This analysis is by Bloomberg Government Analyst Andrew Silverman. It appeared first on the Bloomberg Terminal.

The G20’s tax plans — Pillar 1 and Pillar 2 — are intended to tax companies at a 15% minimum rate and steer tax income away from manufacturing-based nations and to market-based ones. It may not stop tax avoidance. Pillar 1 could just cause more revenue to go to China than to France, for example. Pillar 2 may see US companies pay far more tax than their Russian counterparts. US companies are the plan’s main targets, our analysis suggests, and whether the US eventually adopts the measures or not, US companies will be disadvantaged once any provisions take effect.

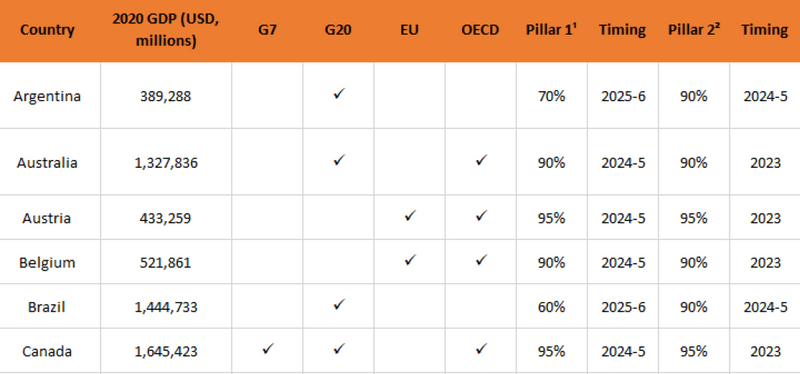

Bloomberg Intelligence’s heat map provides the probabilities that OECD countries and those in the G20 will adopt Pillars 1 and 2 and it offers a timeline for adoption.

G-20 tax heat map lays out probabilities, timing

The largest multinationals will soon have to deal with the product of a G20 global corporate tax initiative: Pillars 1 and 2. Companies like Apple and Microsoft may fall squarely in the crosshairs of both sets of levies, markedly increasing their tax expense. Russian and Chinese companies like Sberbank and Alibaba could largely avoid the new taxes.

Bloomberg Intelligence’s heat map lays out the probabilities that OECD and G20 countries will adopt the proposals and offers a sense of timing.

Tax heat map

A global corporate tax could cost Apple, Alphabet most heavily

The global tax on the 100 largest companies that’s still being negotiated appears designed to apply primarily to US companies and those in tech — such as Apple and Alphabet — more than others. Companies may fall under the tax regardless of whether their home country adopts it. European and Asian manufacturers and retailers are likely also at risk.

US tech companies worst positioned for global tax

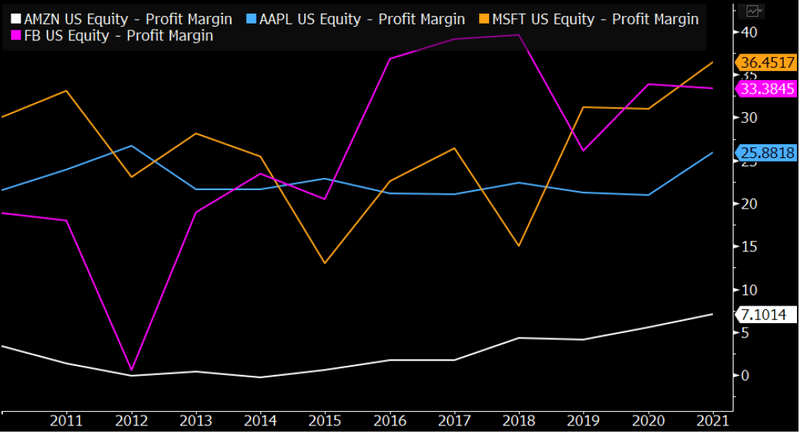

Apple, Microsoft, Alphabet and Meta are most squarely targeted by the “Pillar 1” global corporate tax. Amazon.com may fall into a safe harbor. Pillar 1 would reallocate a portion of the taxable income of any multinational with global annual revenue above 20 billion euros away from the company’s home country and to nations where it earns at least 1 million euros of revenue a year. Pillar 1 only applies to companies with a profit margin above 10%.

