Bloomberg Professional Services

APAC ex-Japan

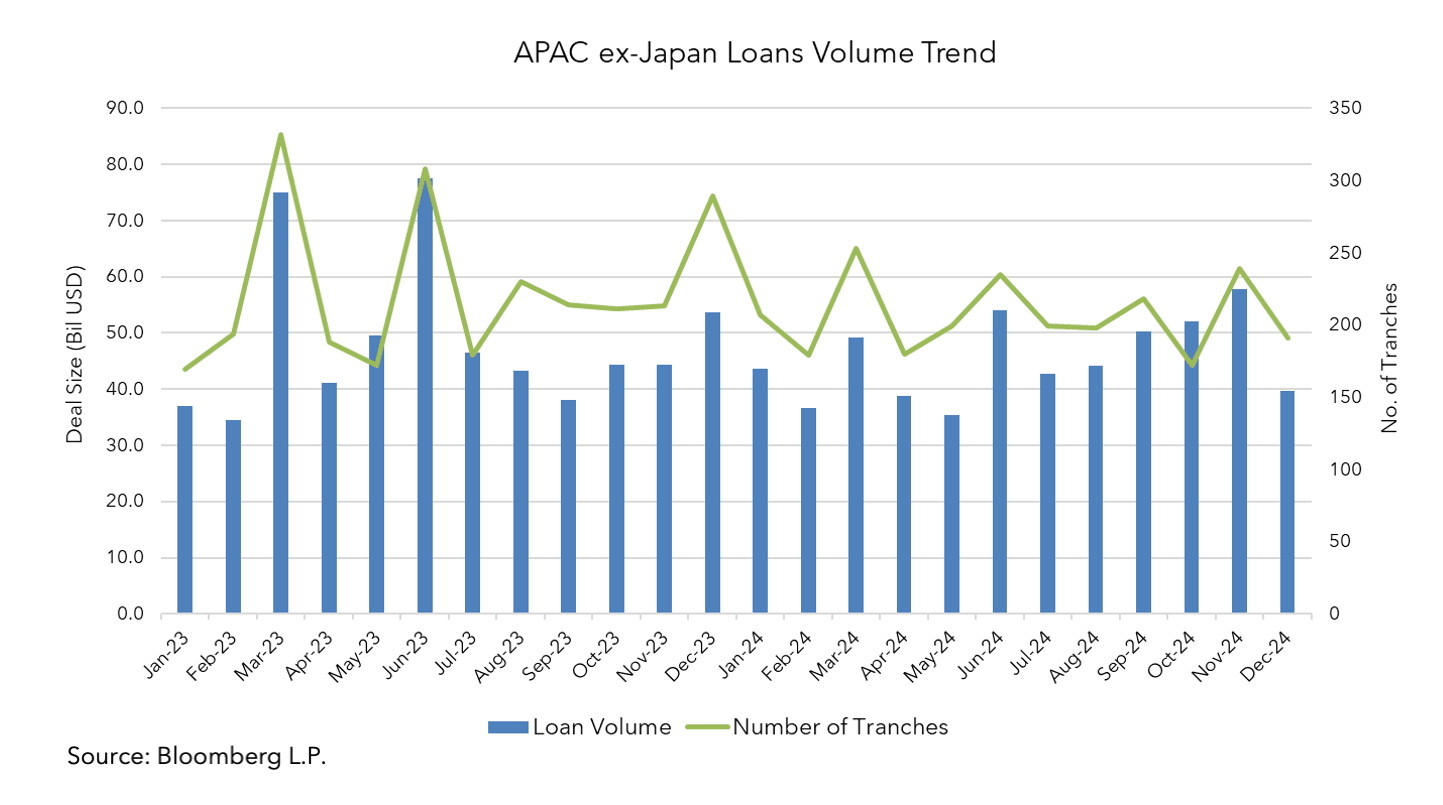

Syndicated lending signed in APAC ex-JP totaled USD 544.8 billion in 2024, marking a 6.8% drop from 2023. The market staged a recovery of 19.9% in the second half of 2024 after the continuous downturn of issuance volume since the first half of 2023.

