How green are your investments?

This article was written by Bloomberg’s Sustainable Indices Team.

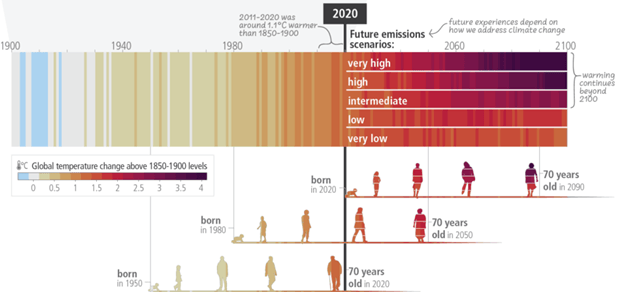

The call for action against global warming has echoed louder each year as global temperatures continue to rise and the ambitious goal of achieving net-zero by 2050 eludes us. We are currently at 1.1oC above the pre-industrial age according to the Climate Change 2023 report published by the Intergovernmental Panel on Climate Change (IPCC) in March 2023. The temperature trajectory is growing at an unsustainable rate and extreme climate events like floods, wildfires, and droughts are becoming more common.

Figure 1 below shows IPCC estimates of what current and future generations will experience in terms of global warming if we don’t curtail emissions and transition to a low carbon economy in the near term.

Figure 1: Extent to which current and future generations will experience a hotter and different world depends on our choices in the near-term (sourced from page 7 of this report)

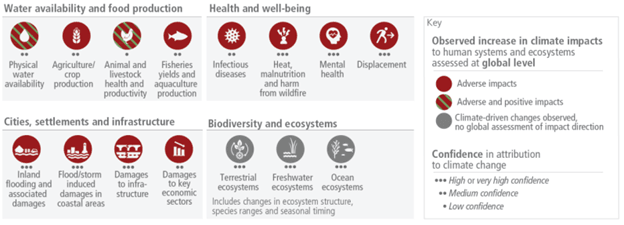

While these temperature increases appear small, there are massive consequences for humanity even at this small scale. Adverse impacts to water availability, food production, health, infrastructure, and biodiversity are expected to lead to large losses and damages to nature and people.

Below, Figure 2 shows the potential impacts from climate change. These outcomes are expected to disproportionately affect developing nations which contributed the least to the emission problem, posing a question about fairness. Should developing nations curtail their emissions at the same rate as developed nations?

Figure 2: Substantial impacts and related losses and damages attributed to climate change (sourced from page 7 of this report)

Given this monumental list of outcomes, institutional investors are facing pressures to divest from fossil fuel companies and focus on sustainable investing.

Regulations across jurisdictions are evolving and many are enforcing investors and companies to be more transparent about their climate mitigation and adaptation plans.

With this backdrop, institutional investors are wondering: how green are my investments? How can I design a prudent sustainability strategy and what are my choices to shift to a low carbon investment strategy? Below we explore four different approaches to low carbon investing.

Approach 1: Divestiture from Fossil Fuel Companies

While this strategy may help in the near term there are three critical challenges that investors need to consider.

1) Excluding fossil fuel companies can lead to large tracking error to the parent index as most of the energy sector can be removed. This approach can lead to unintended consequences like under performance against the parent index during energy price shocks, such as those we have experienced over the last few years.

2) By divesting, the investor is not engaging with these companies, but that can still be detrimental to our long-term goal of net zero. Climate science has shown that emission reduction alone will not get us to net zero and investment in low carbon solutions are necessary. In his book “How to Avoid a Climate Disaster,” Bill Gates noted that through the Covid-19 pandemic we only reduced annual GHG CO2e emissions in 2020 by 5% which is shockingly low considering energy demand shuttered overnight. Many energy companies are evolving their operations and investing in new renewable technologies, so continuing to engage with them to promote this type of investment will be instrumental in transitioning to a low carbon economy.

3) The investment strategy may not track or report on emissions, making it difficult to assess investor sustainability goals.

Approach 2: Remove the Highest Emitting Companies

Another approach is to remove the highest emitting companies from your investments. Investors may appreciate this tactic as it is a market weighted approach which is simple to understand and benchmark against. This approach addresses two out of the three deficiencies we noted with the divestiture approach. First, it allows for emissions tracking which can support sustainability goals and/or regulatory requirements. Second, it allows for continued engagement with certain firms as the exclusions are not explicitly focused on the oil and gas companies.

Exclusions will evolve through time as companies improve their operations due to sustainability goals and regulatory pressures. Tracking error will depend on the parent universe and how concentrated the highest emitters are to a particular sector. This approach can be used to design Paris Aligned Benchmark (PAB) and Climate Transition Benchmark (CTB) indices per the European Union’s Benchmark Regulations (EU BMR).

Approach 3: Optimized Decarbonized Indices

The optimized decarbonized indices meet all three objectives and go beyond. These indices can be designed to closely track their parent index with minimal turnover. As explored earlier this year in light of the rise in popularity of Paris-Aligned Benchmarks (PAB), they can incorporate constraints to reduce concentration risks to a given country, sector, company, and/or security.

For fixed income, these indices can be designed to closely track parent index duration and improve upon the yield-to-worst (YTW) of the parent index. Transition risk constraints can also be considered to increase exposure to companies which invest in green technology or to companies that have more robust sustainability plans that are environmentally friendly per the EU Taxonomy. Clients can also increase exposure to green, social, and sustainable (GSS) bonds to support environmentally friendly projects.

Optimized decarbonized indices can allow investors to engage with companies, track and measure emissions, support green companies, and meet both sustainability goals and regulatory requirements while minimizing transaction costs.

Approach 4: Transition Pathway Indices

Transition pathway indices are optimized decarbonized indices that go one step further. Earlier we discussed the fairness question of whether developing nations should be required to curtail emissions at the same rate as developed nations. If you believe that different nations should decarbonize at different rates based on fairness, then transition pathway indices can be utilized.

Transition pathway indices use the latest Network for Greening the Financial System (NGFS) climate models which incorporate policy ambition, policy reaction, technology change, and CO2e removal estimates to forecast decarbonization pathways across global regions and sectors. For example, transition pathway indices can account for different decarbonization pathways between the automotive and cement sectors due to differing low carbon technology innovations. We will explore this approach in more detail in a future blog.

Visit I <GO> on the Terminal or browse our website to find out more about Bloomberg’s Sustainable Indices and request a consultation with an index specialist.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.