This article was written by Vildana Hajric. It appeared first on the Bloomberg Terminal.

Ask a crypto super-fan about institutional involvement in the digital-assets space and you might get the sense that just about every big-money firm is in some way dabbling. Yet, it turns out, only 4% of institutional funds in Europe actually have exposure to crypto.

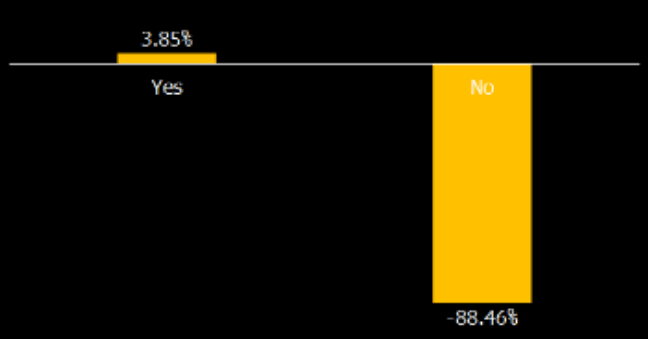

That’s the takeaway from a Bloomberg Intelligence survey that polled 93 institutional funds in Europe, which found that 88% of those asked said their firms weren’t invested in crypto. Another 8% wouldn’t confirm or deny it either way. Most have strict mandates about what they can invest in, with crypto often being excluded, regardless of the money-managers’ opinions on the asset class.

“There are still too many risks and a lack of regulation around this new investment class,” wrote BI analysts including Jakub Busz.

Is your firm invested in crypto?

Institutional crypto trading won’t kick off without greater clarity when it comes to regulation, especially among those that are more risk-averse, such as pension funds, Busz said. “The risk and volatility seems too high and many traders do not see underlying value in cryptocurrencies. They are much more enthusiastic about the use of blockchain as a technology for trading — mainly for settlements,” he said, adding that recent troubles in the space might be slowing down adaption even further.

BI’s survey polled traders across the UK and Europe who altogether manage more than £25 trillion in assets ($30 trillion). Still, Busz and his colleagues found that most equity traders in Europe are optimistic about crypto despite the low exposure. Nearly 60% see it as a new asset class that may eventually find its way into portfolios.

Meanwhile, a BI poll at the end of last year found that among US asset managers, only 5% invested in or planned to take crypto positions in the near future.

Talking about hedging against money supply — however you want to measure it — makes no sense, because an increase in the money supply isn’t necessarily bad. Contrary to what some Bitcoiners seem to believe, there’s no reason to think that something bad happens to you when M2 or M3 goes up. Sometimes an increase in a monetary measure can presage an increase in consumer prices, in which case something bad might happen as a result of the increase in the money supply, but this is far from a consistent thing.

Going back to periods of more ‘normal’ inflation, we saw a big year-on-year jump in M2 in 2011, in the wake of the Great Financial Crisis, but inflation remained fairly mild and the increase didn’t last very long.

There was also a big gap in 2009, when M2 soared while inflation went down. And also the timing of the relationship is suspect and inconsistent.

The point is, if you look at the above chart and think there’s any meaningful relationship between these measures of money supply and the actual price of goods, you’re squinting too hard. And again, the only reason to hedge is against something bad happening, which is why it’s the yellow line, and not the white line, that matters for an individual investor’s circumstance.

(Perhaps you could argue that if these M-measures just keep going up too much, then the entire fiat system will collapse, and leave Bitcoin as the sole survivor, but this is really just an extreme version of price inflation. And beyond that, if that’s the bet, then it undermines the idea that Bitcoin did its job in 2021.)

Now some might argue that Bitcoin isn’t a particularly good consumer prices hedge, but is a hedge against ‘asset inflation.’ Inflationistas used to talk a lot about asset inflation in the old days, because stocks and bonds and real estate were the only thing really going up.

But here’s the thing: you don’t need a hedge against asset inflation, because you can just buy, well, assets. If there’s some set of conditions causing stocks, bonds and real estate to go up, you can just buy stocks, bonds and real estate.

This is where someone chimes in and says that not everyone is able to buy stocks, bonds or real estate. And that’s true, particularly for people outside the US, where financial infrastructure isn’t as built out. But that’s changing rapidly, and anyway, that’s really not the target of the broader pro-Bitcoin push over the last years, particularly from people arguing that it should be a part of a diversified portfolio. But sure, there are some people for whom acquiring Bitcoin may be easier than buying a more traditional financial asset.

The fact of the matter is that there’s a commonly understood definition of the word ‘inflation’ and many people bought Bitcoin after being told that it was a hedge against inflation due to its fixed supply. And over the last year, while prices of all kinds of goods have shot up, owning Bitcoin has made you poorer rather than richer. That’s probably not what people sign up for when they bought in.