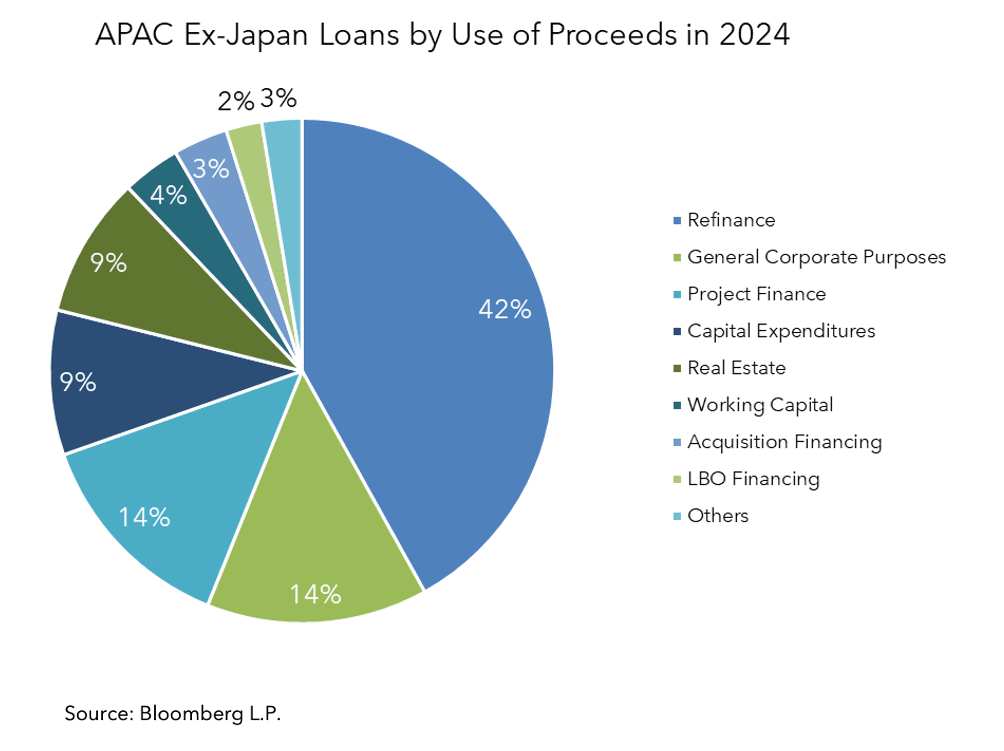

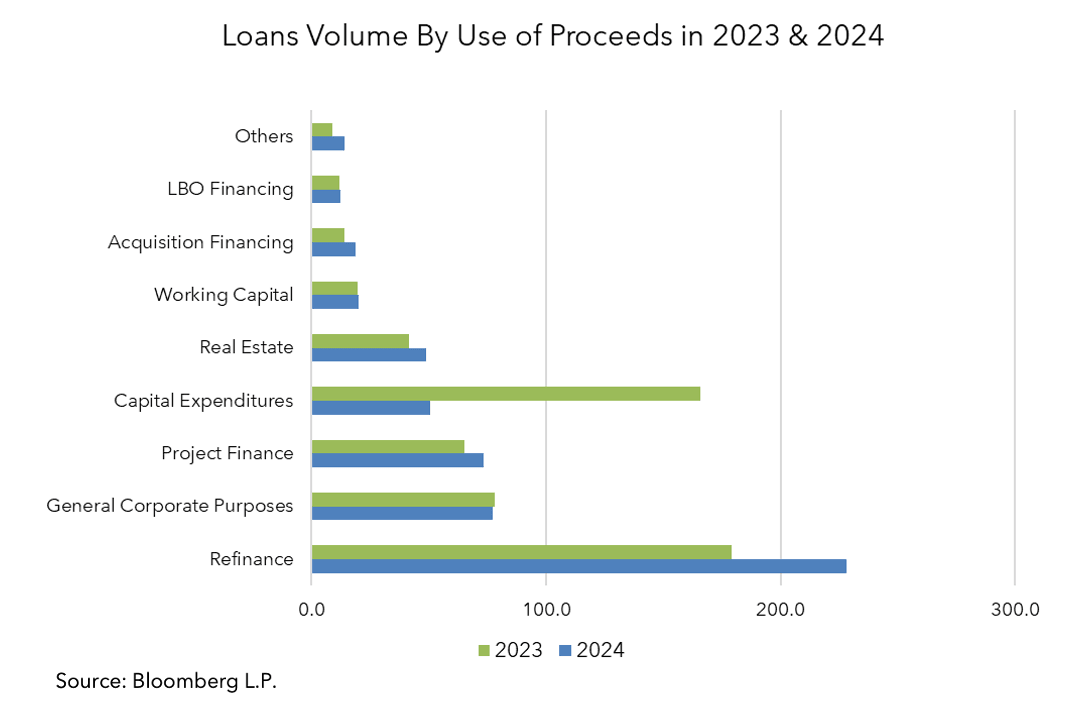

In terms of the financing purposes, 42% of the loans issued in 2024 went into supporting refinancing efforts. Capital–related spending saw a sharp drop of over 68% from the 2023 level. In 2023, Chinese borrowers issued dozens of mega infrastructure projects, each worth over USD 1 billion, which did not sustain into 2024. With China’s 14-th Five-Year Plan coming to an end in 2025 and the country seeking to boost its domestic economy, it remains to be seen whether the demand of Capex funding could stage a comeback.

