This article was written by Alexandra Harris. It appeared first on the Bloomberg Terminal.

- Central bank has released principles for cutting balance sheet

- One key question is where the liquidity will be drained from

The Federal Reserve’s decision to start shrinking its bond portfolio – whenever that eventually happens – will cause ripples across key dollar funding markets from Treasury bills and repurchase agreements to foreign-exchange swaps. The big question is which markets will feel it most.

While the monetary authority last week released a statement outlining its principles for cutting the size of its $9 trillion balance sheet, a model that appears broadly similar to the last time it engaged in so-called quantitative tightening, it has yet to flesh out the details. Just as importantly, how market players – including the U.S. Treasury Department – will respond to the Fed’s moves remains a major unknown.

One potential scenario is that it will felt most acutely as a reduction in bank deposits and reserves, which could put upward pressure on repo rates and borrowing benchmarks linked to them, like the Secured Overnight Financing Rate. That would mean an additional tightening of overall financial conditions in addition to the increase in the main fed funds rate target that the central bank will probably have begun implementing already by then. It could also hurt liquidity as well as create dislocations – and potentially trading opportunities – in different parts of the U.S. rates market, like futures and swap spreads.

Meanwhile, if the Treasury chooses to lean more heavily on issuance of bills rather than longer-term debt to plug the funding gap that will emerge from the Fed stepping back, then the amount of excess cash in short-term markets – much of which is currently parked at the central bank’s reverse repo facility – could dwindle. That could also potentially exert upward pressure across the short-term complex.

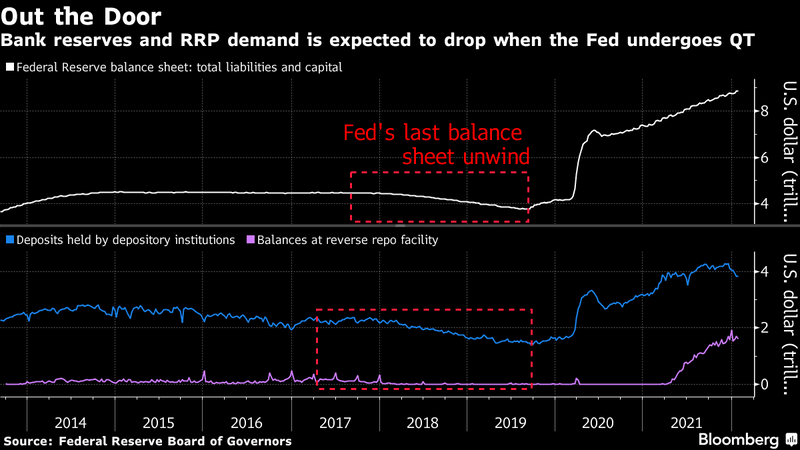

The last time the Fed undertook quantitative tightening, from 2017 to 2019, it set monthly limits to how much it would allow to roll off without being replaced by other securities and pledged to continue until reserves reached a comfortable level for the banking system. Back then, a drop in balances below the system’s ideal level helped fuel a disruptive spike in repo rates, a keystone of short-term funding markets. The Fed has since then implemented additional tools to help reduce potential problems in this area, but a decline in reserves could nevertheless create risks and forestall how much the central bank chooses to shrink its balance sheet.

One additional wrinkle is what state markets and the economy are actually in when the Fed actually beings unwinding. Even if one is confident about how big the drawdown might be and how the Fed might approach it, market participants won’t know if the upcoming tightening will be smooth or bumpy unless they have a clear picture of market conditions, Credit Suisse Group AG strategist Zoltan Pozsar wrote in a note to clients Thursday.

Following are some of the short-term markets, measures and facilities to watch as the Fed embarks on QT:

Bank reserves and reverse repo

As QT removes the excess liquidity from the financial system, a debate has emerged among Wall Street strategists as to whether reserves will drain faster from bank deposits or the central bank’s overnight reverse repurchase agreement facility, whose use has swelled to more than $1 trillion on the back of excess money-fund cash.

If it’s mainly the banks, that could result in a significant drawdown in the amount of reserves that lenders hold with the U.S. monetary authority. Conversely, if it’s money-market funds, then there will likely be a drop in how much is squirreled away with the Fed’s RRP. Of course, it will likely be a combination of the two, but whether one or the other takes the brunt will be important and is currently being debated by Wall Street strategists.

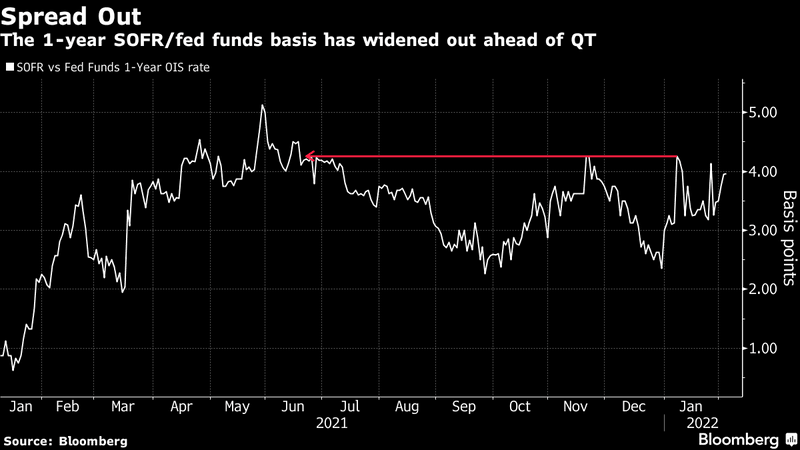

Funding rates

Once QT is underway, the expectation is that the spread between the effective fed funds rate and SOFR – a key benchmark replacing the London interbank offered rate – will eventually widen. The rationale is that if reserves become more scarce, investors like money funds will have to turn to the private market for repurchase agreements. That will in turn put upward pressure on market rates and related benchmarks, like SOFR.

