India’s currency outperforms, enters JPMorgan bond index

Functions for the Market

Background

A decade ago, India was one of the “fragile five” emerging nations along with Turkey, Brazil, South Africa and Indonesia. But this year, the rupee has been Asia’s best currency, with Bloomberg Economics expecting additional gains ahead.

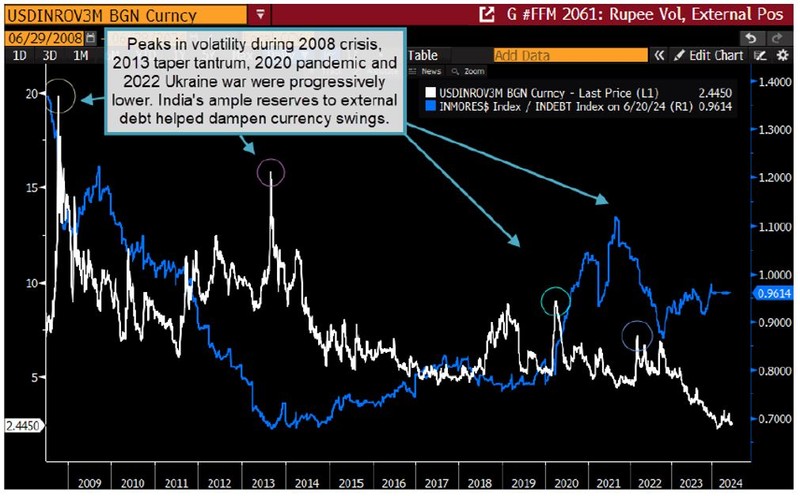

The currency’s implied volatility has peaked at lower levels during successive crises, with a less-bearish options skew and correlations that signal increased stability. In fact, India has rapidly become one of Asia’s most stable currencies in recent years.

The issue

The rupee’s peaks in volatility have been progressively lower over the past 15 to 20 years, as seen in the 2008 financial crisis, 2013 taper tantrum, 2020 pandemic and 2022 Ukraine war. India’s improving ratio of reserves to external debt has given it the resources and fundamentals needed to dampen currency swings.

India is also outperforming other leading Asian currencies in 2024. The World Currency Ranker shows the rupee has a total return of 3.2% this year, even as the yuan declined by 0.4% and the yen dropped 12.8%. Meanwhile, India’s inclusion in a key JPMorgan bond index this month is driving inflows that should boost the rupee over nine months, writes Abhishek Gupta, an economist at Bloomberg Economics.

Given India’s strong growth prospects, fiscal consolidation and $654 billion in FX reserves, Gupta expects investors using the JPMorgan benchmark to be 3% overweight by March 2025. He estimates inflows of $35 billion this fiscal year, with the rupee at 82-84 in nine months versus 83.5 now.

Meanwhile, the skew in three-month USDINR options suggests traders have become less negative on the rupee over three-year and six-year spans. Buying dollar calls has also become increasingly cheap, with the benchmark risk reversal almost half as wide as in 2018. Even with the rupee reaching record lows against the dollar, a decline in spot-implied volatility correlation indicates traders are more confident in the central bank’s ability to manage the currency.

Tracking

Use Bloomberg’s GP, OVDV, HRA and CORR tools for analysis. To track the rupee’s path to resilience since the 2008 financial crisis, use the shortcut G #FFM 2061.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.