Chinese borrowers took a big step back in 2024 in debt issuance, especially with limited supply of mega infrastructure projects from Chinese borrowers. On the other hand, Australian companies have been busy borrowing. Lending increased the most among borrowers in the financial sector, up by 63.8%.

Loans issued in CNY dropped by 43.9% in 2024 from the previous year, marking the lowest volume issued in the region since 2018. Australian borrower activities boosted the AUD volume by 20.3 billion as the loans were largely raised within the domestic market.

Technology companies borrowed some of the most notable syndicated loans this year. ByteDance issued a USD 10.8 billion syndicated loan attracting 12 bookrunners, while Alipay refinanced its previous USD 6.5 billion loan deal, extending its maturity to 2027. Looking ahead, Reliance International’s USD 1.2 billion loan and parent group Reliance Industries’ USD 3.5 billion loan are set to expire in 2025.

In 2024, Bank of China remained in the lead as the top mandated lead arranger for loans across the region, with KB Financial Group and DBS following suit. Meanwhile, among the bookrunners, Bank of China claimed the top spot, followed by HSBC and KB Financial Group.

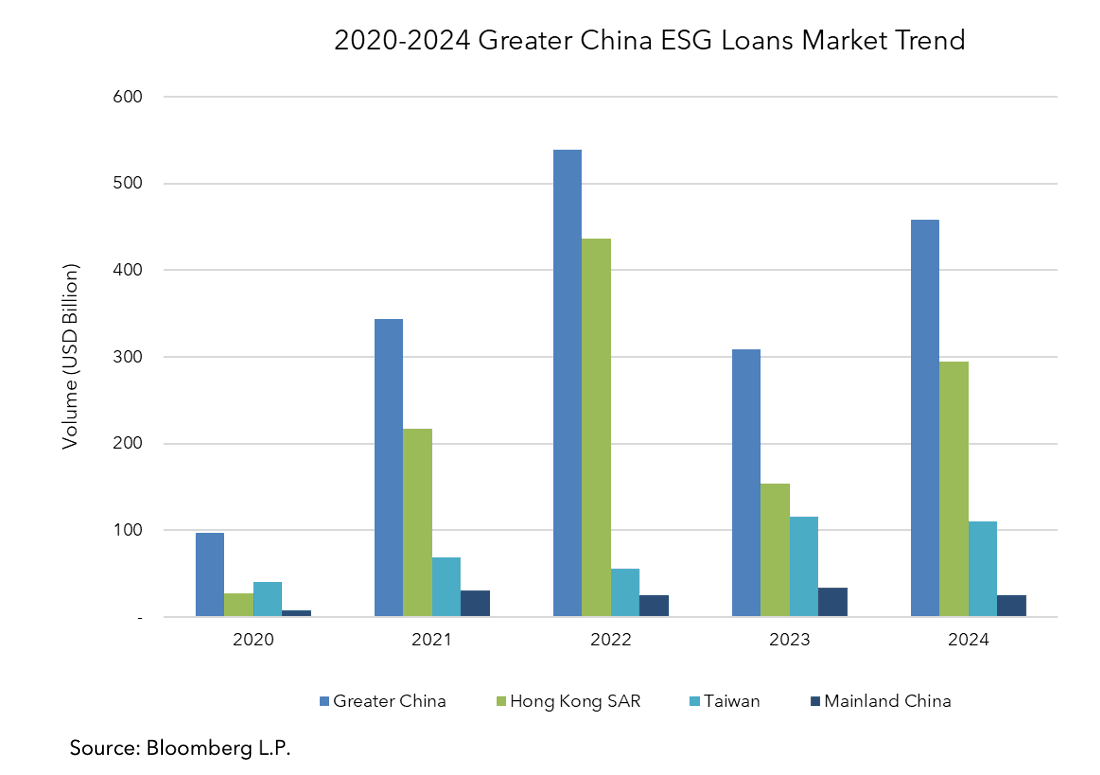

ESG

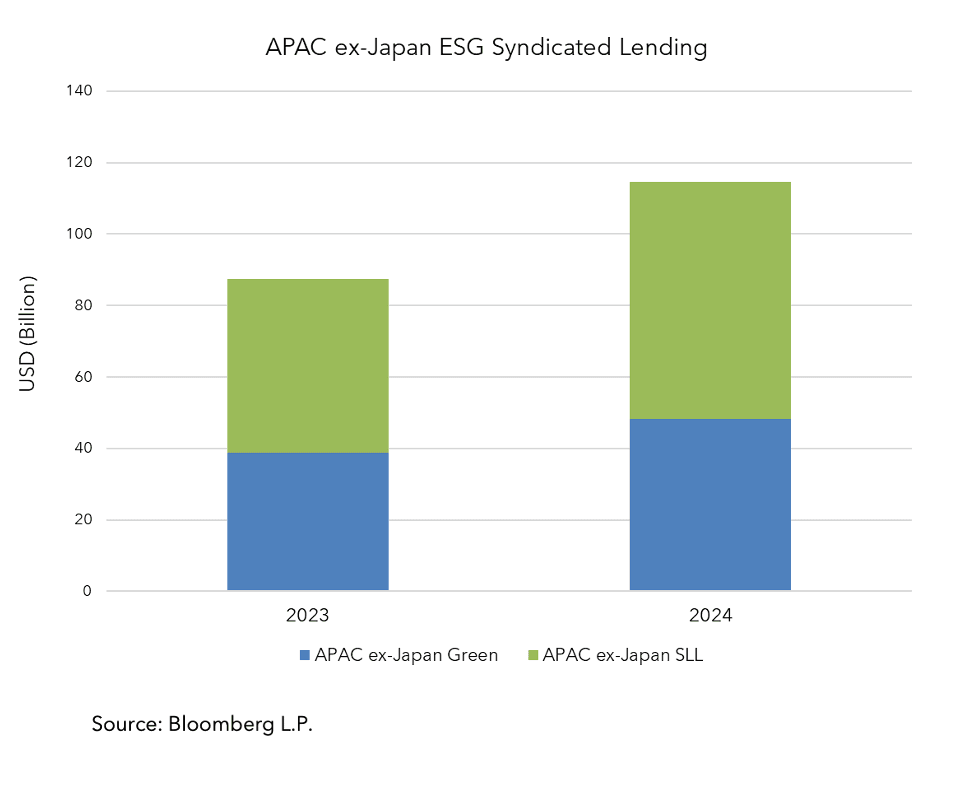

Green and sustainability-linked lending saw substantial recovery in the final quarter, with USD 34.5 billion issued across the region, bringing the total volume of ESG-related lending in 2024 to USD 113 billion, marking a 29.5% increase in volume year-on-year.

