This article was written by Equities Data Analysts Daniel Zelkin, Brian Rooney and Jack McManimon. It appeared first on the Bloomberg Terminal.

Background

Q2 results were poorer than expected for Canadian financial institutions, with several major banks reporting lower than expected EPS figures. Analysts see positives though, even as some US banks struggle to navigate the economic landscape. Following their second quarter results, Canadian banks are forecasted to see positive Net Interest Income growth across the sector. Loan provisions and total deposits are also expected to climb, a trend that will continue in 2023.

While some analysts predict a delayed reaction to a looming recession for US banks northern neighbors, others remain optimistic regarding several key performance indicators of Canadian lenders.

Issue

Provisions and Net Interest Income

Rising interest rates have seen banks pivot from strategies enacted in prior years, driving an increase in provisions to accommodate for devalued debt securities and loan defaults. Accounting for the steep increase in loan loss provisions due to a 16.3-billion-dollar acquisition of Bank of West, brokers are expecting a year over year growth of 162%. Bloomberg Intelligence analysts Paul Gulberg and Ethan Kay spoke about Toronto-Dominion Bank, “TD provisions could triple in 2023, with related ratio reaching 35-45 bps, approaching pre-pandemic levels”. Personal and commercial loan loss provisions are expected to increase period-over-period for all major Canadian banks.

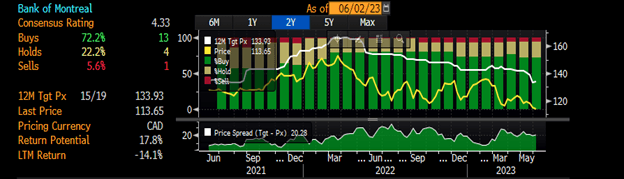

Net Interest Income guidance for the remainder of 2023 is generally premised on stable central bank rates, so future profitability is assumed by analysts to depend on the Federal Reserve and Bank of Canada’s desire to increase rates. Brokers predict RBC could gain interest income with HSBC Canada acquisition in 2024, padding their gains thus far. Analysts are particularly bullish on Bank of Montreal, with 72.2% of analysts recommending a buy of the firm’s stock.

Deposits

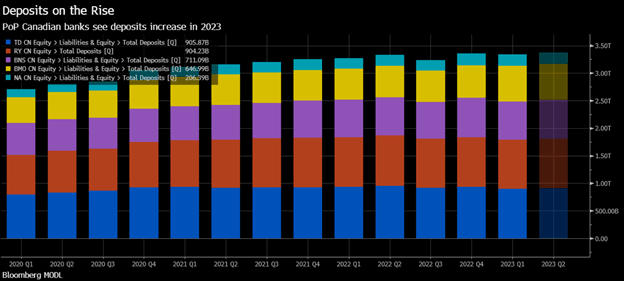

Analysts are expecting deposit growth across the Big Six Canadian Banks, with double digit year-over-year growths for Bank of Montreal, National Bank of Canada, and Bank of Nova Scotia. Deposits were also more resilient in Canada than the U.S.in Q2, with Canadian deposits for major banks up 1.7% PoP on average while U.S. deposits were down 4.0%.

Tracking

Use Bloomberg’s new KPIC function to quickly compare key performance indicators between Canadian and American banks. This tool facilitates more in-depth comparison across KPIs, visualization of key industry data, and aggregates statistics to easily understand company performance vs. industry peers in the banking sector. See how analysts predict further growth in the net interest income growth for Canadian Banks as they continue to consider the higher interest rate environment.