Apple’s 2021 revenue equated to 309.4 billion euros and its profit margin was 25.9%. Amazon’s revenue last year was about 397.4 billion euros, but its gross profit margin was only 7.1%. Amazon has never had margin above 8.5% and last year’s 7.1% was its second-highest ever.

Amazon’s margins are below peers, good for tax

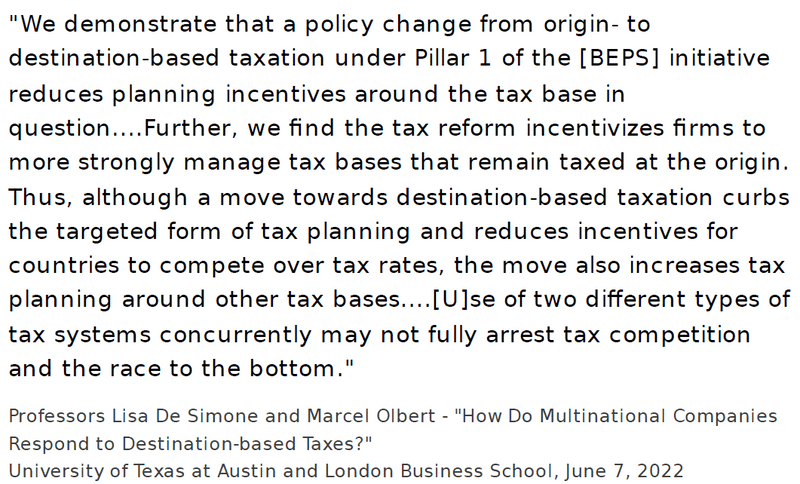

Tax pincer may fail against digital companies

A new study shows that the goal of Pillar 1, to eliminate tax avoidance using a combination of destination and origin-based taxes, is unlikely to succeed. Pillar 1 would reallocate only 25% of a company’s income to its primary market countries, so 75% of income would continue to be taxed where the company is headquartered. It’s akin to a “pincer movement,” a military strategy in which an enemy is attacked on two sides at once. Yet, a 2022 study from the University of Texas and London Business School shows that a similar approach used with EU VAT in 2015 caused multinationals, especially digital companies like Microsoft, to double-down on their planning and caused tax avoidance to worsen. Pincer movements don’t always work, as Napoleon proved at the Battle of Waterloo.

Economic report

Chinese companies far less affected by the tax

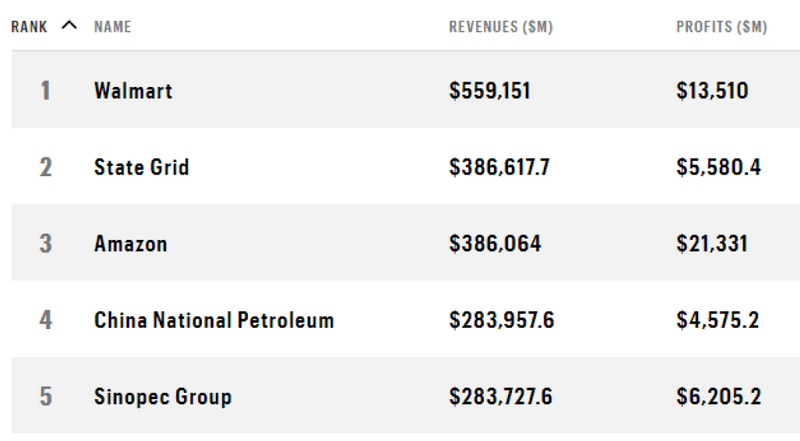

After the US, China is home to most of the world’s wealthiest companies, but many will be exempt from Pillar 1. China National Petroleum and Sinopec Group are two of the highest revenue-producing companies in the world, but most of their income arises from fossil fuels, which are excluded from Pillar 1. China’s State Grid was the second-highest revenue-grossing company last year, but it’s state-owned and also carved out. Likewise, Ping An Insurance, ICBC, China Construction Bank and Agricultural Bank of China are probably excluded as regulated financial institutions.

Also, given China’s tax-reduction policy, which a 2022 Wuhan University study says reduced federal revenue by 7.6 trillion yuan in 2016-20, there’s an open question on whether China will adopt Pillar 1.

China home to 3 the top 5 richest companies