In the fourth quarter, Australia overtook Singapore as the country with the most Green loans issued, resulting in the highest issuance of Green loans to be from Australian borrowers by a small margin in the year of 2024. For Sustainability-linked loans, Chinese borrowers saw the highest issuance in 2024, with the US dollar still dominating as the highest issued currency for SLLs.

The largest and most notable Green loan of the year was issued to Charter Hall Prime Office Fund for AUD 3.35 billion (USD 2.1 billion equivalent) for the development of green properties outlined in its sustainability framework, which is certified by CBI. Additionally, the Green loan facilities secured in this transaction have been certified by the Climate Bond Initiative and verified by DNV and KPMG. The loan was underwritten and syndicated by ANZ, Commonwealth Bank of Australia, HSBC, SMBC, and Westpac Banking as MLABs.

The largest Sustainability-linked loan of this year was issued to Syngenta for USD 4.5 billion, denominated in US dollar across 4 tranches and advised by sustainability coordinators Credit Agricole CIB and Bank of China. The loan was led by a consortium including Agricultural Bank of China, Bank of China, China Construction Bank, Credit Agricole CIB, DBS, ICBC from their Hong Kong branches and subscribed to by banks across the region.

United Overseas Bank led in the Bookrunner rankings for Green loans across the region, followed by HSBC and Commonwealth Bank Australia. On the other hand, Oversea-Chinese Banking Corp led the ranks of Mandated Lead Arrangers, followed by DBS and United Overseas Bank. For Sustainability-linked loans, ANZ led as the top Bookrunner in the region, followed by China Construction Bank and Mega Financial. As for the Mandated Lead Arrangers, ANZ once again topped the list, followed by Oversea-Chinese Banking Corp and Agricultural Bank of China.

