Bloomberg Professional Services

This analysis is by Bloomberg Intelligence Rates Strategist Ira Jersey and Senior Associate Analyst Will Hoffman. It appeared first on the Bloomberg Terminal.

US rate-market volatility may remain high within this year’s ranges throughout May, with headline risk continuing to drive intraday moves. The tone of next week’s FOMC meeting may be more dovish, given the weak sentiment of the Beige Book report. The strike of the “Fed Put” is in reach should unemployment spike.

Fed to lean dovish as Beige Book sentiment flags

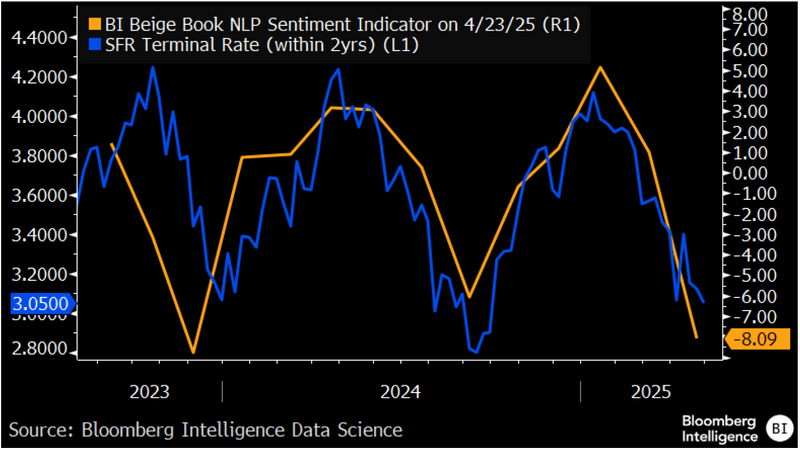

The market doesn’t yet fully reflect the dovish tilt to the most-recent Beige Book report compiled by the Federal Reserve. The sentiment expressed in the Beige Book was the most dovish since thelate-2023 reading, and below the report just prior to the 50-bp interest-rate cut last September. The market has yet to price in as much dovishness, however, in terms of how low short-term rates may go. The market was priced in September for the Fed to cut to 2.7%, but the terminal rate now is priced for a bit over 3%. This seems to reflect fears that the Fed will be late in cutting rates amid tariff-induced inflation.

We think the Fed will eventually cut to what’s currently priced and see the potential for even lower rates, but it may be late in doing so because of inflation fears as it chases a flagging economic backdrop.

BI Beige Book sentiment vs. Fed expectations

Dollar hasn’t (yet) lost reserve currency status

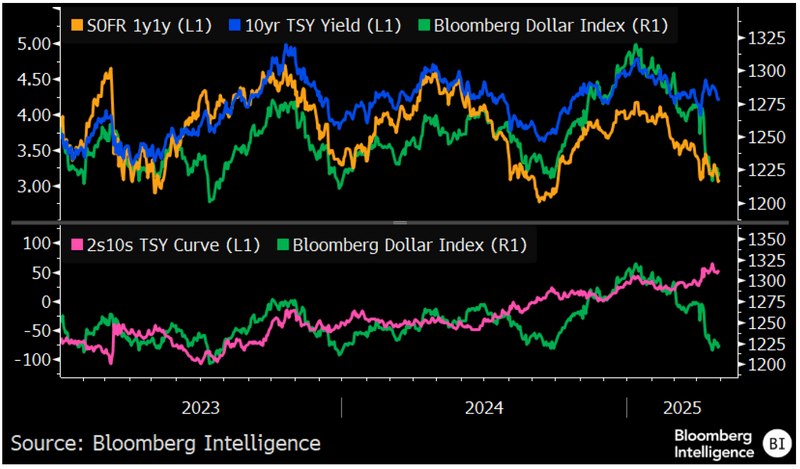

Fear is growing that the dollar will lose its reserve currency status, which helps explain the recent divergence of the 10-year Treasury yield and broad dollar indexes, but we think there isn’t a causal relationship. Historically, the dollar tends to relate to short-term interest differentials vs. longer-term differentials. Given long- and short-rate expectations have followed each other quite closely over the last two years, it’s not surprising that the 10-year yield and the dollar have been correlated. We think the recent breakdown of the correlation reflect yield-curve steepening, rather than a breakdown of the dollar’s reserve currency status.

