How new EBA rules will impact credit risk & ESG data requirements

This article was written by Bradley Foster, Global Head of Content (Enterprise) and Murat Bozdemir, Regulatory and Reference Data Product Manager at Bloomberg.

Takeaways

Here are the key takeaways from the new EBA rules:

- New European-wide prescriptive guidelines emphasizing the need for integrated credit risk management supported by data to go live in June 2021

- ESG factors centre piece of the requirements as banks need to consider the impact on creditworthiness

- Sensitivity and scenario analysis must be considered: feasibility of a company’s future repayment capacity under potential adverse conditions

- Underlying industry challenges such as dependency on external ratings and shortcomings of Internal Ratings Based models (IRB) together with the impact of COVID-19 on the economy exacerbates the pressure on banks

Background

The European Banking Authority (EBA) recently published new guidelines on loan origination and monitoring, addressing shortcomings in credit-granting practices by banks, highlighted by the financial crisis and recent COVID-19 pandemic. Prescriptive by nature, these guidelines are an important step forward, delivering standardization for loan origination and credit risk management at the European level. Their objective is to improve practices, governance and processes in relation to credit granting, in order to ensure robust and prudent standards for credit risk taking, management and monitoring.

The guidelines introduce extensive data requirements for assessing corporate borrowers’ creditworthiness and specify the ongoing monitoring of credit risk and credit exposures, including regular credit reviews. Environmental, social and governance (ESG) factors are a center piece of the requirements, which also encourage the adoption of automated and statistical models in loan origination and credit monitoring. Lastly, the guidelines recommend better practices for loan pricing and valuation of real estate as part of transactions.

The new EBA guidelines will apply as of 30 June 2021 to credit institutions of all sizes in the 27 EU member states. In the following sections we will discuss some of the key requirements.

New governance requirements

The guidelines emphasize the responsibility of the management body in setting and managing the credit strategy in line with the risk appetite of an institution, aligned with the internal capital adequacy assessment process (ICAAP) and internal liquidity adequacy assessment process (ILAAP). The credit risk appetite should be supported by appropriate credit risk metrics and limits, covering client segments, currency, collateral types and credit risk mitigation instrument, with a combination of backward-looking and forward-looking indicators depending on the type of exposure.

From a governance perspective, there is also attention on using technology-enabled innovation for credit-granting purposes. Models should be fit for purpose and banks must understand the quality of data inputs to their models, detect and prevent bias in the credit decision-making process.

The guidelines also outline minimum elements to be included in credit procedures and policies regarding how firms identify and manage money laundering, sanctions and terrorist financing (ML/TF) risks to which they are exposed.

ESG factors and the impact on credit health

In line with the ambition of the European Commission to steer Europe to a carbon neutral and green economy, the guidelines requires banks to take into account the risks associated with ESG factors on the financial conditions of borrowers, and in particular the potential impact of environmental factors and climate change.

The risks of climate change for the financial performance of borrowers can materialize as physical risks, including liability risks for contributing to climate change, or risks that arise from the transition to a low-carbon and climate-resilient economy. In addition, other risks can occur, such as changes in market and consumer preferences and legal risks that may affect the performance of underlying assets.

In order to identify borrowers with great exposure to ESG factors, directly or indirectly, firms can use heat maps that highlight, for example, climate-related and environmental risks of individual economic sectors.

Assessment of borrower’s creditworthiness: credit risk data requirements

The guidelines differentiate between lending to medium-sized, large enterprises and small business. When carrying out the creditworthiness assessment, the financial position and credit risk of the borrower, as well its organisational structure should be taken into account. The guidelines recommend considering the following data points:

- current and the projected financial position, including balance sheet and capital structure, working capital, income, cash flow

- net operating income and profitability, especially in relation to interest-carrying debt

- leverage, dividend distribution, and actual and projected capital expenditure, as well as its cash conversion cycle

- loan exposure profile to maturity, in relation to potential market movements and collateral provisions)

- the probability of default (PD), based on credit scoring or internal risk rating based models

- asset class- or product type-specific metrics and indicators such as country, sector or supply chain dependencies and concentration data

Sensitivity analysis in creditworthiness assessment

The guidelines require that the creditworthiness assessment should include feasibility of a company’s future repayment capacity under potential adverse conditions that may occur. To this end, banks should carry out a single- or multifactor sensitivity analysis, considering market and idiosyncratic events that are relevant. The following scenarios should be considered:

Idiosyncratic events

- a severe but plausible decline in a borrower’s revenues or profit margins

- a severe but plausible operational loss event

- the occurrence of severe but plausible management problems

- the failures of significant trading partners, customers or suppliers

- a severe but plausible reputational damage

- a severe but plausible outflow of liquidity, changes in funding or an increase in a borrower’s balance sheet leverage

