ARTICLE

Outlook: China’s world wealth hub Hong Kong could surpass Switzerland

Bloomberg Professional Services

This Bloomberg Intelligence report appeared first on the Bloomberg Terminal.

Hong Kong banks’ potential for trillions

Hong Kong’s financial infrastructure gives it an edge in attracting wealth inflows from high-net worth individuals from mainland China and across the rest of Asia. Affluent mainland households could accelerate diversification overseas via Hong Kong’s established cross-border market access programs as China’s capital account remains closed, while some could migrate to the city. Wealth managers operating in the city could benefit from accelerating net new money sourced from both local households and offshore residents.

Key research topics:

- Richer China: Personal investable assets in mainland China could soar 83% from 2023-30 to $80 trillion, with overseas investments rising to 11% of households’ investable assets by 2030, up from its 8% in 2023, supported by wealth reallocation from property investments and bank deposits.

- A base for capital flight: Hong Kong’s cross-border wealth may reach $2.8 trillion in 2025, overtaking Switzerland as the world’s largest cross-border wealth hub. China’s Greater Bay Area could more than double the addressable client base of Hong Kong’s private wealth firms.

- UBS’ loss may be Hong Kong banks’ gain: HSBC and Standard Chartered may be best positioned to win share of wealth inflows after UBS cut jobs in the region as it absorbed Credit Suisse. Fed rate cuts could stimulate investor risk appetite and drive a shift out of deposits, money market and bond investments.

- Family-office friendly: Hong Kong’s family office assets under management (AUM) could double to $387 billion by 2030 from 2023, led by Chinese and Asian ultra-rich. The city could widen its lead over Singapore in single family offices, as shown in Figure 21. Heightened geopolitical risk may spur existing family offices to diversify further abroad.

Hong Kong’s local, offshore wealth

Private wealth in Hong Kong set to double

Hong Kong’s private-wealth AUM could nearly double over seven years to reach $2.3 trillion by 2030 in our scenario, as wealthy Chinese seek offshore diversification through the city and new migrants drive local resident’s wealth. Hong Kong’s $3.8 trillion of total household wealth in 2023 rises 7.5% annually through 2030 in our model.

Figure 1: Hong Kong Private Banking; Private Wealth Industry 3.1 Mainland Chinese Account for Growing Share of Assets

