Clean-energy ETFs still not being invited to the US tech party

This analysis is by Bloomberg Intelligence Director of ESG Research EMEA & APAC Adeline Diab and Bloomberg Intelligence ESG Analyst Rahul Mahtani. It appeared first on the Bloomberg Terminal.

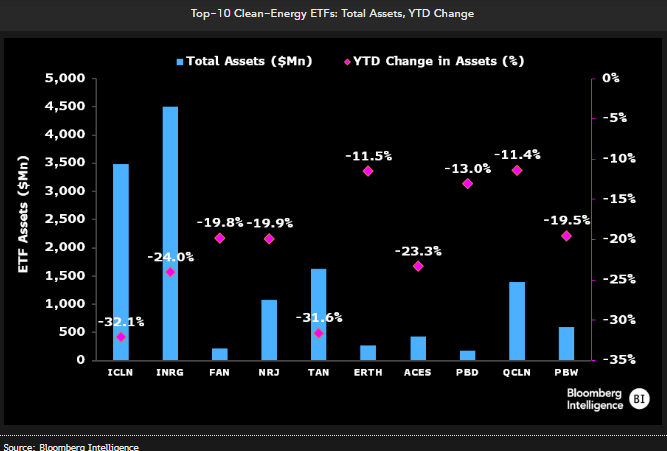

The top 10 clean energy ETFs have seen their total asset value shrink 25% in the past year, in stark contrast to the US tech surge, which has been propelled by AI hype, and while flows could recover thanks to the sector’s growth prospects and supportive global policies, radical differences in stock fundamentals, combined with a pronounced sensitivity to rising rates due to the sector’s high borrowing needs, continue to pose risks to the recovery. Quarterly outflows averaged $500 million and 30% losses in the past 12 months.

Clean energy ETFs out of favor amid further outflows

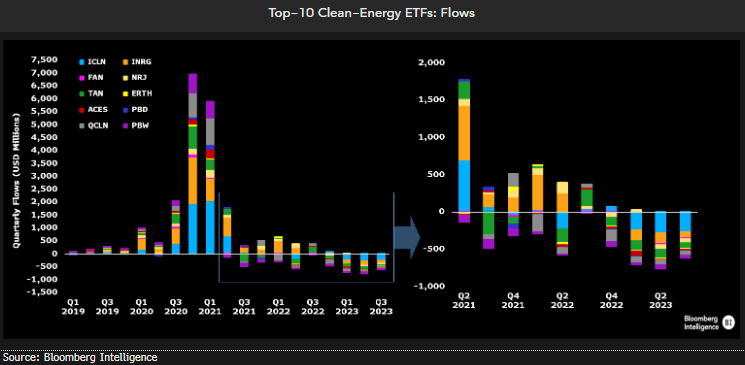

Clean-energy ETFs have fallen out of favor and continue to face headwinds amid rising rates, despite supportive policies including the $400 billion climate-stimulus under the US Inflation Reduction Act. Flows in our top 10 clean-energy ETFs have been negative throughout 2023, averaging $500 million a quarter — a reversal from 2022’s $500 million quarterly inflows and a radical shift from the exponential growth of 2020-21, when quarterly flows peaked at more than $5 billion. While some clean-energy stocks show strong revenue growth, and an improving margin outlook, clean-tech stocks are not all created equal and we expect dispersion to weigh on the sector’s revival prospects.

Any form of recovery would still pale in comparison to the 5x flow acceleration of 2020-21 as global green stimulus was unveiled during the pandemic.

Clean-energy ETFs fade as assets plunge

$4.5 billion AUM has been wiped off the top 10 clean energy ETFs in the past 12 months, reflecting a severe 25% contraction driven by both outflows and poor returns. Weak performance weighed on the top 10 clean energy ETFs — missing out on the AI-driven tech surge in the US. All 10 ETFs faced losses over 30% in the last year and continue to decline in 2023. In contrast, the Nasdaq is up 35% YTD and 15% from last year.

The largest clean energy ETFs, Blackrock’s ICLN and INRG, with a combined $8 billion in assets, have shrunk more than 20% in the past year and are about 40% below their $14 billion peak in 2021. Solar-focused TAN ETF has suffered a similar fate with its assets collapsing by 30% to about $1.6 billion, despite the industry’s fast growth and demand.

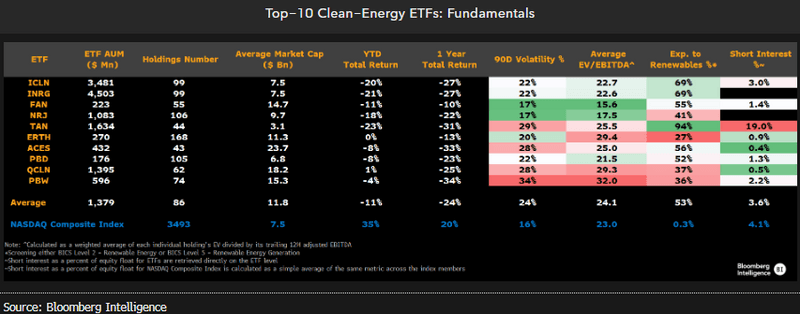

Lower valuation not enough to shine on clean energy ETFs

Despite a comparable valuation to the Nasdaq (24x EV/EBITDA) following a decline in the past year, clean-energy ETFs’ quality trails. Seven of the 10 ETFs recorded negative average profits since 2021, whereas the Nasdaq delivered 8-12% margin in the same period. In addition, the leverage of the top 10 clean-energy ETFs’ holdings was about an elevated 30% vs. the Nasdaq’s 25%, which may drag the funds’ outlook in a high-rate environment.

While volatility may have halved in the last year for clean-energy ETFs (to an average of 24% in 3Q) their performance has continued to deteriorate. These ETFs have faced double-digit losses averaging 11% year-to-date, underperforming the tech-fuelled Nasdaq index by 46%. The largest clean-energy ETFs, Blackrock’s ICLN and INRG, were down 27% in the last 12 months and 20% in 2023.