterinarian confidence.

Zoetis Osteoarthritis Sales Projections (Billions)

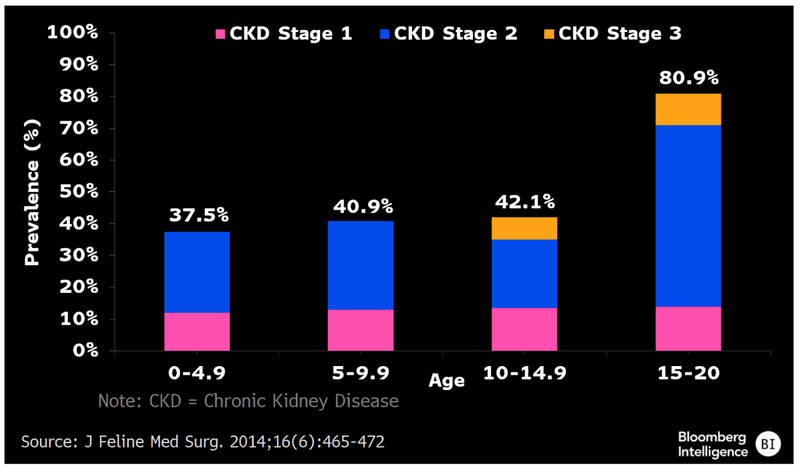

Feline chronic kidney disease is growth area

Pet longevity may fuel rapid growth in the $300 million renal market. Over 80% of cats over age 15 have chronic kidney disease, according to recent NIH studies, and CKD is implicated as the cause of death in up to a third of cases. Zoetis expects that monoclonal antibodies could generate renal market revenue of $1 billion a year by 2032, suggesting annual gains around 13%. IDEXX’s screening tool for SDMA, a kidney function biomarker, can lead to earlier diagnosis of CKD, as 67-70% of kidneys are dysfunctional before symptoms manifest.

Treatments for the condition largely have been limited to palliative care, with Elanco’s Varenzin focusing on anemia in cats while its Elura targets feline weight management. Boehringer Ingelheim’s Semintra is labeled for reduction of proteinuria for cats with CKD.

Chronic Kidney Disease in Cats

Oncology is set for more advanced treatments

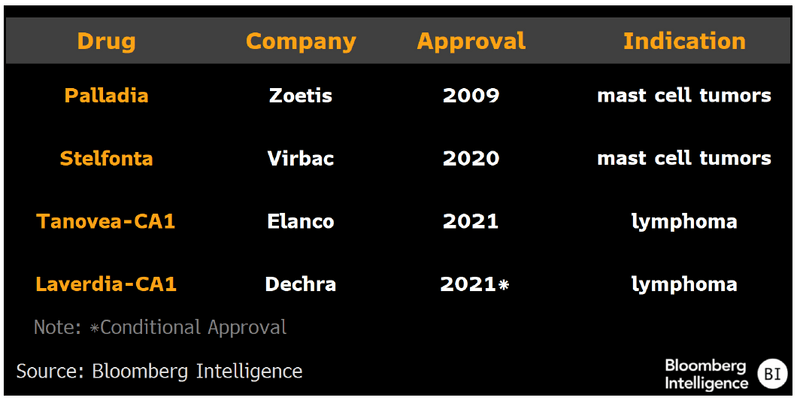

We expect that pet oncology can be an $800 million market by 2032, suggesting 10% annual growth, since cancer is the leading cause of death in dogs, at 47%, and cats, at 32%, according to the Veterinary Cancer Society. Many pets are treated with lower doses of human drugs, like chemotherapies, but demand for animal-specific therapies is increasing as the population of animal companies gets larger and older. It’s unknown if PD-1 therapy can change oncology care for animals as it did for humans, though Merck & Co. has received conditional license approval for a canine PD-1 antibody, gilvetmab, to treat melanoma and mast cell tumors, one of the most common canine tumors.

Precision oncology may be another avenue for R&D, given the high overlap in oncogenic mutational hotspots between dogs and humans.

