This analysis is by Bloomberg Intelligence ESG Analyst Michelle Leung. It appeared first on the Bloomberg Terminal.

China’s first “Guidance for Enterprise ESG Disclosure”, taking effect on June 1, is much needed to bridge the gap in ESG disclosure standards in China and possibly lift equity returns over time. We find that components of the CSI 300 Index with higher-than-average ESG disclosure scores have outperformed over the past three years and year-to-date.

Increasing ESG disclosure is the megatrend in Asia

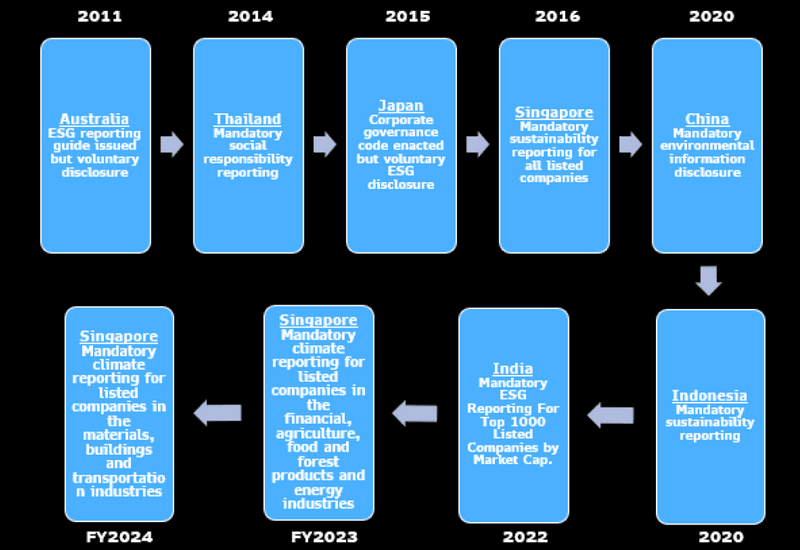

China’s first “Guidance for Enterprise ESG Disclosure”, issued by the China Enterprise Reform and Development Society, will take effect on June 1. Given the rapid development of ESG products in China, the guidance is much needed to lift ESG disclosure standards among the country’s enterprises. The guidance is based on Chinese laws and regulations, fitting in with the operating conditions in the country. Currently, there are at least 25 jurisdictions that have mandated corporate ESG disclosure, according to a study by the European Corporate Governance Institute. Among Asian countries, Thailand, China, Singapore, Indonesia and India have made sustainability and environmental information disclosure mandatory but ESG reporting remains mostly optional.

Timeline for ESG disclosure/Reporting in Asia

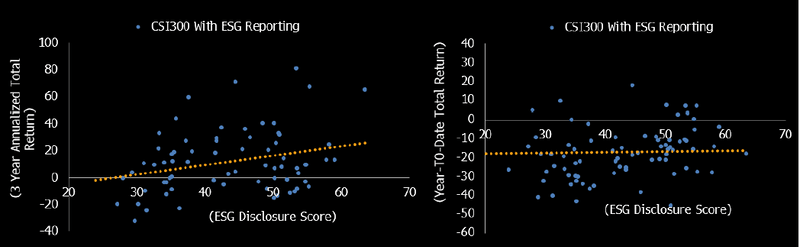

Better ESG disclosure may yield higher return

Our study of CSI 300 Index constituents shows that firms with Bloomberg ESG disclosure scores that are higher than the average of 42.5 provided a better three-year annualized return of 16.3% than the index average of 13.6%. The shares of these firms have also fallen less this year, averaging minus 14.4% vs. minus 19%. Zhejiang Huayou Cobalt had the highest score of 63.2 and a three-year annualized return of 62.4%, way above the average. About 26% of CSI 300 firms are rated by Bloomberg, with scores based on Global Reporting Initiative and Investor Stewardship Group standards.

Although better ESG performance may aid share prices, as negative ESG incidents become less likely over time, sector exposure and earnings should remain the key drivers of share performance.

3-Year annualized return vs. BIoomberg ESG score

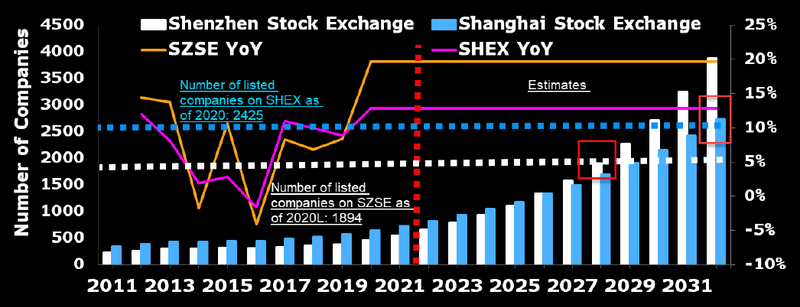

Long way to full ESG disclosure at current pace

Based on the current pace of increase, it could still take up to six to 10 years for all of the companies listed on the Shanghai and Shenzhen stock exchanges to release annual ESG reports, even if the speed has been accelerating. The number of listed companies that release such annual reports hit a record of 451 for the Shanghai exchange and 641 for the Shenzhen exchange in 2020, representing 24% of all listed firms on each bourse. The growth in the number of companies publishing ESG reports also accelerated last year to the fastest pace over the past decade to 20% for Shanghai and 13% for Shenzhen, reflecting a sweeping ESG wave. Financials have the highest reporting percentage of 99%, followed by real estate’s 86% and industrials’ 84%.

Number of companies that release ESG reports

Synchronizing with ISSB could be China’s next step

Adopting international ESG disclosure standards should be China’s long-term goal, which may help achieve mandatory ESG reporting, but a few problems, such as the lack of an established process for collecting high-quality ESG data and scant ESG coverage by third-party rating agencies, should be addressed first. While the China Securities Regulatory Commission is asking A-share companies to report ESG information voluntarily — based on various disclosure requirements — synchronizing with global ESG standards like International Sustainability Standards Board (ISSB) could be the next step. China’s Ministry of Finance has asked Chinese companies to provide feedback on the ISSB proposals by June 15 based on their domestic needs, and this will then be submitted to the ISSB.

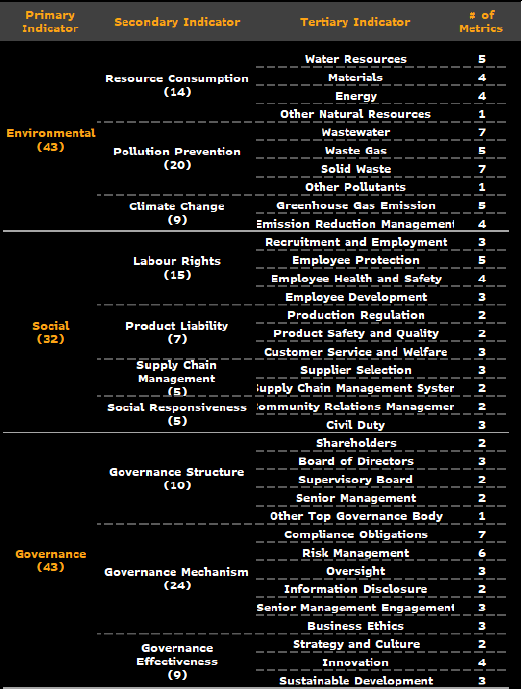

ESG metrics of enterprise ESG disclosure guidance