This analysis is by Bloomberg Intelligence ESG Strategist Shaheen Contractor and Senior ESG Analyst Rob Du Boff. It appeared first on the Bloomberg Terminal.

Does Tesla belong in an ESG fund? The age-old debate is being stoked anew by its removal from the S&P 500 ESG Index. We believe Tesla’s status as the largest maker of electric cars might fit a fund focused on environmental or impact themes (eg climate), while its social and governance shortfalls make inclusion in ESG funds debatable — and that its index removal is perhaps overdue. The renewed debate aside, many big ESG funds hold Tesla. The company ranks 46th in the S&P 500 in our analysis of ESG sentiment and how managers favor companies via their holdings.

Many ESG funds like and own Tesla even as S&P ESG index drops it

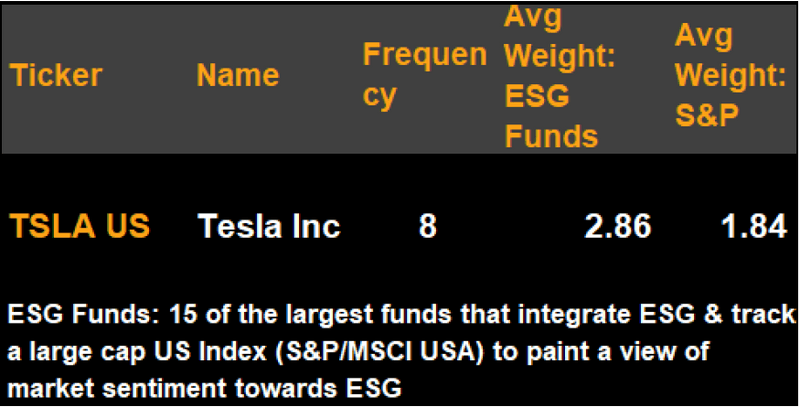

Tesla’s ESG status remains among the most debated for any stock and many ESG-oriented funds held it as of their most-recent filings. Tesla ranks 46th in the S&P 500 in our analysis of companies’ likelihood of inclusion in ESG and sustainability funds. Eight of 15 large US funds that include such themes in their portfolio filters hold Tesla, with the company being on average 1% overweight vs. the S&P 500. A number of funds that hold Tesla are passive funds based on MSCI ESG Indexes. Interestingly, few active funds in our sample hold Tesla.

Though Tesla might fit an environmental focus or impact theme, we believe its social and governance issues make its inclusion in ESG funds debatable and that Tesla’s removal from the S&P 500 ESG Index perhaps overdue.

Tesla’s inclusion & weight in 15 large ESG funds

Tesla might fit an `E’ impact theme but it’s weak on `G’

Tesla’s inclusion in ESG funds seems to ignore challenges the company faces on ‘S’ and ‘G’ issues. While overboarding statistics appear strong, they don’t account for Elon Musk’s roles in private companies such as SpaceX CEO as well as his current pursuit of Twitter, which may distract from his duties as CEO. Telsa also has poor Bloomberg executive compensation and shareholder rights scores, marked by very high levels of equity pay vs. performance and declining shareholder support on say-on-pay, held once every three years (the best practice is annual voting). A classified board with three-year director terms is also less shareholder friendly than annual voting for all directors.

The board also lags in gender diversity with 25% female representation, despite naming a woman chair following Musk’s SEC-mandated removal.

Tesla’s Bloomberg governance scores

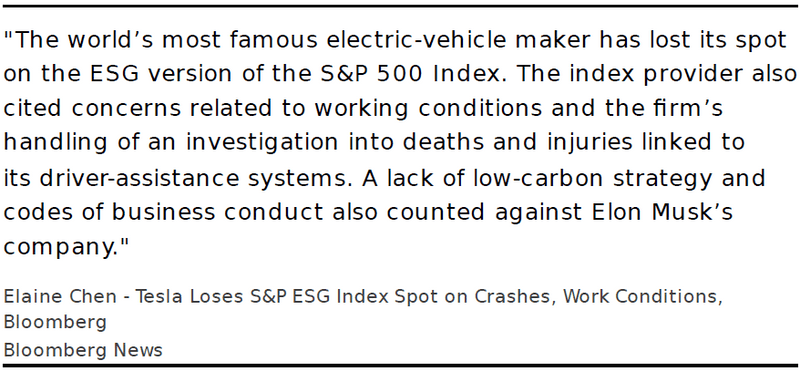

Concerns that led to S&P ESG Index dropping Tesla

The S&P 500 ESG Index dropped Tesla as of its rebalance on May 2, citing concerns relating to racial discrimination, poor working conditions and the company’s handing of an investigation into injuries and deaths related to its autopilot vehicles.

Tesla’s removal was discussed in an S&P blog post dated May 17.

Bloomberg News

Our U.S. ESG aggregate constituents in $92 billion fund assets

The exhibit to the right identifies the 15 large funds that integrate ESG criteria according to their fund prospectuses, and are benchmarked to a large-cap index like the S&P and MSCI USA. Given the large size of funds (totaling about $92 billion in assets), we use our aggregate as a way to represent U.S. fund managers’ ESG decisions. Stocks that appear frequently in the funds and are on average overweight relative to the S&P are most likely to be ESG steadfast, while those that appear at low frequency and are underweight are the least ESG friendly.

Aggregate portfolio: U.S. ESG funds selected