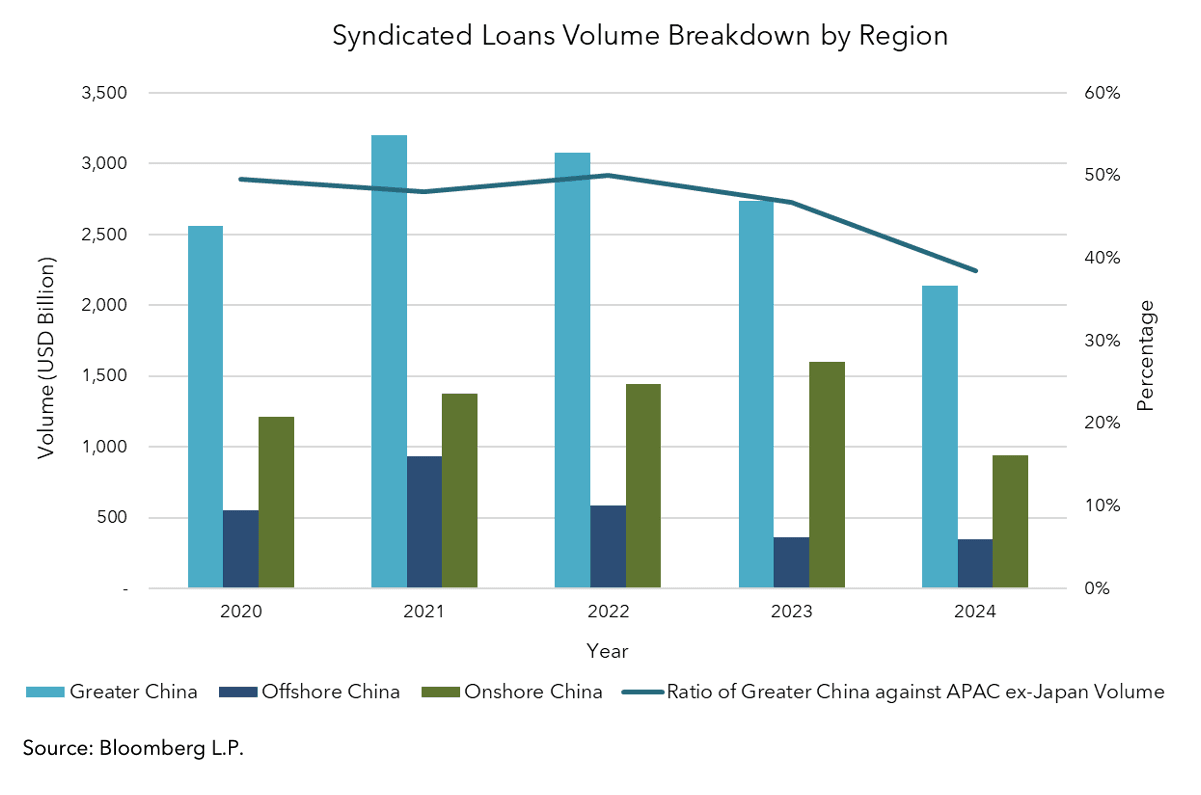

Greater China

In 2024, the total issuance volume of syndicated loans in Greater China declined by 21.5%, with China’s onshore and offshore sectors falling by 41.2% and 1.7% respectively. Refinancing accounted for the largest proportion (26.3%) of Greater China syndicated loans, with a rise of 6.2% compared to last year, followed by general corporate purposes (20.9%) and capital expenditures (14.8%).

Although China has lowered the cost of home sales and introduced lower interest rates to ease the slowdown in the property market, syndicated real estate loans still accounted for only 6.9% of the market. Financial institutions were still cautious and demanded more collateral assets for lending. In terms of Green loans in the Greater China region, the total issuance of syndicated loans increased by 37.08% in 2024 compared with the same period last year.

In the past 2 years, the volume of USD-denominated loans has decreased across the Greater China market, while the usage of offshore CNY has grown. It is worth noting that the offshore CNH increased significantly by about 5.76 times compared with the previous year in Greater China loans.

Across the Greater China region, a deal to highlight is the USD 5 billion term loan issued to Alipay Hong Kong Holding in August, with Bookrunners Australia & New Zealand Bank, Banco Bilbao Vizcaya Argentaria SA, Bank of China, BNP Paribus, JP Morgan Chase Bank, China Construction Bank, China Merchants Bank, Citibank, CMB Wing Lung, DBS Bank, Goldman Sachs, Hongkong & Shanghai Bank Corporation, ING Bank, Mizuho Bank, Morgan Stanley and Oversea-Chinese Banking Corporation and Standard Chartered Bank. The loan was expected to be used for refinancing and working capital purposes.