Family offices

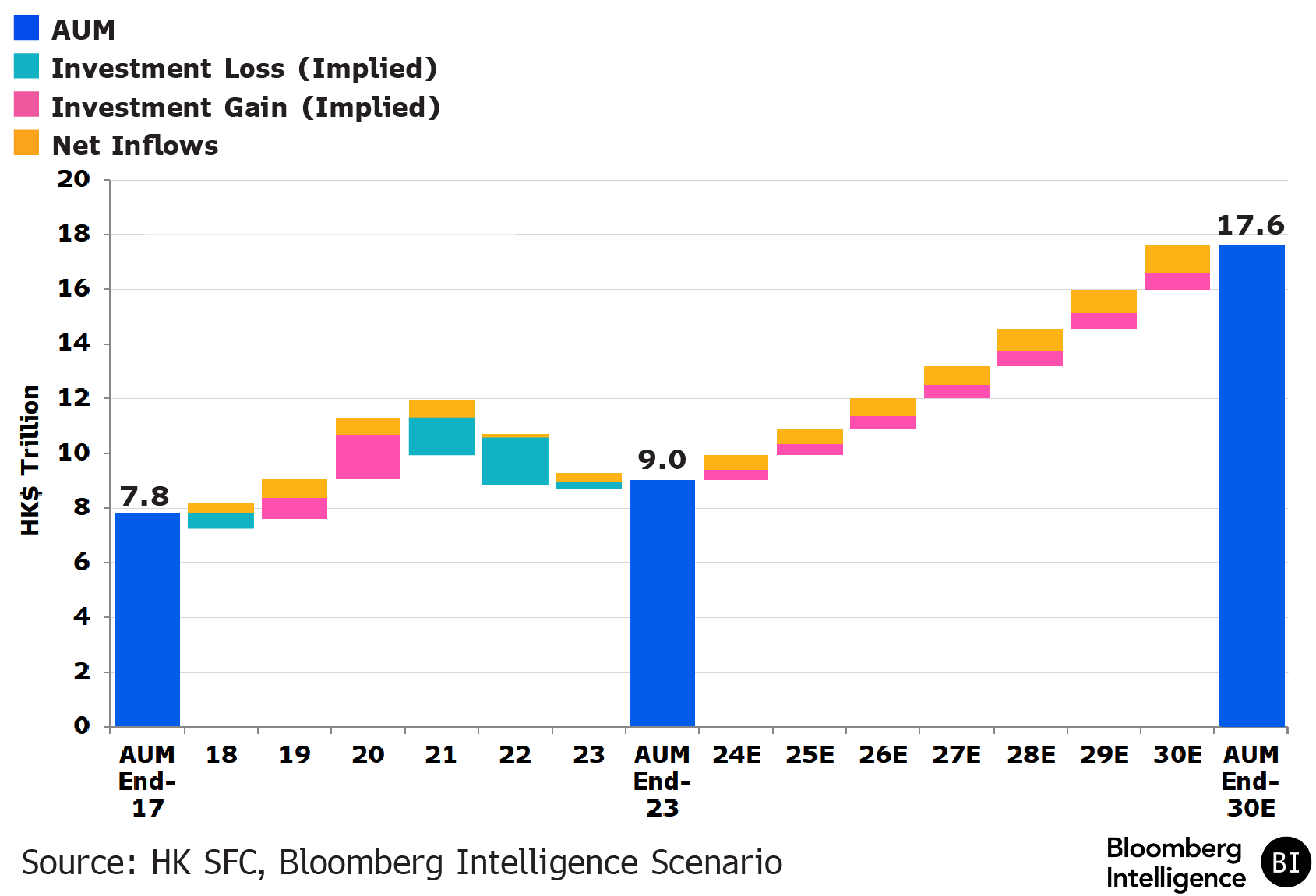

Assets under management may hit HK$3 trillion by 2030

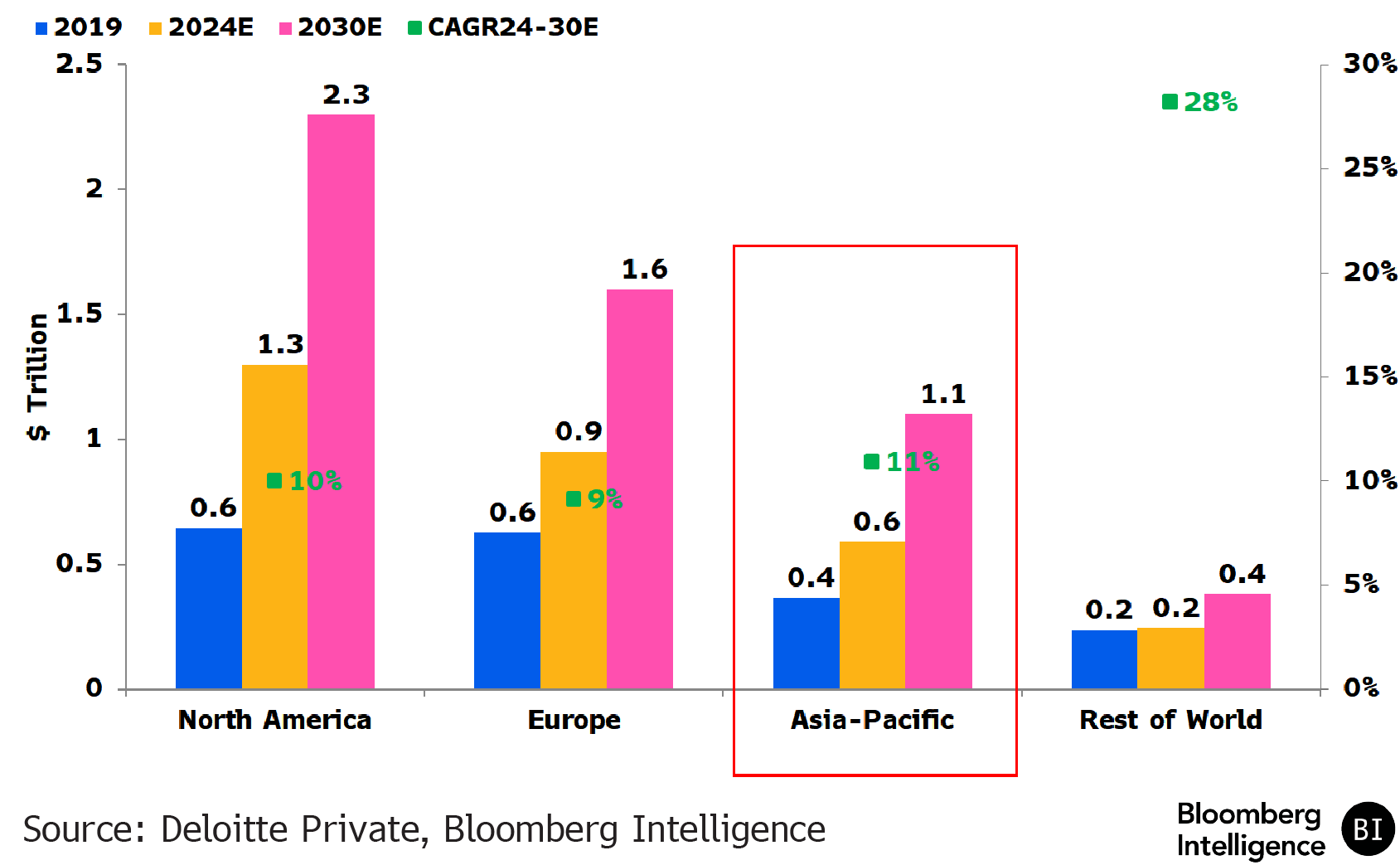

Hong Kong’s family offices and private trusts had $193 billion of AUM in 2023, according to the regulator’s survey, or about a third of the region’s AUM, and could double to HK$3 trillion ($386 billion) by 2030, we calculate, if growth keeps pace with the rest of the region. Family office AUM in the Asia-Pacific region could rise 11% per year on average to $1.1 trillion by 2030 from $590 billion in 2024, outpacing annual global growth of 9.7% according to Deloitte. Singapore doesn’t disclose AUM of family offices.

Figure 19: AUM of Family Offices, $ Trillion

Download the Hong Kong’s Wealth Management Outlook.