Silk Road opens up Saudi investment options to China investors

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analysts Edmond Christou and Francis Chan. It appeared first on the Bloomberg Terminal.

New Saudi ETFs in Hong Kong may offer Chinese investors a better risk-return profile than local lenders, based on BI analysis. This initiative is a result of greater trade flows between Asia and the Gulf along the so-called Silk Road. Saudi lenders’ asset growth is solid like Chinese peers, yet may deliver high-single-digit 2024 EPS growth, with help from better margins and $80-a-barrel oil. Profit growth at most of the 11 Chinese banks BI follows may be in the low-single digits at best in 2024, with the risk of higher provisioning due to accelerating bad property loans. Chinese bank margins may contract this year and offset low-double-digit asset growth, with scope for ROE to miss the 10% consensus and underperform 13-14% for Saudi peers expectations in 2024-25. Indian banks are more expensive than Saudi rivals, but risky.

Systemic risk and sluggish revenue prospects render Chinese banks’ low valuations uninspiring, whereas economic expansion, superior loan and capital quality make higher Saudi peers’ metrics look justified, even though both are deemed growth stocks. Interest-rate cuts are a setback for Chinese-bank margins, unlike their Saudi counterparts.

Similar growth pace, yet divergent ROE, credit risks

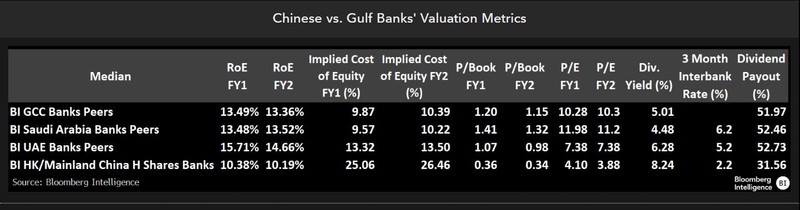

Chinese lenders’ lower valuations mean they have been viewed as catch-up plays, with ICBC, CCB, AgBank and BOC’s share prices up 4.8-6.6% in March. Their price-to-book (P/B) ratio of 0.4x is low vs. Saudi peers’ 1.4x, given both have similar growth trajectories, but is nevertheless uninspiring. Expected return on equity (ROE) for Chinese banks is about 10% in 2024-25 (vs. 13.5% for Saudi peers), with a lofty implied 25-26% cost of equity over 2024-25 (more than double the 10% for Saudi peers) reflecting lingering systemic risk and sluggish revenue prospects.

UAE peers’ valuations also point to the cyclical economy and risks of a slowing property market, with an implied cost of equity the highest of Gulf lenders at 13%, and a 1.1x P/B below that of regional peers, despite the share-price rally since the pandemic.

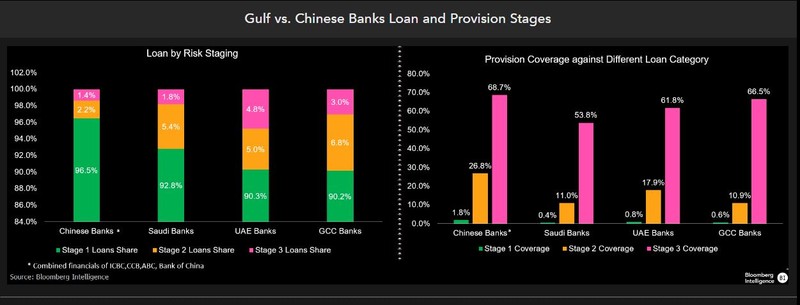

Asset quality stable at Saudi banks, unlike Chinese peers

Chinese banks’ credit exposure to real estate developers is 5-6% of their overall loan books, based on our analysis, yet the share of the four major lenders’ Stage 1 “good loans” remained surprisingly high at 96.5% of total loans in 2023, surpassing that of Saudi peers. This suggests Chinese banks’ loan downgrades aren’t yet fully reflected. Saudi lenders’ share of Stage 1 loans was 93% of 2023’s total, but this figure already integrates legacy troubled contracting-sector exposure. Similarly, UAE banks’ staging profiles account for lingering real estate exposure which has recovered since the pandemic due to higher collateral values.

