This analysis is by Bloomberg Intelligence ETF Analysts Rebecca Sin and Athanasios Psarofagis. It appeared first on the Bloomberg Terminal

The stereotype of physical exchange-traded funds (ETFs) being superior to synthetic ones can be put to bed: some synthetic ETFs do outperform their physical counterparts. Depending on the underlying assets, there’s room for both physical and synthetic to coexist as the needs of investors vary by region and tax jurisdiction.

What are synthetic ETFs?

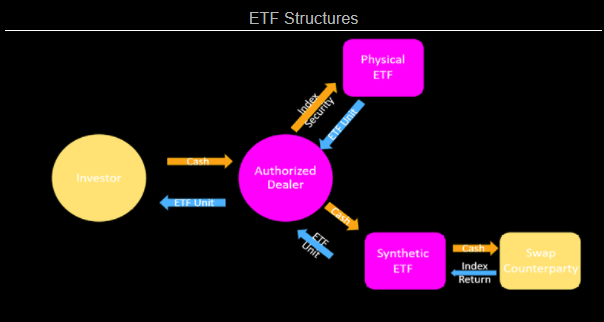

Most ETFs are physical in nature, replicating an index by physically buying all securities of the index. An example would be the iShares S&P 500 (CSPX LN), where the ETF physically owns all the securities of the S&P 500. A synthetic ETF would instead use a derivative or swap as the replication method. For example, the iShares S&P 500 Swap UCITS (i500 LN) has a swap agreement which tracks the S&P 500.

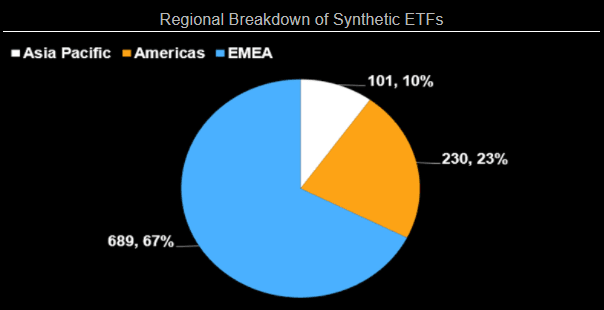

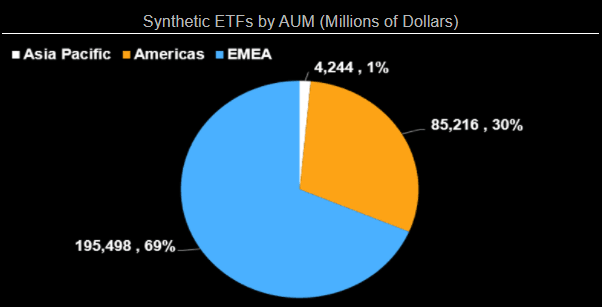

In the whole ETF universe, only 1,020 ETFs are synthetic, accounting for approximately 11% of the universe; of that number, 67% are in EMEA, 23% in the Americas and 10% in the Asia-Pacific. From an assets-under-management perspective, almost 70% are from EMEA due to the UCITS scheme.

Underlying assets matter

There has been a long debate over synthetic vs. physical ETFs and there are pros and cons to both. Depending on the underlying assets, synthetic may be the preferred choice for replication method. Some ETFs simply can’t be physical as the cost would outweigh the performance, such as oil ETFs where storage and transport costs to move oil would be very high. For other ETFs, there may be tax advantages to using a swap as opposed to a physical structure.

Performance of synthetic vs. Physical ETFs

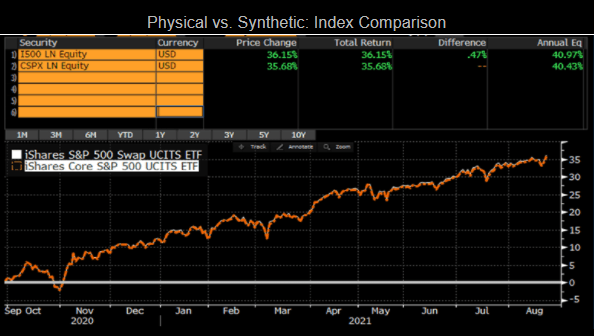

In some cases, synthetic can end up outperforming physical. For example, in September 2020, iShares launched an S&P 500 swaps version (I500 LN) that is identical to its physical S&P 500 ETF (CSPX LN) and on a one-year basis, the swap version has performed 47 basis points better than the physical ETF. The difference in performance is due to the replication method of swap vs. physical.

Comparing replication methods

Swap-based ETFs may offer lower trading differences and this is due to a lower withholding-tax drag. For instance, the i500 LN pays 0% withholding tax as the swap/derivative is exempt. Some physical Irish ETFs, such as the CSPX LN, pay 15% withholding tax on U.S. dividends.

From an AUM perspective, EMEA leads with almost 70% of synthetic ETFs partly because the UCITs regime offers tax benefits for many investors in the region. America has about 30% of synthetic ETFs, mainly in commodities.

Not All synthetic ETFs are created equals

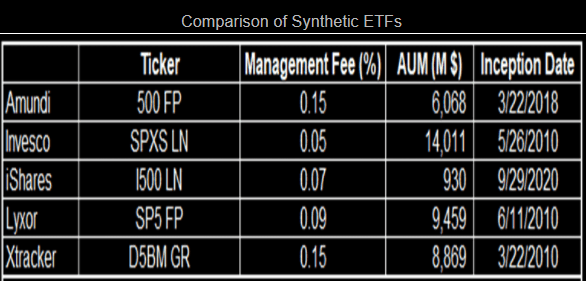

Even among S&P 500 synthetic ETFs, performance isn’t equal — it can differ depending on choice of swap counterparty, whether the swap is written on the gross or net index, the cost of managing the fund, and the fee structure (not all swap-fee structures are represented in the management fee). A swap written on a net benchmark may be more volatile and can lead to a higher tracking error, which is the result of implied vs. expected dividends priced into the swap. Looking at the fee structures of five ETFs, even though Invesco is the cheapest, iShares has the best performance.