This analysis is by Bloomberg Intelligence Senior ETF Analysts Eric Balchunas and Athanasios Psarofagis. It appeared first on the Bloomberg Terminal.

Exchange-traded funds tracking Bitcoin, deep value, long-dated Treasuries, inflation hedges, electric vehicles, ESG, the metaverse and cheap beta are among the 22 ETFs we see as representative of themes that could drive the market in 2022. Key trends include the desire for cheap beta, as well as things to accent it as portfolios look more like barbells, with vanilla and shiny funds at either end. ETFs continue to transcend the “passive” label as active strategies expand the tent both in products and assets. That includes digital assets — in the form of futures for now — as investors wait for the SEC to follow other countries and approve a spot Bitcoin ETF in the U.S.

Bitcoin ETF competition to intensify; ESG, rates drive flows

The ProShares Bitcoin Strategy ETF (BITO) and rivals should continue to attract inflows, but we expect greater cost competition in 2022, with issuers more focused on fees and the ability to track the cryptocurrency. VOTE and FRDM may grow along with ESG investing, while higher rates could help IGHG. GBTC’s bid to become a spot Bitcoin ETF may fall short.

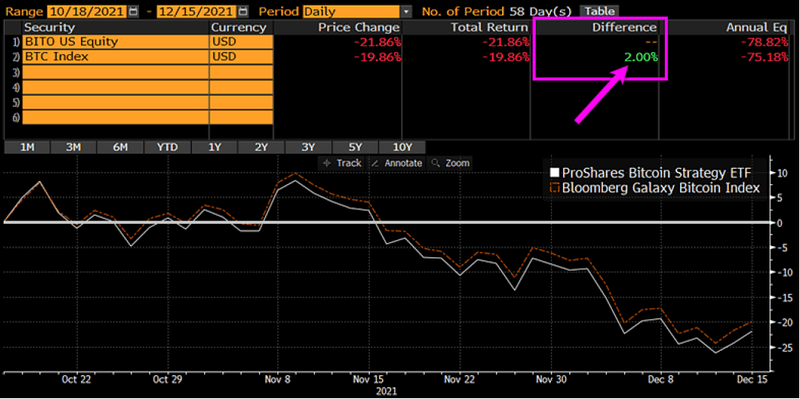

Focus may turn to costs for Bitcoin ETFs

Cost competition among the three U.S.-listed Bitcoin futures ETFs — measured by tracking difference — could intensify in 2022 as issuers market their products more aggressively. After two months of trading, the first to launch — BITO — is trailing spot Bitcoin by 2 percentage points. That’s the worst tracking of the three so far and indicates BITO could underperform by 12 points in its first year, largely due to costs to roll futures contracts. The ETFs also compete on fees, with BITO and Valkyrie’s BTF at 95 bps, undercut by VanEck’s XBTF at 65 bps.

Potential Bitcoin ETFs from Ark and BlockFi may further pressure fees in the segment.

BITO lags spot Bitcoin by 2 points after 2 months

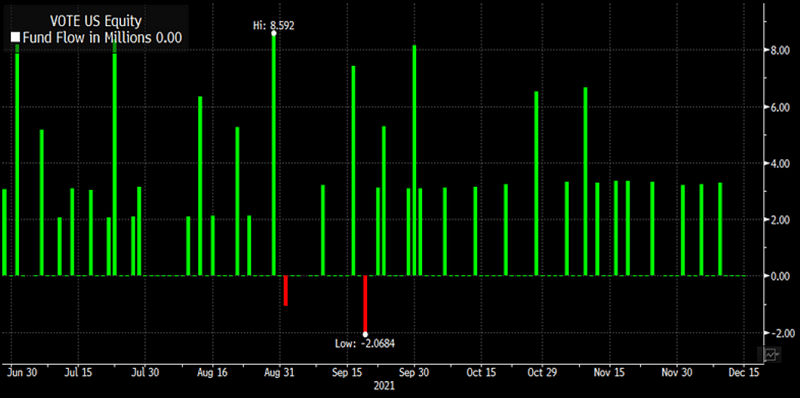

Engine No. 1 creates ESG category all its own

The launch of Engine No. 1’s Transform 500 ETF (VOTE) in June created a new segment of ESG ETFs based on activist investing. ESG ETFs typically fall on a spectrum, from exclusionary to inclusionary strategies. The first offer ESG exposure by excluding a few stocks from a broad index. Purer inclusionary strategies use more of a bottom-up selection process based on ESG criteria. We expect watered-down exclusionary ETFs to dwarf purer peers in assets by offering higher beta and lower fees. VOTE turns that on its head by offering an untouched broad index at 5 bps and enacting ESG principles via proxy voting.

