Monetizing patents: Trends in royalties and licensing

This analysis is by Bloomberg Intelligence analyst Matt Larson. It originally appeared on the Bloomberg Professional service.

Targets of patent-infringement suits chip away at royalty rates Patent owners could see stagnation in licensing revenue as product manufacturers and companies taking licenses to intellectual property push for lower royalty rates through both private negotiations and court battles. As companies ramp up efforts to make money from their intellectual-property assets through licensing and litigation campaigns, target licensees are fighting to boost profit margins and minimize costs from third-party intellectual property through court challenges and industry practices.

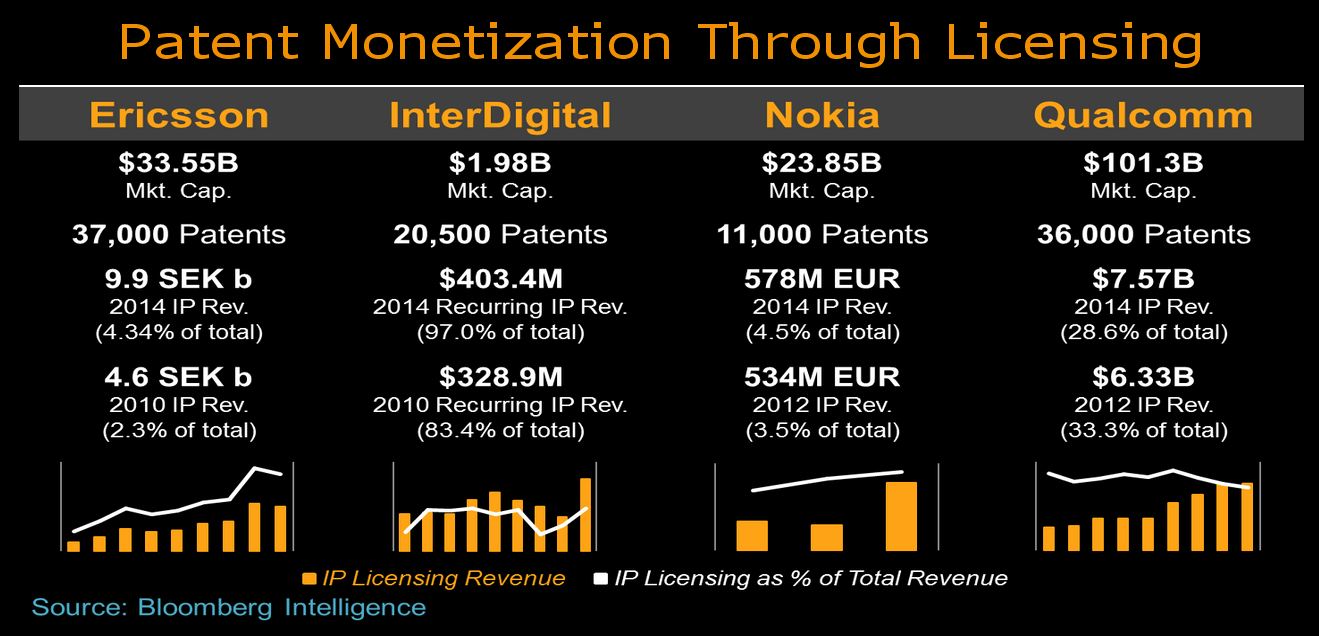

Qualcomm, Ericsson turn to patent portfolios for revenue sources

Qualcomm, Ericsson and other companies with significant intellectual-property assets are turning to their patent portolios as a major source of high-margin revenue. Seeking a return on research and development and investment in IP, these companies look to licensing patents to both direct competitors and companies in related industries. Many companies, including Nokia and Qualcomm, break out their intellectual-property business into a separate business unit or subsidiary focused on making money on those assets.

Apple, Microsoft, device makers favored by tech-licensing policy

A recently updated patent policy, which seeks to define licensing terms for patents on technical standards, strongly benefits device makers such as Apple and Microsoft over companies focused on patent licensing. The IEEE’s policy limits device makers’ exposure by effectively limiting royalties that can be collected on so-called standard-essential patents. Because many products implement hundreds of standards, device makers benefit from even a small reduction in royalties.

Apple, device makers may reap patent-royalty adjustment savings

Apple and other device makers could increase profits as industry trends reduce patent-royalty rates on smartphones, tablets and other complex, multi-component devices. Even a 1% increase in Apple’s handset operating margin could boost operating income by about $1 billion a year. Recent trends are moving away from calculating royalties based on the sales prices of end-products and are increasingly moving toward royalties based on the incremental value of individual components that practice a patented technology.

Wireless patent policy signals troubles for Qualcomm, Ericsson

A recently adopted policy by technology standard-setting organization IEEE threatens to reduce royalty payments under licenses to patented technologies incorporated into industry standards by a factor of 10. The policy reflects handset makers’ attempts to reduce royalty payments on products that practice industry standards. Courts in the U.S. and overseas have recently ruled that patent royalties should be based on functionality or operative components, rather than the value of an entire device.