This analysis is by Bloomberg Intelligence Senior Market Structure Analyst Jamie Douglas Coutts. It appeared first on the Bloomberg Terminal.

Merge prompts crypto-ecosystem to focus on fees, monetary policy

While the severe decline in crypto-economy demand is set to enter its second year, prompted by the fastest tightening in decades and exacerbated by excess capacity, Ethereum’s blockspace dominance has persisted. Given robust fundamentals, we see the emergence of Ethereum’s staking yield as the benchmark rate for the entire crypto-economy.

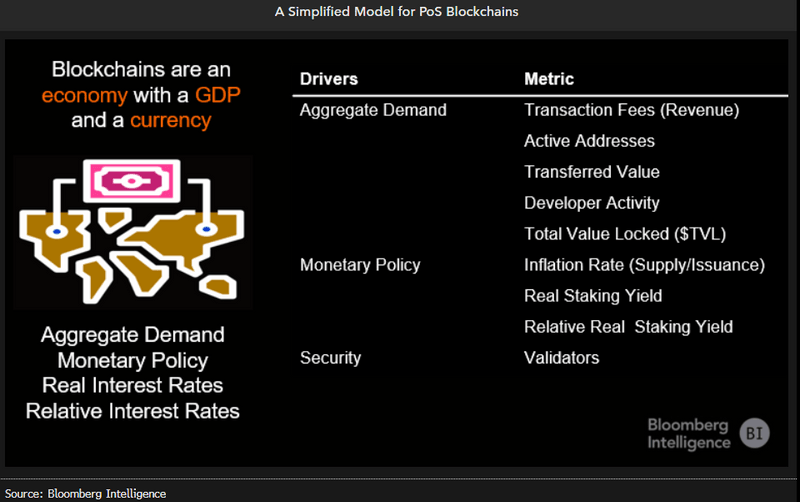

Modeling the crypto-economy via a macroeconomic lens

For framing, the new paradigm of blockchain networks can be viewed through the lens of traditional macroeconomics to measure how well an economy is performing, the forces that drive it, and how performance can be improved through measures such as aggregate demand, capital flows, real and relative interest rates.

In the crypto-economy, a blockchain collarory is a national economy with a GDP, currency, governance and monetary policy. Therefore, on-chain data can be mapped to the demand-and-supply metrics which drive the value of these currencies relative to other currencies. Covered in previous notes, the crypto-economy is a also subset of the global economy, with the same external macro forces (liquidity) and structural trends (technology adoption) playing an outsized role in the valuation as they do with all risk assets.

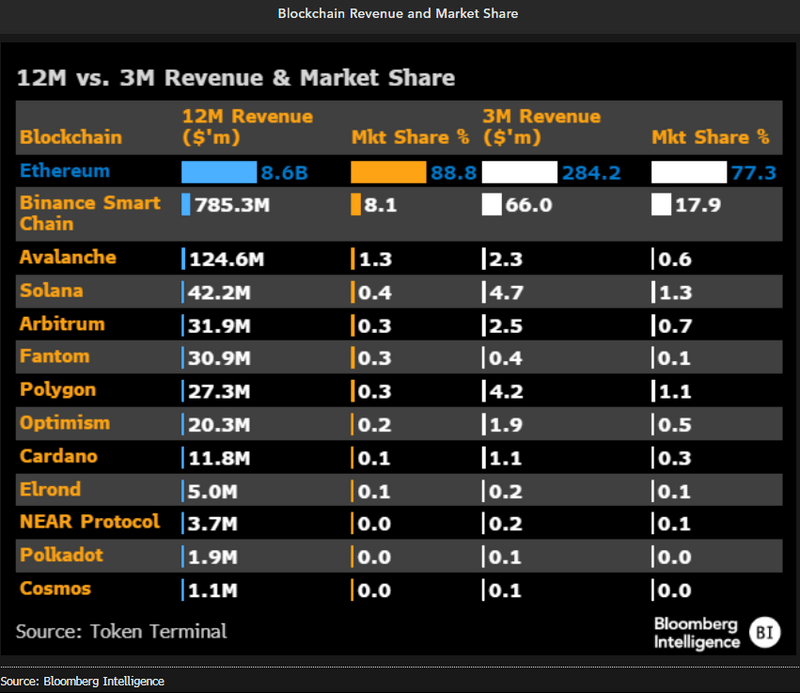

Ethereum’s GDP Dominates the Crypto-Economy

Blockchain transaction fees continue to be hyper-concentrated, with Ethereum controlling a lion’s share of the shrinking revenue pool over the past 12 months. Activity on Ethereum generated $8.6 billion in fees during the period, or 88.8% of the market.

The only rival with a meaningful level of fee income is Binance Smart Chain, accounting for 8.1% of the market in the past year, although this dynamic changed in the past three months, rising to 17.9%. Outside of Binance, while there has been some jockeying in rankings, the long list of alternative layer-1s has failed to make serious inroads into Ethereum’s dominance in both absolute and relative terms. When we consider the 3x growth of Ethereum ecosystem chains in our list, including Polygon, Arbitrum and Optimism, it appears its market position has been further fortified.