The gap between SOFR and the fed funds rate on an overnight basis is currently 3 basis points in favor of the central bank benchmark, while swap markets indicate that gap is likely to be around 3 basis points in the other direction around a year from now. But some suggest that the premium of SOFR over fed funds could be even wider than that. A call last month by Credit Suisse’s Pozsar that it should be bigger prompted some temporary widening within markets. Bank of America strategists Mark Cabana and Katie Craig, on the other hand, reckon that widening will be limited because QT will affect bank reserves more and banks could be slower off the mark in repricing deposits than money markets are in adjusting.

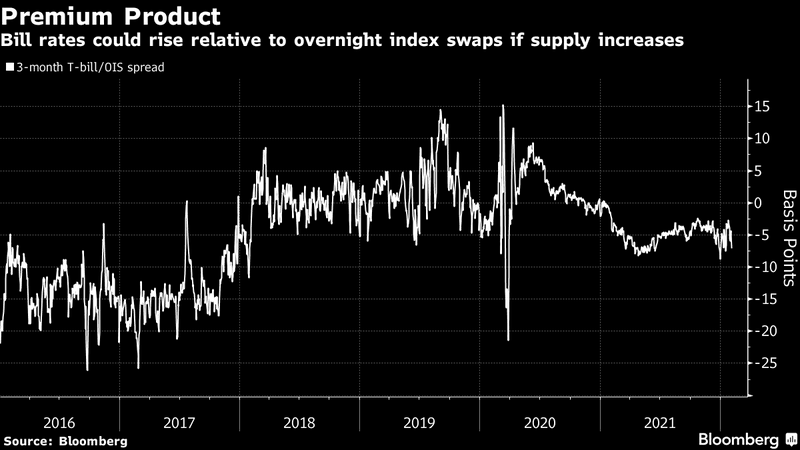

T-bill supply

As the Fed lets securities roll off its balance sheet, the Treasury typically will issue new debt to offset the maturing issues. At the latest quarterly refunding announcement on Wednesday, department officials cautioned about the significant uncertainty in forecasted deficits and redemptions from the Fed’s open market account. For the moment this leaves market participants guessing how Treasury will finance the Fed’s unwind.

Barclays Plc strategist Joseph Abate has estimated that in the second half of the year Treasury bill issuance could increase by as much as $275 billion or as little as $25 billion, depending on the Fed’s decisions. To lure funds away from the Fed’s reverse repo facility – where more than $1 trillion is currently parked each night – these bills would have to come at a premium. And the bigger the influx of supply, the more upward pressure there would be on bill rates relative to other markets such as overnight index swaps, which measure where traders expect the overnight central bank rate to be over various horizons.

“It boils down to how much of QT will be financed via added bill issuance and the extent to which the market moves from RRP to bills,” said Gennadiy Goldberg, senior interest rates strategist at TD Securities. “The only issue is how quickly that happens – in reality it may take ages.”

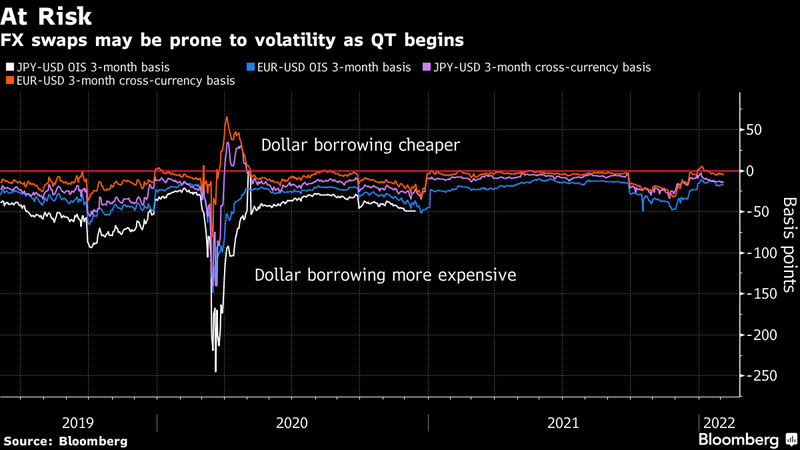

FX swaps

Of course, the impact of balance-sheet reduction won’t just be confined to U.S.-based instruments and one of the first places its effects could emerge might be in foreign-exchange swap markets, according to Credit Suisse’s Pozsar. The complexity of the QT process combined with benchmark rate increases has the potential to cause dislocation in FX swaps, which could produce discomfort among potential foreign buyers and in turn have knock on effects for marginal demand, auctions and dealer inventories. At a time when the largest single buyer, the Fed, is already stepping back, this has scope to create disruption in the wider Treasury market, so swaps will be a key area for observers to watch.