ARTICLE

Global yield surge threatens demand for US Treasuries and equities

Functions for the Market

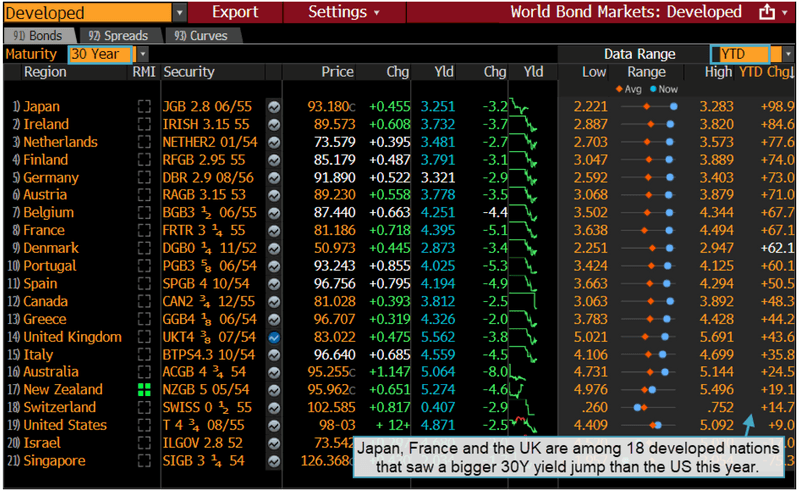

- Long-term bond yields in the UK, Japan, France and other countries have surged, threatening demand for both US Treasuries and equities.

- 30-year Treasury yields climbed 9 basis points this year to 4.87%, they rose even more for 18 similarly-rated markets.

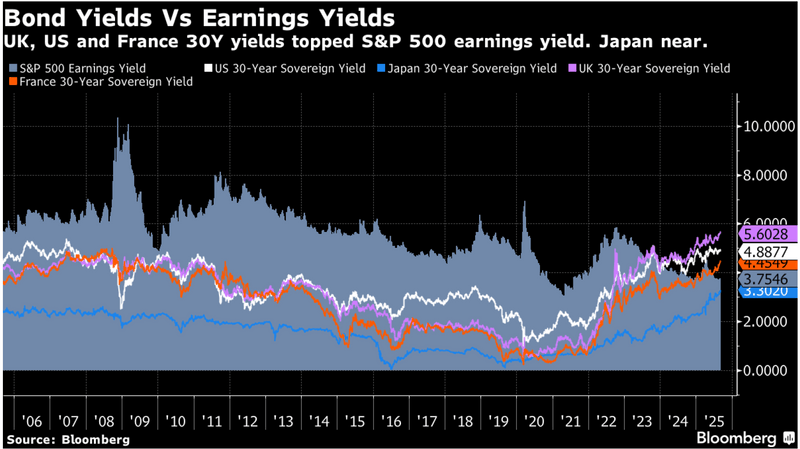

- Global investors may favor home markets over American bonds and stocks, with many long-dated sovereign yields topping the S&P 500 Index earnings yield.

Background

The US 30-year yield approached 5% at the start of September, a month historically tough for longer-maturity bonds. This year bond investors have faced a number of anxieties: the erosion of the Federal Reserve independence, political upheaval and ballooning budget deficits.

France saw a third change in government in just over a year after Prime Minister Francois Bayrou lost a confidence motion in parliament. This has helped fuel uncertainty over how the country can tackle its mounting debt burden. Franklin Templeton sees UK gilt yields topping 6% this year, as policy makers fail to keep a lid on government spending and inflation, leading in turn to higher debt servicing costs.

PRODUCT MENTIONS

Italy and the US risk having debt servicing costs topping 5% of GDP by 2034, ahead of France, Spain and the UK, according to Bloomberg Economics. Faced with the largest debt load among developed economies, Japan sees major costs ahead to maintain its debt.

The issue

When longer-term yields jump, they feed into mortgages, auto loans and credit card rates, squeezing households and broader economies. Rising yields overseas may also dampen demand for US bonds.

Japan, France and the UK are among 18 developed nations that saw a bigger 30-year yield jump than the US this year, threatening demand for US Treasuries and equities. The rise in Japan was 99 basis points, and in the UK the yield closed on Sept. 2 at 5.69%, the highest since May 1998.

In September, yields on 30-year sovereigns climbed above the S&P 500 earnings yield in the UK, US and France. The so-called “risk-free benchmarks” are unusually high and have raised doubts over equity valuations following a three-year stock rally.

Tracking

Track yields on 30-year sovereigns against the S&P 500 with the GP function:

- Type “gp S&P earnings yield 20Y daily” in the command line and hit <GO>.

- Type “us 30 year” in the Add Data box and select USGG30YR Index- US Generic Govt 30 Yr. Repeat to add GJGB30 Index, GUKG30 Index and GFRN30 Index for Japan, UK and France. Untick Normalize.

- Click Actions to save. The shortcut is G #FFM 2366

For more information on this or other functionality, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.