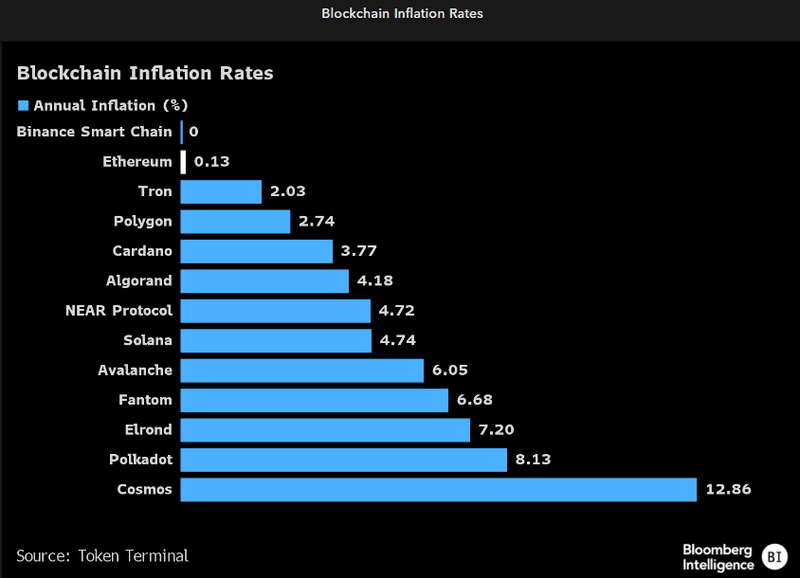

Shifting to Sound Monetary Policies

After a successful merge, the dominant cashflow-generating crypto-economy slashed its annual inflation rate, adopting sound monetary policy as a core economic pillar. In terms of monetary debasement, Ethereum’s current inflation rate of 0.13% ranks second only to Binance, which has zero inflation. Yet Ethereum is likely to leapfrog Binance and become deflationary once network activity begins to increase from the current bear-market low.

It illustrates an important milestone which will reverberate across the ecosystem. Networks with confidence in their community, product-market-fit and ability to sustain and grow their income (fees) could, in time, follow suit as real staking yields become increasingly important for relative value analysis of crypto economies by a more discerning investor class than in previous cycles.

Excess capacity hampers asset prices

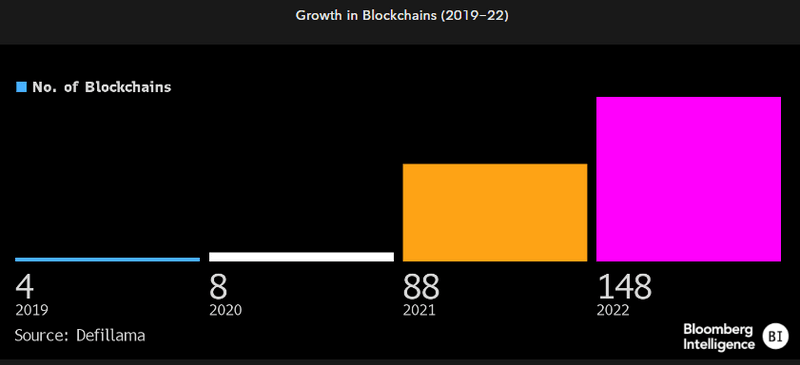

The overbuild in block space these past three years has left the crypto-economy with an excess capacity issue, further depressing the prices of these currencies. There are now 148 layer 1 and 2 chains, an increase of 68% in the past 12 months and up from just eight chains in 2020.

Yet longer term, the increase in capacity should enable the ecosystem to scale with the rise in demand for Web3, DeFi applications and tokenization of real-world assets. If crypto is to realize its potential, the build-out is a necessary evil to ensure that creative destruction roots out the unsustainable crypto-economies (models) which are unable to generate a sustainable level of fee income due from a sub-optimal product-market fit.

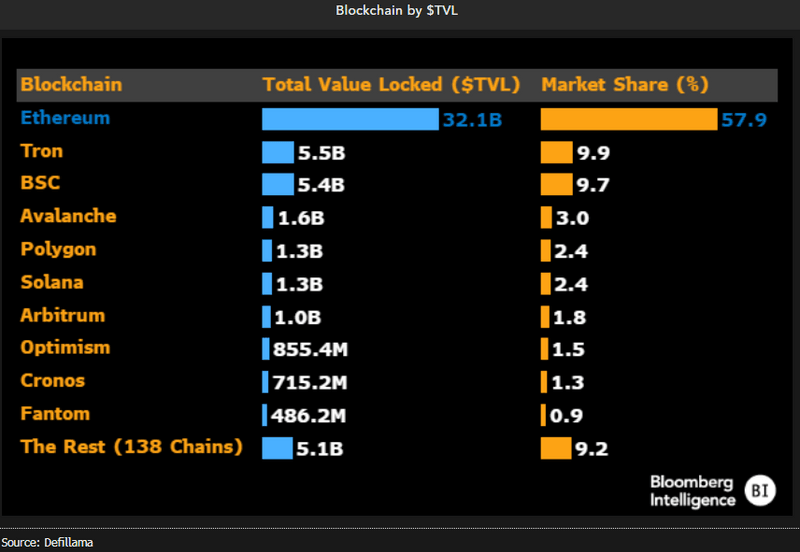

Crypto capital deployment remains concentrated

Albeit less concentrated than the fee market, total value locked — a proxy for capital investment or foreign direct investment — remains heavily skewed to the crypto-economies with robust fee income and lowest inflation rates. Ethereum’s share of TVL, currently 57.9% (or closer to 62% when accounting for sidechains and layer-2s) is down from 68% in January and 90% in 1Q20. Over the past year, Binance Smart Chain increased its market share by 50%, rising to 9.7% of total market TVL, the third largest.

TVL by its nature is mercenary capital seeking the highest returns usually in staking/lend/borrow/trade protocols. And while the bull market propagated a slew of marginal chains offering eye-popping nominal yields, the era of sustainable crypto-economics is upon us where fee income and positive real yields will be paramount.