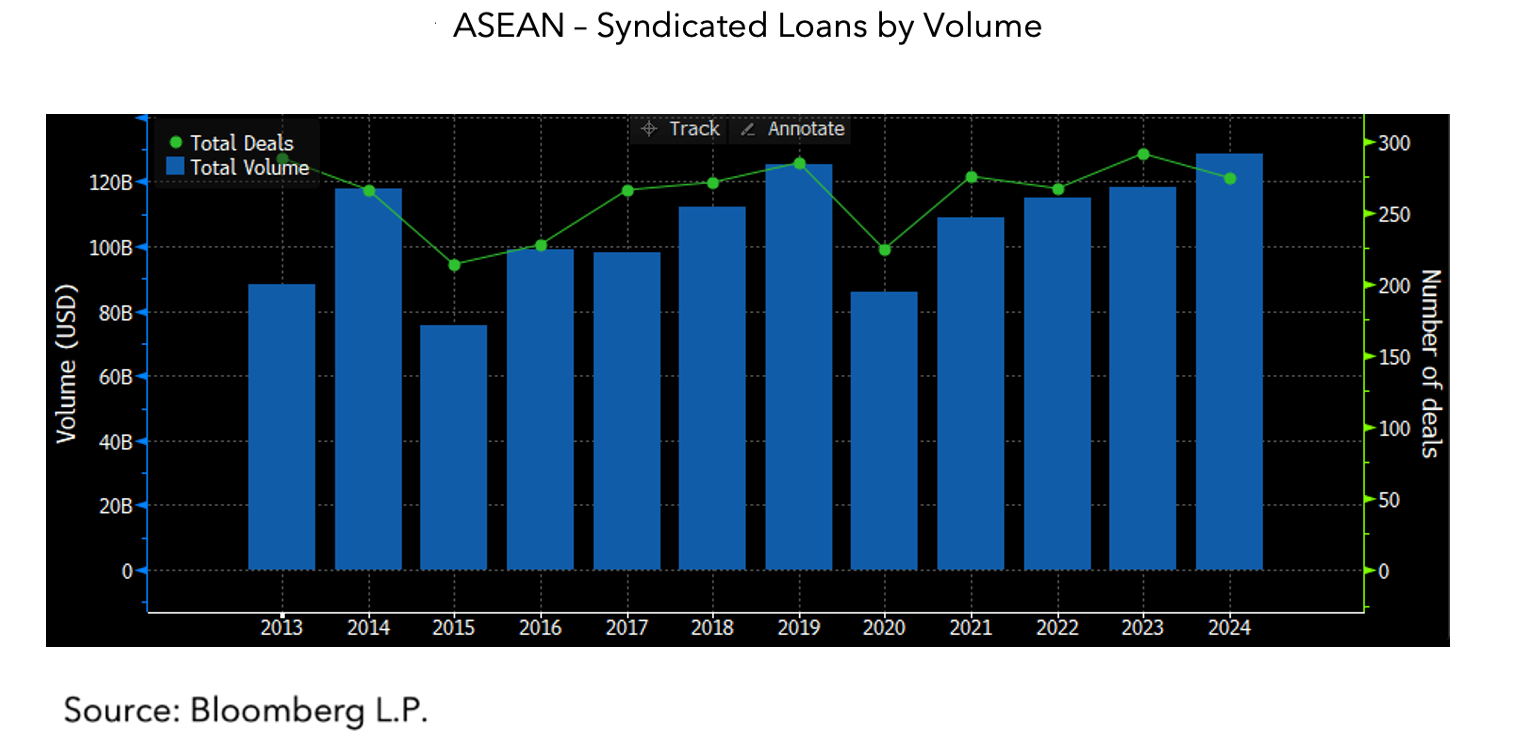

ASEAN

Syndicated borrowing amongst ASEAN borrowers in 2024 totaled USD 128 billion, marking an increase of 15.6% from 2023 and reaching the highest issuance level in the past 10 years. While the broader APAC market volume dropped by 6.8%, the ASEAN market has recovered to its pre-pandemic levels, taking up a quarter of the APAC ex-Japan issuance.

