Hong Kong’s global wealth hub status may be at make-or-break

This analysis is by Bloomberg Intelligence Senior Industry Analyst, Francis Chan. It appeared first on the Bloomberg Terminal.

Hong Kong’s tenuous stature as a global wealth hub could reach a roadblock unless its population and capital outflows halt or reverse course soon. Its currency peg and mainland China fund inflows will be critical to its prospects, shaped by the war in Ukraine and global inflation, putting global banks’ wealth management ambitions to the test.

1. City’s global wealth-hub status in peril

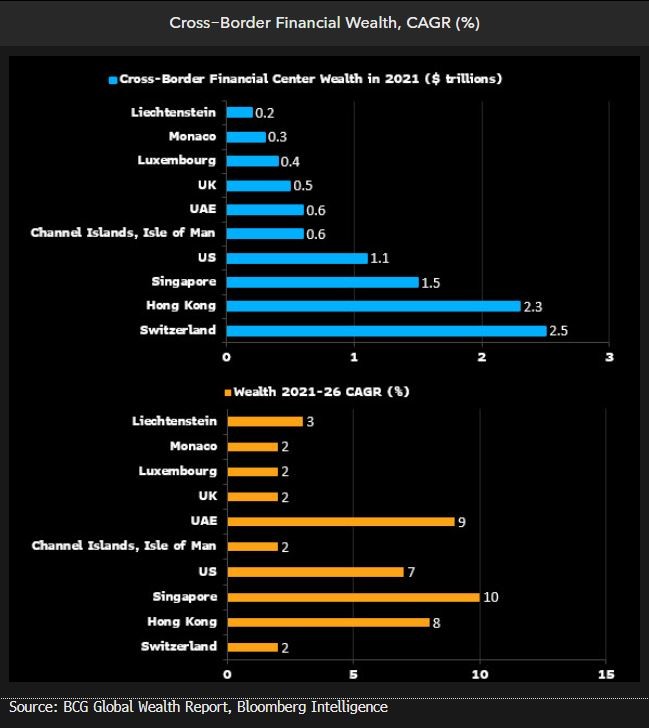

Hong Kong’s wealth and cross-border assets risk missing Boston Consulting Group’s 8-9% average annual growth forecast through 2026. The city’s beacon as a global wealth hub is in danger of dimming unless underlying trends change course in short order. Global inflation and the fallout from Russia’s invasion of Ukraine need to fade as soon as 2024. The city’s population exodus and wealth outflows must slow or halt by year-end, and the currency’s peg with the greenback and mainland fund inflows must continue.

Hong Kong’s cross-border financial wealth could rise 8% a year to $2.9 trillion vs. $2.3 trillion in 2021, based on BCG’s wealth report, the third-fastest among global centers after Singapore at 10%, and the UAE at 9%. Singapore could also gain from Hong Kong’s fund flows.

2. Money markets at risk of liquidity strain

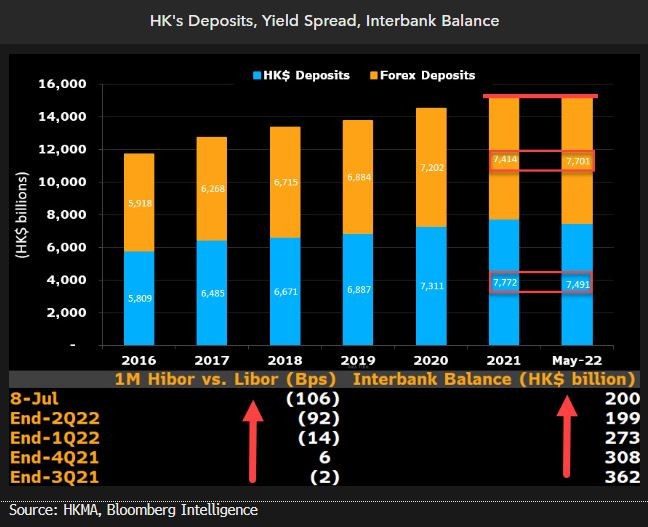

Hong Kong’s liquidity barometers could turn lower in 2H and early 2023, reflecting the grim impact of capital outflows, the city’s population exodus, negative yield spreads of Hong Kong dollars vs. US dollars, and growing Sino-U.S. tensions. Collectively, they constitute a credible near-term threat to the city’s status as global wealth center. Growth has eluded the city’s bank deposits year-to-date, while more residents are stashing more cash in foreign currency. Aggressive Fed tightening has widened the negative spread between one-month Hibor and Libor to 106 basis points.

