Bloomberg Economics

This article was written by Abhishek Gupta, Senior India Economist at Bloomberg Economics. It appeared first on the Bloomberg Terminal.

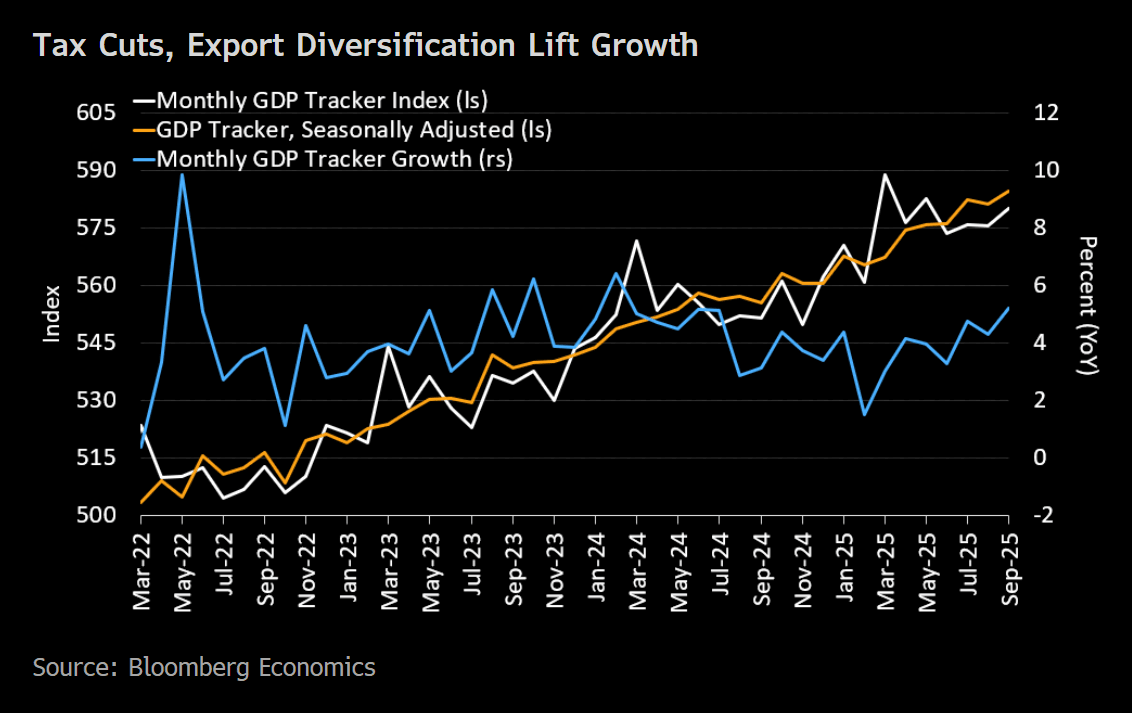

India’s economy rebounded in September, Bloomberg Economics’ monthly GDP tracker shows — defying expectations after the US imposed 50% tariffs on Indian exports. The recovery looks durable, setting the stage for stronger growth ahead.

