This analysis is by Bloomberg Intelligence Senior Market Structure Analyst Jamie Douglas Coutts. It appeared first on the Bloomberg Terminal.

With a more accommodating macro backdrop, Ethereum appears to have bottomed, solidified by improved activity resilience than the previous bear cycle, and broadening use cases. Looking forward, the ambitious transition to Proof of Stake (the Merge) due in September, outlined in earlier reports, is an event catalyst that has the potential to recast Ether as a global institutional-grade asset.

Ethereum activity weathers bear market

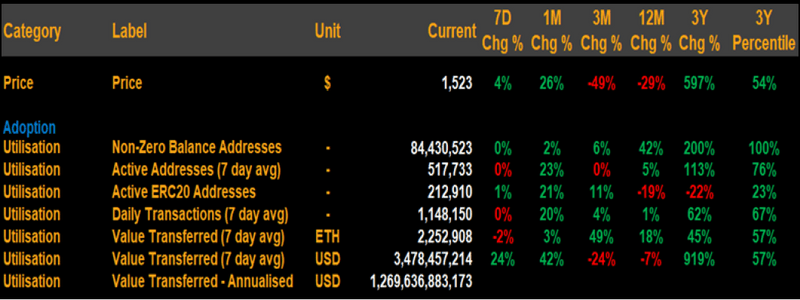

Our fundamental dashboard shows that the network has recovered strongly since the May 21 peak, indicating that the asset could be mispriced. Key adoption metrics highlighted in previous Bitcoin on-chain intelligence reports that have a high correlation with price (signal); active users, non-zero balance addresses and transactions have outperformed in absolute terms to the last bear market and relative to Bitcoin.

Non-zero balance addresses are all-time highs (3-year 100% percentile), almost double that of the Bitcoin network. While Active addresses are flat year-on-year (+5%), they are 113% higher than three years ago, again outperforming Bitcoin, which was down 30% over the same period. Transaction count has remained firm YoY, with transfer volumes down only 7% despite a price fall of 29%.

Ethereum fundamentals dashboard

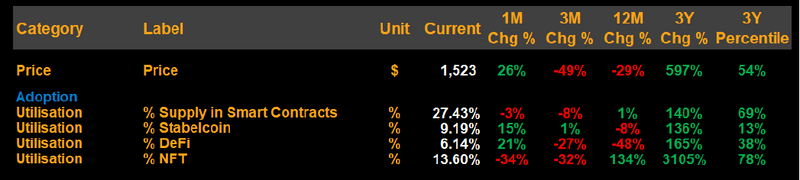

NFTs flip DeFi, stables for smart contract usage

Ethereum’s success will be predicated on its utility for engaging in economic and social activity. Stablecoins, DeFi, NFTs, have emerged as the first smart contract use cases (primitives) which are driving blockspace demand. While Ether locked into smart contracts was flat YoY at 27.43% of the total, the 1.4x increase over three years, demonstrates robust growth over a full bull/bear cycle, despite fierce competition from alternative Layer-1s.

Tightening liquidity conditions have predictably impacted the two financial primitives, Stables and DeFi. Despite the mania moderating in the past three months, NFT’s picked up the smart contract slack and we are optimistic that the social primitives could be the largest source of future adoption, diversifying activity away from financial drivers (Stables, DeFi).

Ethereum smart contract activity

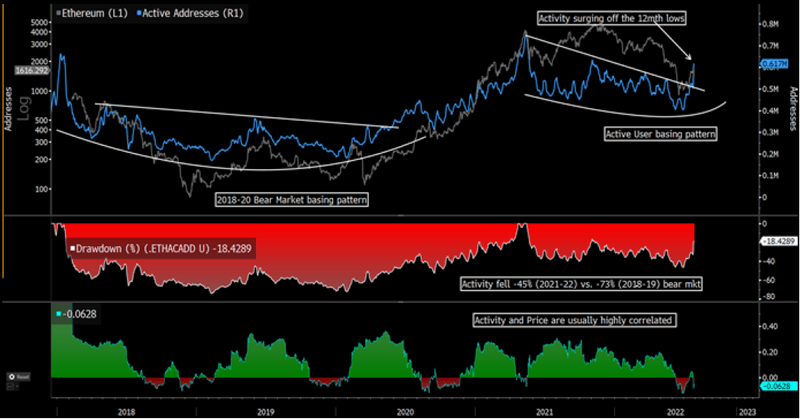

Active addresses surge showing basing pattern

Active addresses, a core driver of blockchain asset valuation, may have bottomed over the past quarter, which given the historical correlation (green), supports the rapid price recovery off the June lows. As of July 26, Active addresses (7-day average), a proxy for active users, surged 46% over the past month, adding more than 180,000 addresses. The resurgence follows the ecosystem’s second recession since inception. However, this cycle, Ethereum fared significantly better as activity only fell 45% fall vs. 73% in 2018-19 (red).

Whilst, mean reversion is likely short-term, the upcoming Merge, and the re-engineered supply/demand dynamics, tilt risk to further upside. We expect that by the end of 2022, Ethereum could have a staking yield of 6-9%, with a slightly deflationary issuance schedule.

Active addresses, max drawdown & price