- adverse movements in the price of assets to which the borrower is predominantly exposed (e.g. as raw material or end product) and foreign exchange risk

Market events

- a severe but plausible macroeconomic downturn

- a severe but plausible downturn in the economic sectors in which the borrower and its clients are operating

- a significant change in political, regulatory and geographical risk

- a severe but plausible increase in the cost of funding, e.g. an increase in the interest rate by 200 basis points on all credit facilities of the borrower

Industry challenges in managing credit risk: Recent trends & COVID-19

The expansion of loan books across sectors and jurisdictions renders the access to high quality and timely financial and corporate structure data in underwriting borrowers critical, especially for firms with limited or non-existent credit bureau data. It is essential for firms to integrate external data and internal borrow information in credit decision frameworks and scorecards. By gathering and using rich external data sets, combined with default risk analytics and supply chain data and sector risk indicators, banks will be able to streamline their loan origination decision-making process and ongoing portfolio credit risk management. Examples include having early warning indicators for the aggregated counterparty exposure including loan books, concentration risk limits and the capability to run advanced scenario analytics that allow lenders to react quickly and proactively address any risk concerns.

Reliance on internal models (CR IRB)

Larger banks deploy Internal Ratings Based (IRB) PD models for their credit risk assessment and for capital planning. IRB models are often labor-intensive and difficult to maintain, plus have been the subject of increased regulatory scrutiny with enhancements proposed under IRB 2022. Banks are working to improve their ongoing monitoring programs to proactively detect model issues and standardize their internal ratings based PD estimates through peer reviews and other methods for establishing comparability between models.

COVID-19 and reliance on ratings

Many economists expect that the global economy will enter a recession characterized by an increase in unemployment, and inevitably an increase in corporate defaults. Banks remain heavily dependent on external ratings in their credit risk assessment. However, given the dependency on company fundamentals, external ratings often lag and do not provide risk managers with the ability to proactively manage risk in a fast deteriorating market characteristic of this crisis. Regulators and governments have been pushing firms away from over-reliance on ratings.

Unlike prior crisis, banks today have the advantage of having healthier balance sheets, less leverage and being well capitalized and funded. They therefore should have significant buffers and additional loan loss provisions to allow them to absorb losses. Coupled with the short-term relief on their capital requirements granted by regulatory supervisors, all points to banks being better placed to weather this recession, that’s if they adapt their practices to the current situation.

How we can help

The EBA guidelines and industry challenges outlined in this article should be considered in the broader regulatory context. In recent years, regulators have been moving away from firefighting non-performing loans, instead putting greater emphasis on banks having embedded and integrated processes and data frameworks in place that allow them to proactively manage credit risk across all of their exposure.

Bloomberg’s credit risk and ESG solutions supplement clients’ internal analytics and datasets, allowing them to meet the requirements set out by the EBA, while achieving the long-term goal of delivering data automation and more efficient credit risk management processes.

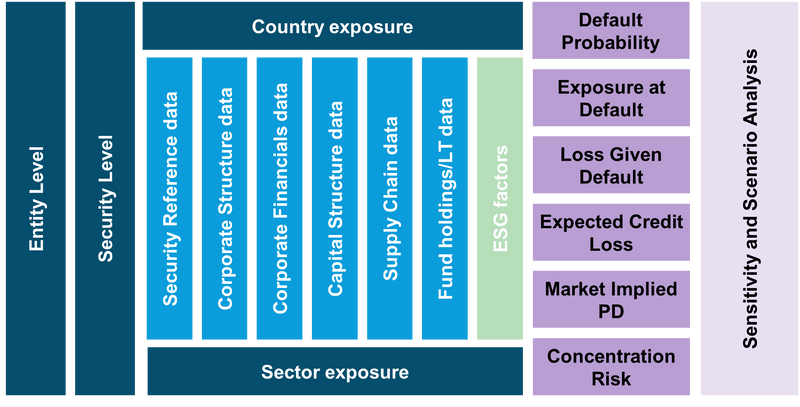

Bloomberg’s credit risk solutions offers interlinked data capturing entity, financial instrument, country and sector level information, providing transparency in corporate structure and sanctions, company financials (fundamentals), estimates, ESG factors, supply chain data, gauged by forward looking PD estimates and ECL calculations, supporting concentration risk and sensitivity and scenario analysis.

Bloomberg provides a rich set of company and instrument level identifiers enabling seamless connection with firm specific internal data, both for public and private companies. To support the discoverability of the vast number of data points available to credit risk managers, Bloomberg data is linked to Risk Taxonomies commonly accepted in the industry.