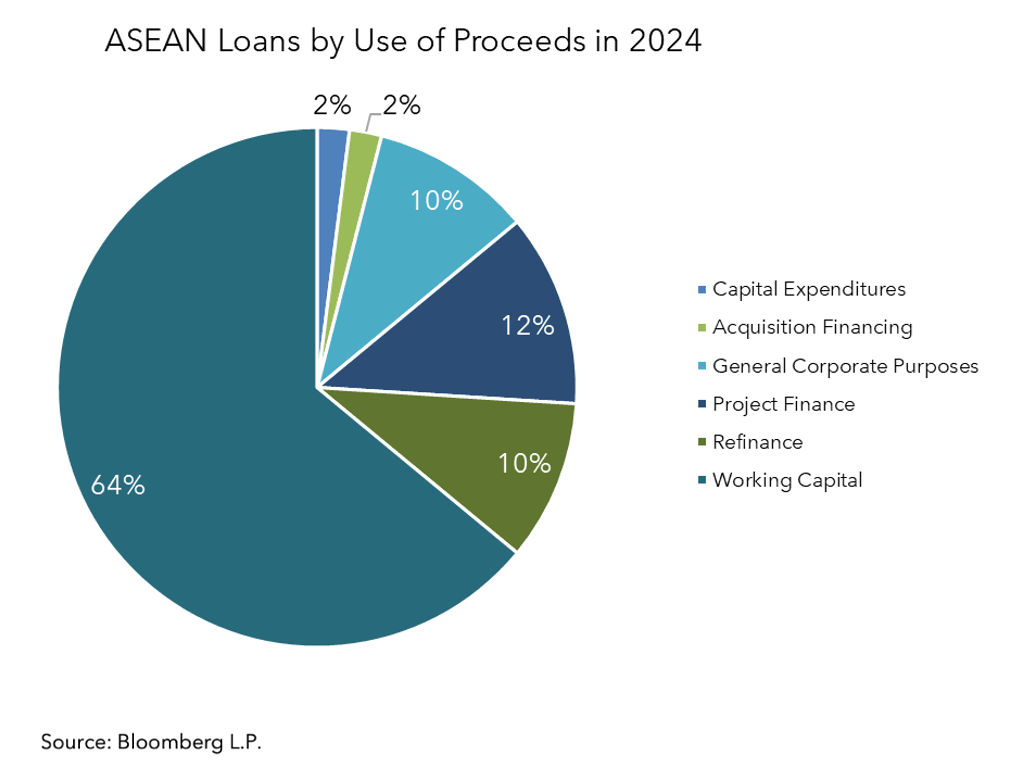

Working capital accounted for the highest proportion of loan issuance purpose among ASEAN borrowers in 2024, making up 64% of the total volume. The USD was the most issued currency, with 48% of loans to ASEAN borrowers denominated in USD, followed by SGD and INR. The largest ASEAN loan signed this year was to CLA Real Estate for SGD 5.835 billion (USD 4.46 billion equivalent) as a club deal with DBS Bank, Oversea-Chinese Banking Corp and UOB. The loan was issued to CLA Real Estate for working capital and general corporate purpose, with a two-year extension option and two one-year extensions embedded.

Among the mandated lead arranging banks, United Overseas Bank ranked top, followed closely by DBS and Oversea Chinese Banking Corp, making up market shares of 9.7%, 9.3% and 9.1% respectively. Among the bookrunners, United Overseas Bank claimed the top spot, followed by Sumitomo Mitsui Financial and Oversea-Chinese Banking Corp, with market shares of 9.0%, 8.5%, and 7.3% respectively.