We think at least some of the adjustment of the dollar index reflects lower short term rate expectations and the index just caught up with forward rate pricing.

Dollar index follows short rates, as it always has

Economy may be close to the ‘Fed Put’

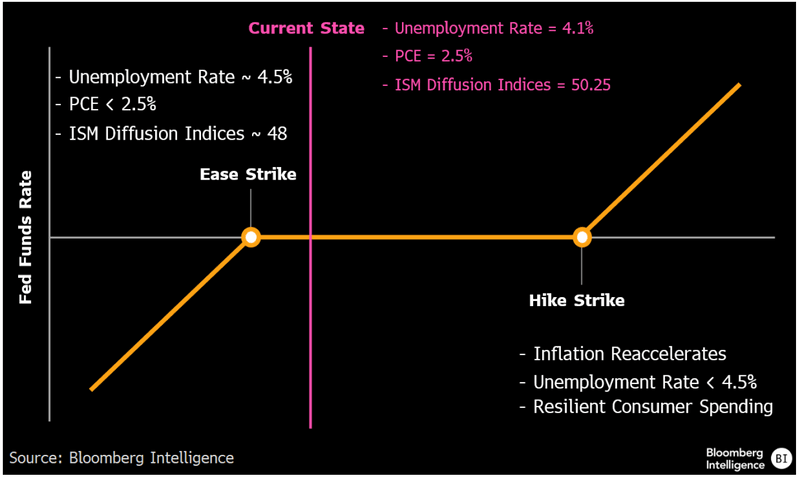

The strike of the “Fed Put” traditionally reflects how much financial-market pain that monetary policymakers are willing to endure, usually in relation to estimates of how much feed-through financial conditions may have on economic growth. With many risk-asset markets staying volatile, but remaining rich on some traditional metrics, we don’t think markets are anywhere close to triggering the Fed to act with easier monetary policy. The economy, however may be in that range.

In a simple example of the Fed’s propensity to hike or cut based on the economic environment, we think the market is close to the Fed cutting. If the PCE deflator falls further and the unemployment rate rises, the Fed would have cover to reduce interest rates. The challenge may remain the inflation expectations stemming from tariff implementation.

Stylized example of Fed Put based on economic data

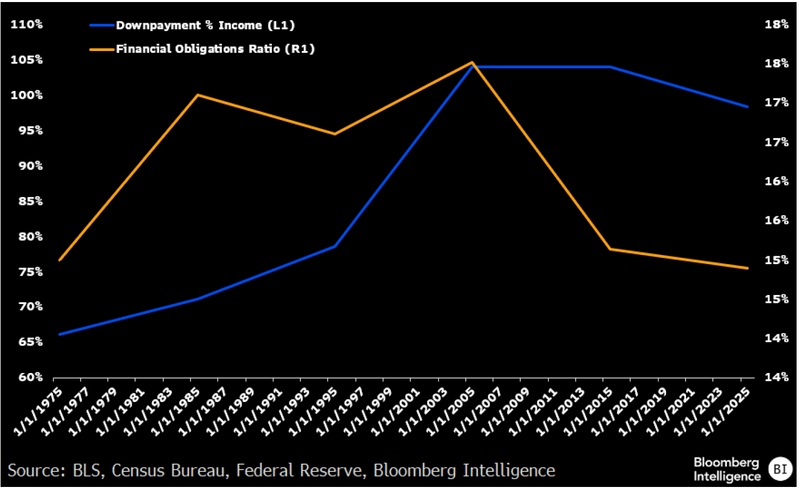

Household financial obligations are low, down payments aren’t

Fiscal and monetary policymakers may need to consider long-term shifts in spending patterns when considering policy shifts. For example, in the mid-1970s, a 20% down payment on a median priced house was about 66% of median household income; now it’s about 98% as house prices have surged. Overall current household payments for financial obligations, however, are now slightly lower than 50 years ago. Low-interest rates for most of the past 15 years are a major reason for high home prices and lower financial obligations ratios.

