Functions for the Market

Bloomberg Market Specialists Jon Pilarski and Takuya Nagasawa contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

The market for Ozempic and similar GLP-1 receptor agonists is booming, driven by their effectiveness in promoting weight loss and addressing other health conditions. Goldman Sachs Group Inc. estimates the obesity-drug market to reach $130 billion by 2030, up from an October forecast of $100 billion.

Analysts have already priced in rapid growth for Eli Lilly and Novo Nordisk, two of the major manufacturers of the drugs. At 54.6 times, Eli Lilly is at a 208% premium to the peer average, versus a 108% average premium over five years. Novo Nordisk’s premium is 114%.

A planned Novo Nordisk factory in North Carolina will double the company’s production footprint in the US. Novo Nordisk is also planning to acquire manufacturing units from Catalent Inc., a contract manufacturer, by year end. The combined manufacturing sites for Novo Nordisk and Catalent include factories that span the globe, including the US, Belgium, and Italy.

The issue

While demand for these drugs continues to rise, the high cost of GLP-1 medications has led some insurance companies and employers to limit or completely halt coverage.

The North Carolina health plan for state employees dropped coverage of weight-loss drugs earlier this year due to a projected $1.5 billion loss by 2030 if coverage continued. Michigan’s largest insurer also joined the resistance movement.

Research on cardiovascular outcomes and positive impact on other comorbidities could help expand insurance coverage of GLP-1 drugs, with pricing likely easing as new entrants come to market, Michael Shah, Senior Industry Analyst at Bloomberg Intelligence, recently wrote.

For example, tirzepatide — the chemical compound Eli Lilly sells under the brand name Zepbound for weight loss — has been found to reduce the severity of obstructive sleep apnea in obese patients. That indication would “differentiate it in an intensifying GLP-1 class and along with broader insurer coverage, could help unlock Medicare, where drugs aren’t covered for obesity alone,” Shah wrote.

Revenue estimates for Zepbound for the coming four years are on a rising trend, with 2028 forecasts climbing to $18.4 billion versus $4 billion at the start of 2022.

Tracking

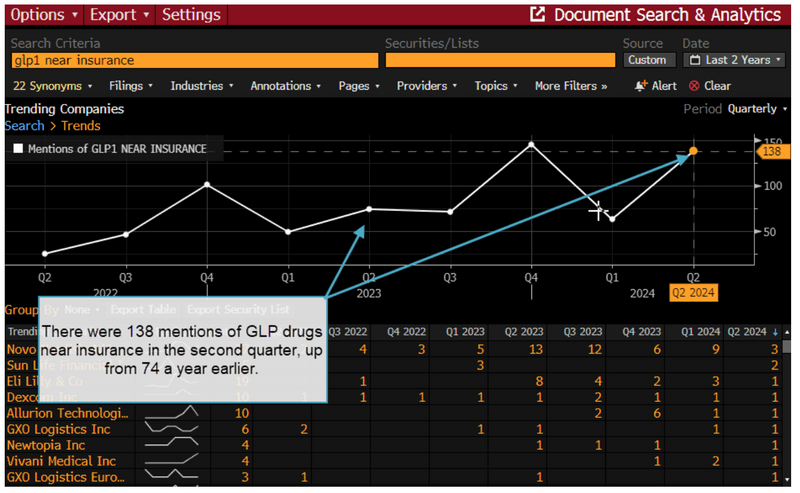

The Terminal’s Document Search function — which now includes curated news and medical journals — can be used to track mentions of glucagon-like peptide or GLP-1 drugs, and the View Trends tab allows users to see surging mentions.

Use Bloomberg’s DS, NH AXL, EEG, EQRV and MAP tools for analysis.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.