South Korea

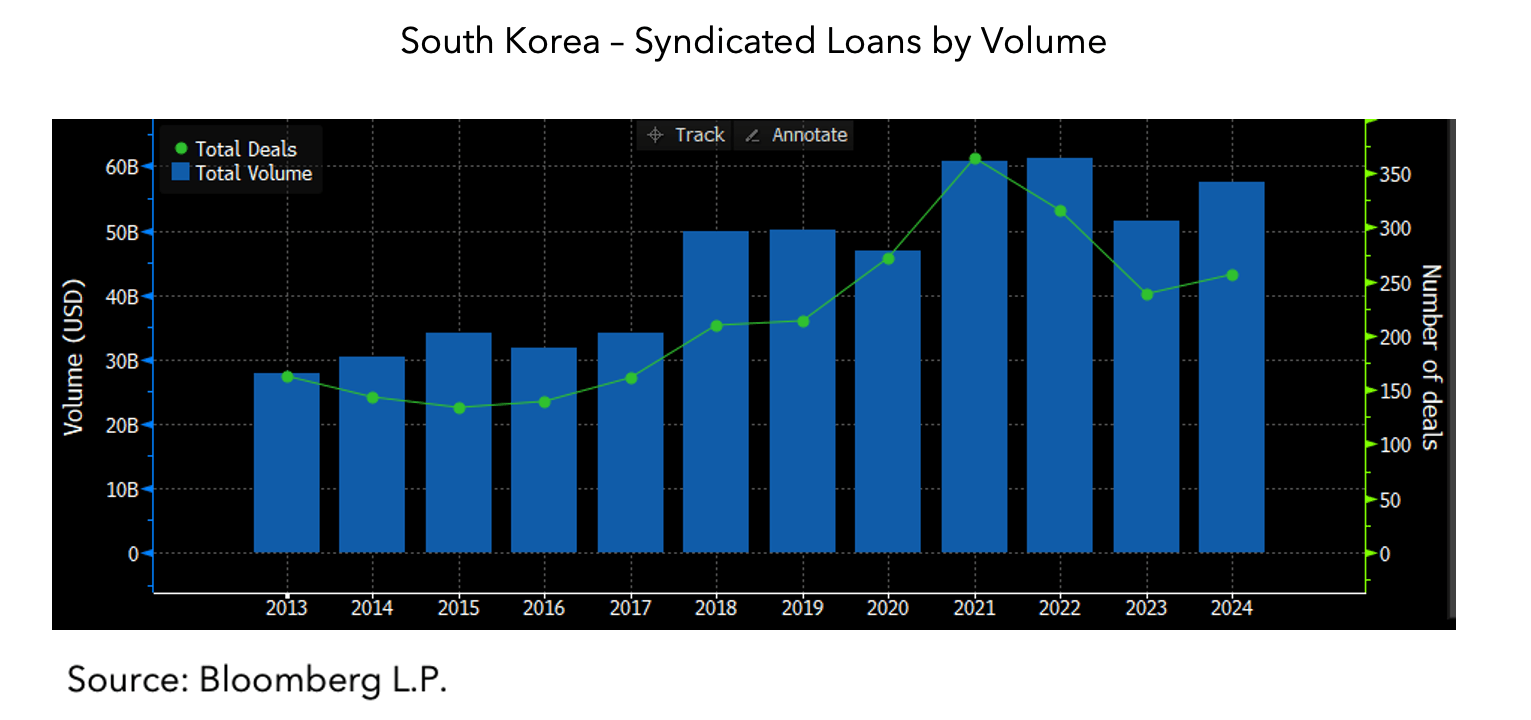

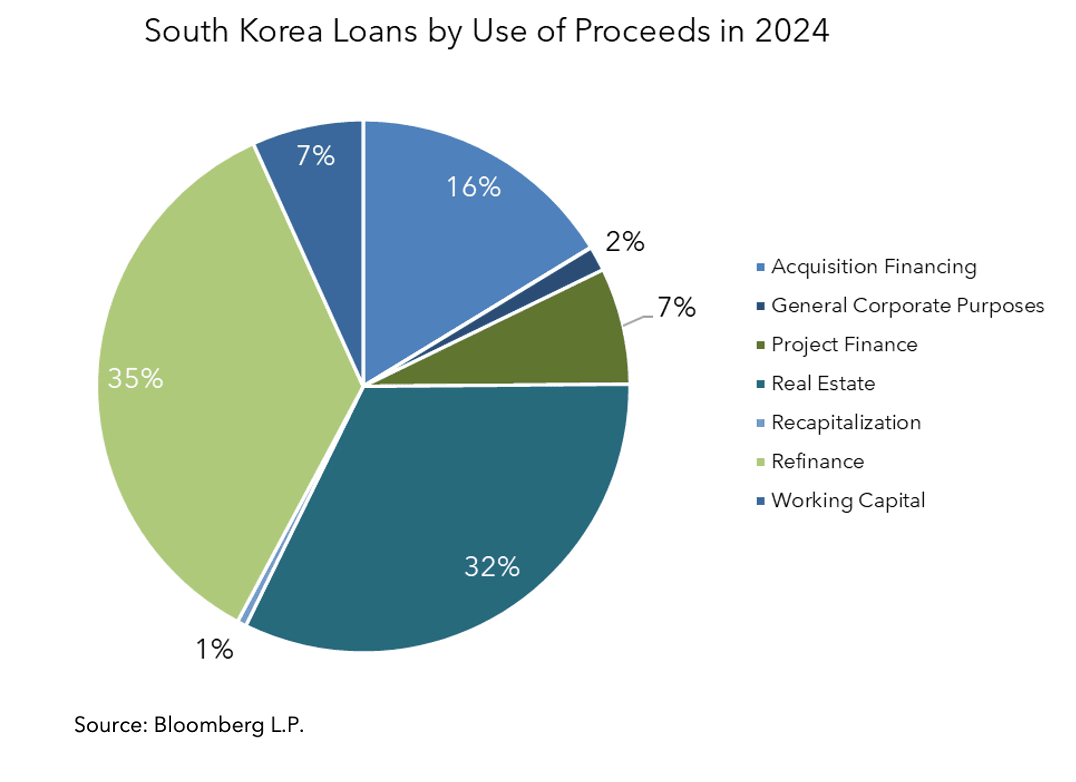

South Korea’s loans market totaled 254 deals worth USD 57.4 billion in 2024. With an increase of 11.7% in total deal volume compared to the same period last year, South Korea’s loan issuance makes up 10% of the total APAC volume.

In the 2024 mandated lead arranger rankings, KB Financial Group continued to claim the top spot with 38% of the market share, followed by Shinhan Financial Group with 24.7%. Lee & Ko ranked the top legal firm for the Legal Adviser – Lender table, and Kim & Change ranked the top for the Legal Adviser – Borrower table.