VOTE, seeded with $100 million, has grown beyond $200 million in six months with relatively consistent inflows.

VOTE draws consistent ‘grassroots’ flows

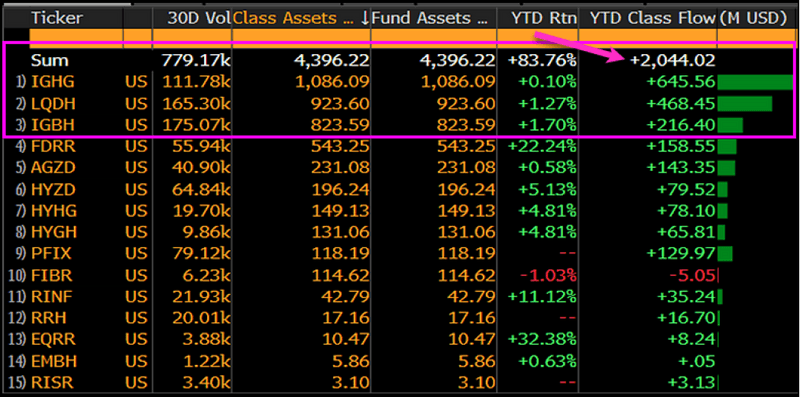

Inflation, Fed hikes support rate-hedged ETFs

With three Federal Reserve rate hikes and heightened inflation expected in 2022, ETFs designed to benefit from rising interest rates could sustain increased inflows. The largest of the group, ProShares’ IGHG, raked in $645 million in 2021, more than doubling its assets. IGHG and other rate-hedged ETFs, such as iShares’ LQDH and IGBH, have been around for 6-8 years but were largely ignored, at least partly because rate-raising cycles never seemed to last.

Rate-hedged ETFs offer exposure to underlying markets, such as investment-grade corporates, while entering into short positions on U.S. Treasuries to hedge rate risk.

Rising rate & rate-hedged ETFs’ $2 Billion inflows

Attempt to convert GBTC to ETF likely to fail

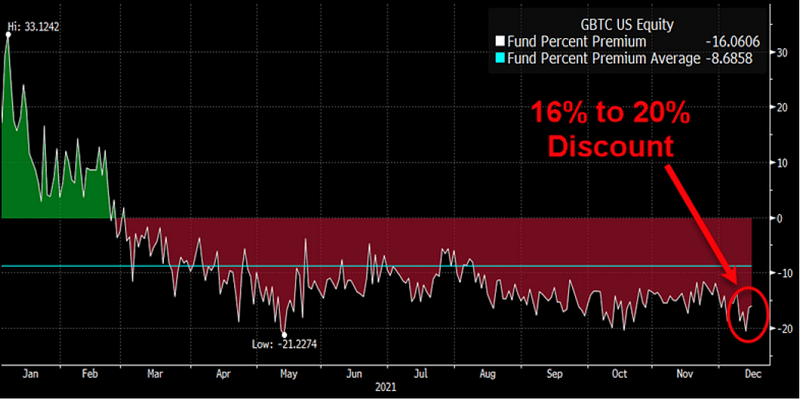

Grayscale’s request to convert the world’s largest Bitcoin fund into a spot Bitcoin ETF will likely be rejected, we believe, based on comments from the SEC and Chairman Gary Gensler. The agency’s final decision on the 19b-4 application for the $31 billion Grayscale Bitcoin Trust (GBTC) is due around July 6. Decision letters for at least 10 other Bitcoin ETF applications will be released in the meantime, and we’ll be monitoring them for insights into the SEC’s views.

GBTC’s over-the-counter trust structure is subject to wide discounts and premiums because it lacks an ETF’s capacity for creations and redemptions.

GBTC’s discount woes