Chinese banks have set a high 180 bps coverage provision for Stage 1 loans (vs. 60 bps at Gulf peers), indicating the build-up of a buffer to combat any asset-quality weakening this year.

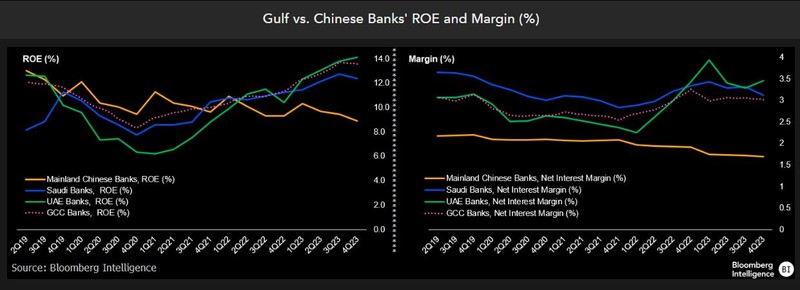

Wide margins send Saudi banks’ ROE above Chinese lenders

Margin headwinds means that Saudi banks’ return on equity (ROE) was less than that of UAE and wider gulf peers, yet nevertheless outpaced Chinese counterparts since 1Q22. Cost-of-funding challenges aside, Saudi lenders’ 3% net interest margin still surpassed the median of Gulf rivals and significantly exceeded Chinese banks’ 1.7% (which is likely to keep driving low profitability). UAE bank outperformance reflects ample liquidity letting them capitalize on the tightening interest-rate cycle amid more moderate asset growth vs. Saudi and Chinese banks.

Gradual interest-rate cuts may help Saudi bank ROE as the cost-of-funding drag eases. Higher-for-longer rates might restrain more gains. The 2024 margin squeeze for the Chinese banks we track looks set to endure as PBOC rate cuts and loan repricing outweigh lower deposit costs.

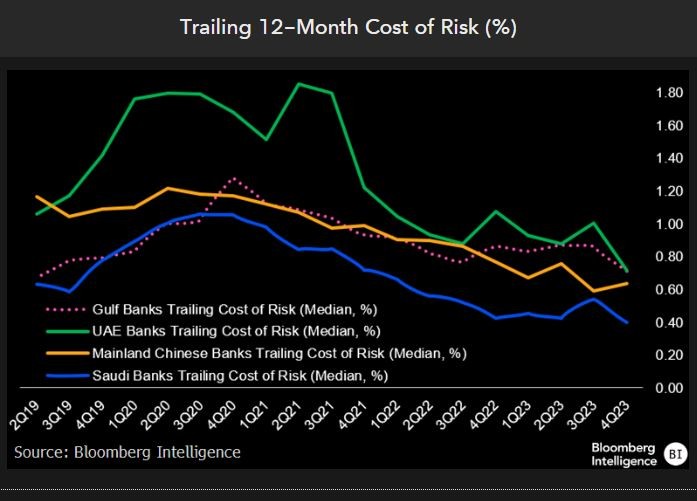

Chinese banks’ CoR may curb EPS on NPL spikes

Gulf and Saudi lenders have operated in a low-provisioning cycle since 2021, with the median cost of risk for Saudi lenders reaching 40 bps in 2023, the lowest since 2016 (helped by recoveries, strong economic indicators and stable asset quality). Yet this may normalize 5-10 bps higher in 2024 to reflect a changing lending mix more toward corporate and fewer recoveries.

Most Chinese banks we cover could reverse their credit-cost declines this year, curbing earnings growth, though more nonperforming-loan (NPL) reserves are likely to be released to absorb new problem credit. In our downside case (where real estate NPL ratios triple at the 11 Chinese lenders we cover), bad-property loans expand to 905 billion yuan by the end of 2024 from 267 billion in June.