Bloomberg Intelligence

This analysis is by Diana Rosero-Pena, Bloomberg Intelligence Lead Analyst, Americas, Consumer, and Andrew Galler, Bloomberg Intelligence Lead Analyst, Global, Health Care. It appeared first on the Bloomberg Terminal.

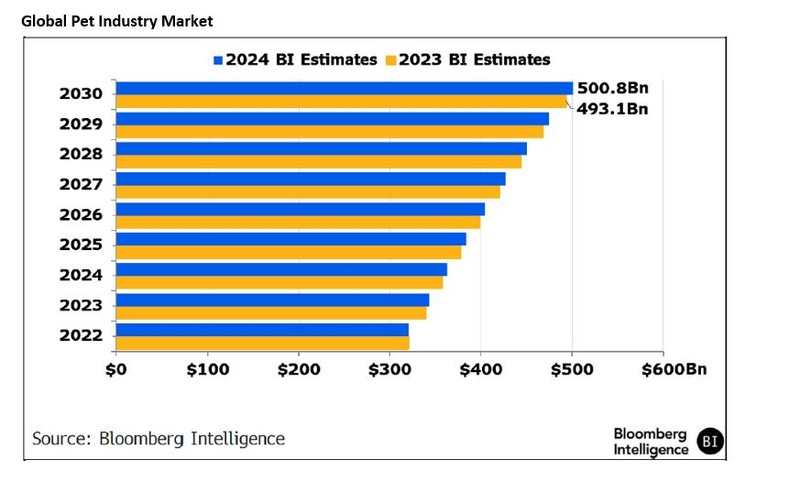

Recent strength in food sales by companies including Mars and J.M. Smucker has set the stage for the global pet industry to expand more than 45% to exceed $500 billion by 2030. Population growth and the humanization of pets will be key drivers supporting premium niches. The US will remain the biggest market and Europe may account for about a third, though other regions may expand more quickly. Our scenario finds that China could grow more than 50% to $49 billion, with Alibaba dominating e-commerce. Investments from US pure plays like Chewy could push e-tail up 87% to account for nearly 30% of the pet economy. Complex, more expensive therapies can help expand the pharmaceutical industry by over 50% to reach $24 billion, with Zoetis likely to remain the market leader. IDEXX dominates in diagnostics.

Key research takeaways

- Food Growth Sets Stage: We expect the global pet food industry to expand nearly 7% this year and then about 5% annually to reach $146 billion by 2030. Food is the biggest ownership expense and limited elasticity allows suppliers to pass along higher costs.

- Pets Fill in for Children in China: China’s pet economy can grow at a 6% compound annual rate through 2030, outpacing GDP projections of 3.5%. Pets increasingly are seen as substitutes for children, fueled by an aging population and declining marriage rates.

- Next-Generation Drugs Stoke Growth: The pet pharmaceuticals industry could expand to over $24 billion by 2030, from about $16 billion now, driven by favorable demographics, consumer spending and — most important — development of novel therapeutics. Pain, oncology and cardiology can spur innovation and the emergence of blockbuster products.

- E-Commerce Strength to Continue: Investments from US digital native Chewy and, to a lesser degree, Amazon may help e-commerce grow as much as 87% to $58.4 billion by 2030. Free shipping can breed customer loyalty and expand e-tailers’ baskets.

- Supplies, Services Highly Elastic: Sales gains for supplies, equipment and services could remain slower than in other categories as they are the most at risk during economic downturns and high inflation. Greater investment in loyalty programs and other pockets of growth can aid customer stickiness.

Already a customer? Access the full report here.

Not a terminal user? Click here to learn more.