Approved Canine Oncology Drugs

Cardiology market can reach $700 million

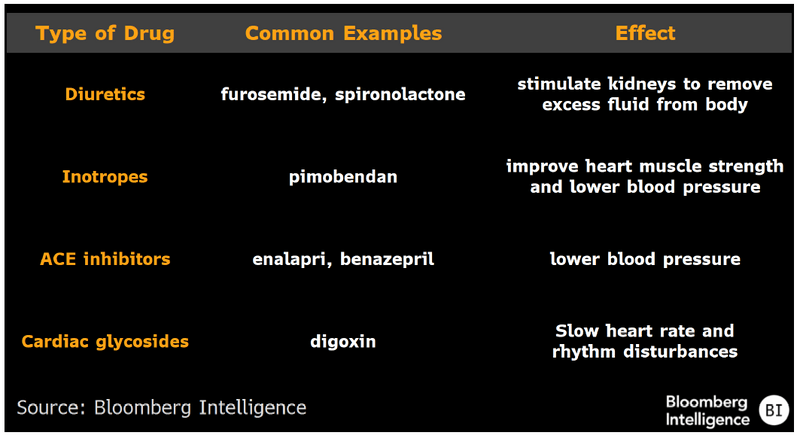

Cardiovascular disease drives around 10% of canine deaths and could reach $700 million in sales by 2032, or 11% annual growth, likely driven by aging populations and improved diagnostics. Chronic degenerative valve disease accounts for about 75% of canine heart illness, according to VCA Animal Hospitals, with older dogs and smaller breeds at higher risk. About 60% is degenerative mitral valve disease (DMVD), 10% tricuspid valve and 30% both valves. Treatments like heart surgery usually aren’t an option for dogs, particularly smaller breeds, and the standard of care largely is limited to targeting symptoms with drugs such as diuretics or ACE inhibitors.

Boehringer’s Vetmedin line focuses on delaying the onset of congestive heart failure in dogs with myxomatous mitral valve disease.

Standard of Care for Canine DMVD

GLP-1 weight-loss mania’s next horizon

As the proportion of overweight cats and dogs rises and related conditions increase, we expect weight-loss medications will become another emergent category in pet health. Here, too, manufacturers are following the path of human therapies, with GLP-1s leading the pipeline for canine and feline weight management. Okava Pharmaceuticals is developing a reformulated exenatide, and Better Choice in February acquired Aimia Pet Healthco to get GLP-1 assets.

Animal health leaders like Zoetis and Elanco have been quiet about their aspirations in the field, however. Zoetis had marketed Slentrol, a microsomal triglyceride transfer protein inhibitor, for weight loss following approval in 2007 but ultimately discontinued it due to low demand.

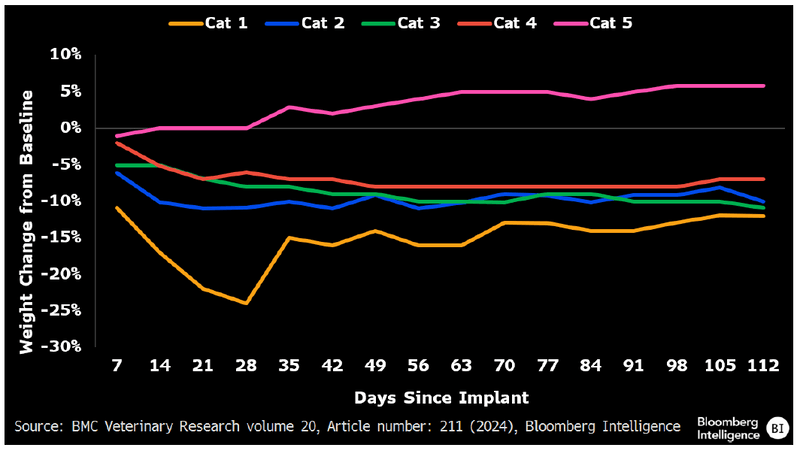

Feline Weight Loss on Okava’s OKV-119