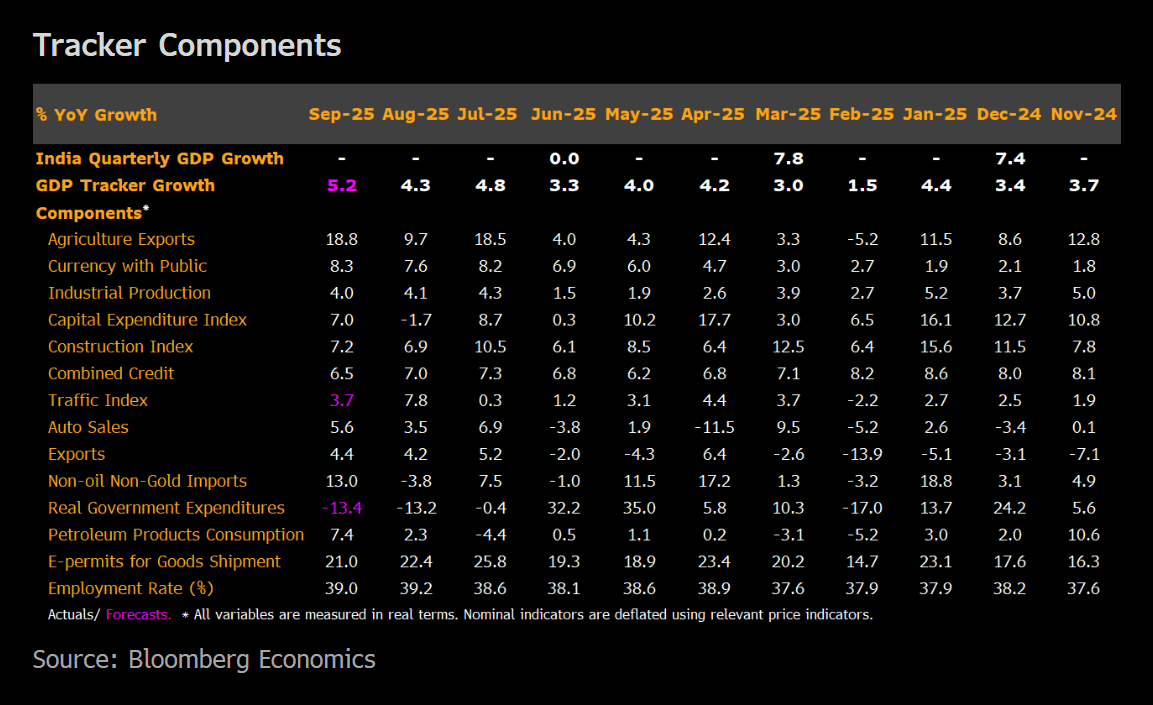

- Our tracker estimates growth at 5.2% year on year in September, up from 4.3% in August. On a seasonally adjusted basis, output rose 0.6% from the previous month, reversing a 0.2% drop.

- The Reserve Bank of India raised its GDP growth forecast for fiscal 2026 to 6.8% from 6.5% at its Oct. 1 review. Both the median consensus and our forecast stand at 6.7%.

- Consensus projections call for growth to ease to 7.0% in the third quarter of 2025 from 7.8% in the previous quarter. Our tracker shows an upswing to 4.8% from 3.8%, suggesting we may soon revise our 3Q25 outlook higher.

- The rebound over July to September — despite tariff headwinds — points to stronger momentum through fiscal 2026. Export diversification, tax cuts, a solid harvest outlook, and surging gold prices are all fueling demand.

- The US raised tariffs on Indian exports to 25% effective Aug. 7 and doubled them to 50% on Aug. 27. Exports to the US — India’s top market — fell 20.3% month on month in September after a 14.4% drop in August. Even so, shipments to the UAE, China, Hong Kong and elsewhere lifted overall exports 2.6% for the month.

An earlier announcement of the cut in goods and services tax rates effective Sept. 22 spurred heavy discounting by firms, boosting consumption. Non-oil, non-gold imports jumped 13.0% in September, reversing a 3.8% drop. The full effect of the GST cut should emerge in October.

Monsoon rainfall from June to September beat its 50-year average by 7.9%, pointing to a strong autumn harvest and winter sowing. Tractor sales soared 42.9% year on year in September, up from 24.6% in August. Agricultural exports nearly doubled to 18.8%. Faster growth in currency held by the public underscores a strengthening rural economy.

Rate-sensitive sectors also showed renewed momentum — capital goods investment, construction, and car sales all climbed, helped by GST cuts.

Households benefited from a 14.7% jump in gold prices, boosting notional wealth. The gold loan market swelled to $230 billion by September from $83 billion in March 2024 — a near 100% annualized rise.

Overall, the combination of lower taxes, firmer rural demand, wealth gains, and 100 basis points of RBI rate cuts earlier this year is driving consumption and investment higher. The new free-trade pact with the European Free Trade Association — comprising Switzerland, Norway, Iceland, Liechtenstein — effective Oct. 1 should further help diversify exports away from the US.

- Note: We estimated figures for cargo and passenger traffic, and government spending using data on some available indicators, as well as seasonal trends to allow for the timely release of the tracker.

- We updated the components in July 2023 to include electronic permits for goods shipments within and across states, along with central government spending. In the September 2025 report, we added exports as a separate component from industrial production to capture tariff effects more directly.