Fed pendulum to swing in small caps’ favor over big tech

Functions for the Market

Background

The small-cap potential for a Q2 revenue recovery and their historical performance during Fed easing cycles make these stocks a likely target for investors looking to diversify.

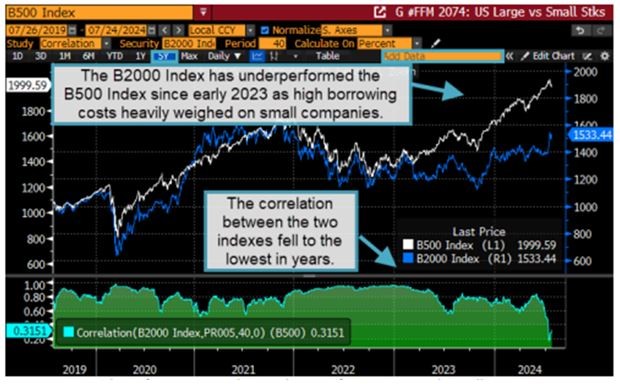

The Bloomberg US 2000 Index has underperformed the Bloomberg US 500 Index since early 2023 due to the outsized impact of high borrowing costs on small companies. However, the two indexes currently have their weakest correlation year. Analysts suggest this may further push investors to diversify in financials, health care and industrials because of their higher exposure in the small-cap gauge.

US small-cap stocks rallied 7% in July 2024, while big tech was blamed for the 1% drop in the Bloomberg US 500 Index. Declines among the Magnificent 7 — mega-cap tech stocks Amazon, Apple, Alphabet, Meta Platforms, Microsoft, Nvidia and Tesla — have the potential to pull some indexes down further.

The Issue

New data shows that June’s inflation rate was the first month-on-month decline since 2020. June also had the highest retail sales increase in the past three months. Better performance may also be bolstered by projected year-over-year revenue growth in the Q2 earnings season — a first since late 2022.

Analysis of the 2000 and 2020 easing cycles suggests that value, small-size and high-leverage factors perform better than a group of large-sized companies within a low-rates environment.

Tracking

Run Bloomberg’s GP to track the performance and correlation of large- and small-cap indexes. Use FTW to review historical factor performance for value, size, leverage and more.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.