Capital outflows from from Hong Kong appear persistent, especially with interbank liquidity almost halving since 3Q21, to HK$200 billion. More western investors may keep shuffling funds to Singapore and elsewhere as geopolitical risks persist.

3. Private wealth business faces flagging growth

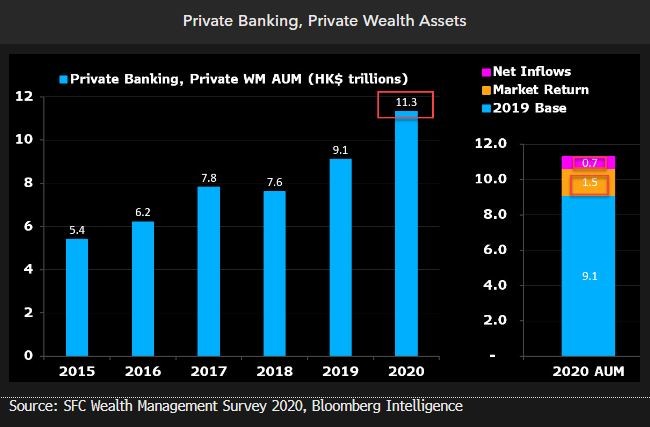

Hong Kong’s private wealth business growth could struggle in the near term amid shrinking market returns and diminished net fund inflows. Its stock market capitalization has plunged 33% since the HSI and HSCEI hit peaks in February 2021, while fixed-income portfolio losses have proliferated on China’s property bond rout and aggressive Fed rate hikes. These trends may persist in 2H, constraining returns on Hong Kong wealth assets. Fund inflows to wealth managers may have been offset by outflows, driven by the stampede of outbound emigrants and global investors. This may hamper wealth ambitions of global banks led by HSBC, UBS and Credit Suisse in the city.

Hong Kong’s new private wealth inflows came to HK$656 billion in 2020, trailing HK$681 billion in 2019. The slowdown may have been more pronounced in 2021 and 2022.

4. Some wealth, private banks’ expansions may stall

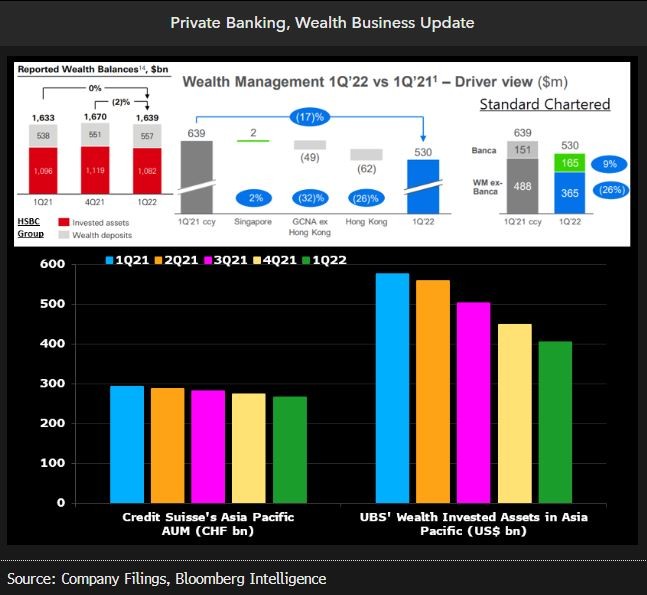

Some global wealth and private banks’ Hong Kong expansion ambitions may get a reality check from falling markets and the city’s dubious growth prospects. HSBC may employ more relationship managers in mainland China without altering its long-term Asian expansion plans, as the border reopening with Hong Kong lacks definition. Its wealth and private-banking sales shrank in 1Q vs. a year earlier. Standard Chartered may also rejig resources, as its wealth income fell 17% due to its struggling Greater China business, led by Hong Kong.

Credit Suisse may rethink its Asia hiring plans after adding 80 relationship managers last year. Its managed assets in Asia fell for four consecutive quarters to 266.2 billion Swiss francs in March. Rival UBS may hire more in mainland China as it eyes the one trillion-yuan private-banking market.