The long expected wealth transfer from Baby Boomer to Millennials may occur as the older generation contributes to house down payments, or the transfer of real estate to the younger generation. The implication of the latter would be less labor mobility.

House down payment and financial obligation ratio

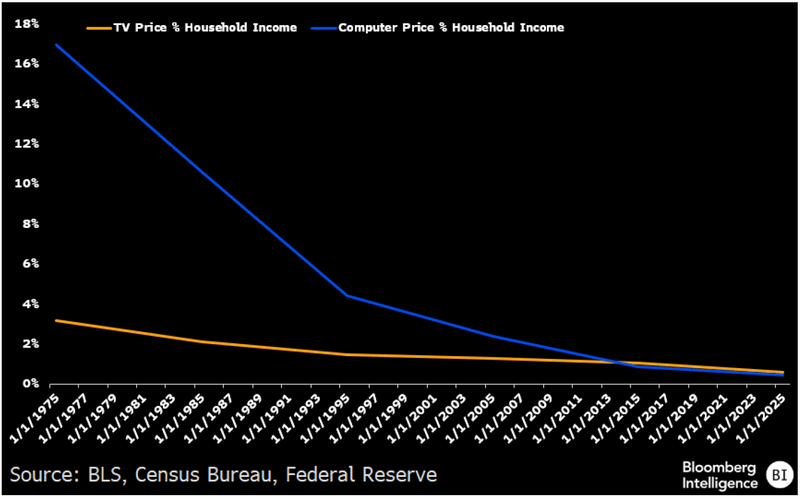

Entertainment and work-from-home shift dynamic

It will come as no surprise that entertainment, and in some case productivity related assets, have come down from the prices 50 years ago. As house down payments as a share of income has risen, personal computer and television prices as a share of household income have plummeted. Following the 2020 pandemic shutdowns, work-from-home has been at least partly normalized, reducing issues relating to labor mobility.

The low cost of entertainment devices has had other societal effects that are beyond our scope, except to note the rise in information noise appears to have increased inversely to the cost of devices to receive information.

TV and personal-computer prices plummeted

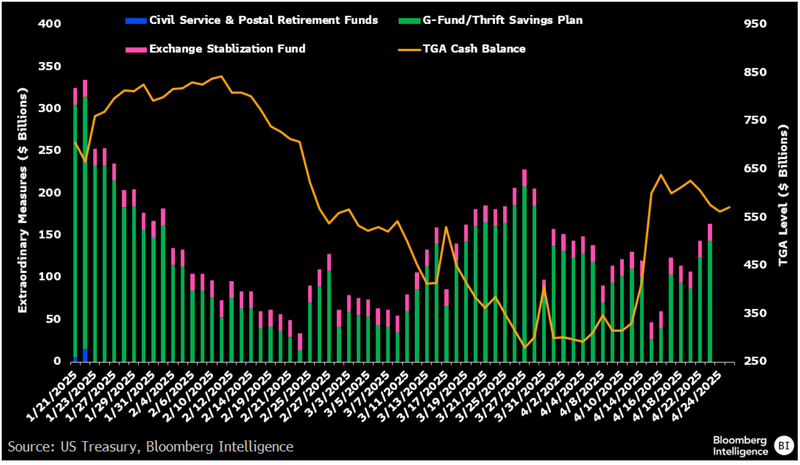

$740 billion of room under debt limit on April 23

The Treasury Department had $740 billion of room under the debt limit as of April 23 (the most recently available data). This includes $576 billion of cash held at the Federal Reserve and $164 billion of extraordinary measures, primarily from the Thrift Savings Fund. Since that reading, the cash balance has fallen to $572 billion as of April 25.

We continue to see early August as the debt ceiling X-date, after which the government won’t be able to make all its expected payments.

Treasury cash and extraordinary measures

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.