Bloomberg Professional Services

The rise of debt issued by Business Development Companies (BDCs) has created a distinct and increasingly important segment within the bond market. This article looks at how indices, such as Bloomberg’s US BDC Aggregate Eligible Index provide investors a benchmark for tracking risk-adjusted performance across this asset class.

This article was written by Jasvinder Singh, Senior Product Manager and Mark Phillips, Global Head of Private Credit at Bloomberg

Debt issued by Business Development Companies (BDCs) has emerged in recent years as a distinct and growing segment of the bond market. In this article, we will examine what BDCs are and the role they can play in a broader portfolio strategy.

PRODUCT MENTIONS

What are BDCs?

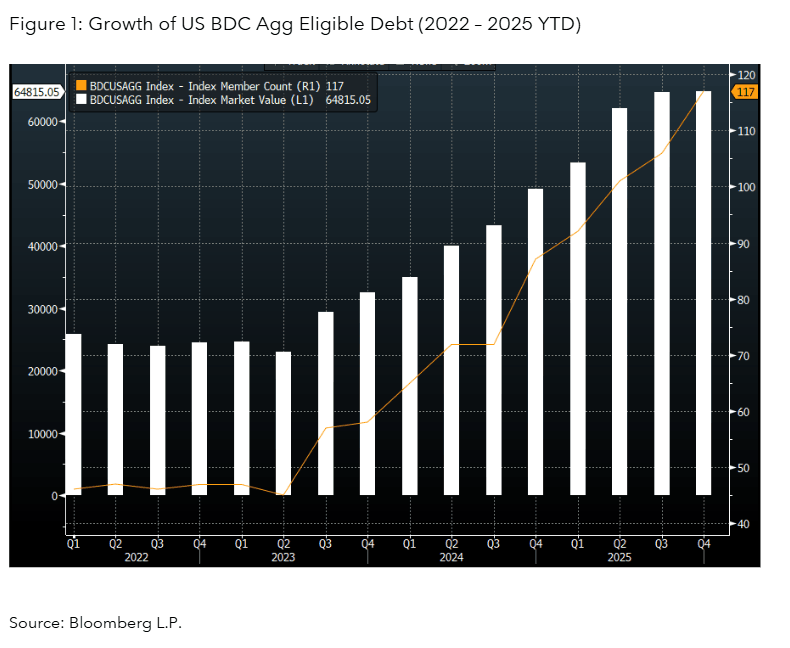

BDCs were created by Congress to provide capital to mid- and small-sized U.S. companies. BDCs raise capital from investors, typically through equity and debt issuance, and deploy it in the form of loans and other capital solutions to these businesses. BDCs’ AUM has grown four-fold since the end of 2020 to ~$450bn in 2025, becoming a key vehicle in enabling investor access to private credit; a market that is currently estimated to be ~$2tn.

Why BDC–issued debt matters?

BDC-issued debt appeals to investors because it can offer some of the following benefits.

- Yield premium over comparable investment-grade corporate bonds, reflecting their exposure to pools of middle-market borrowers. US BDC debt, as measured by the recently launched Bloomberg US BDC Aggregate Eligible Index, has delivered double digits returns in recent years. In comparison, its base index (US Aggregate) had near-zero returns. Yields had a near 100bps premium at October 2025 month-end. Note, for more information on yield premium, please refer to key performance highlights section below.

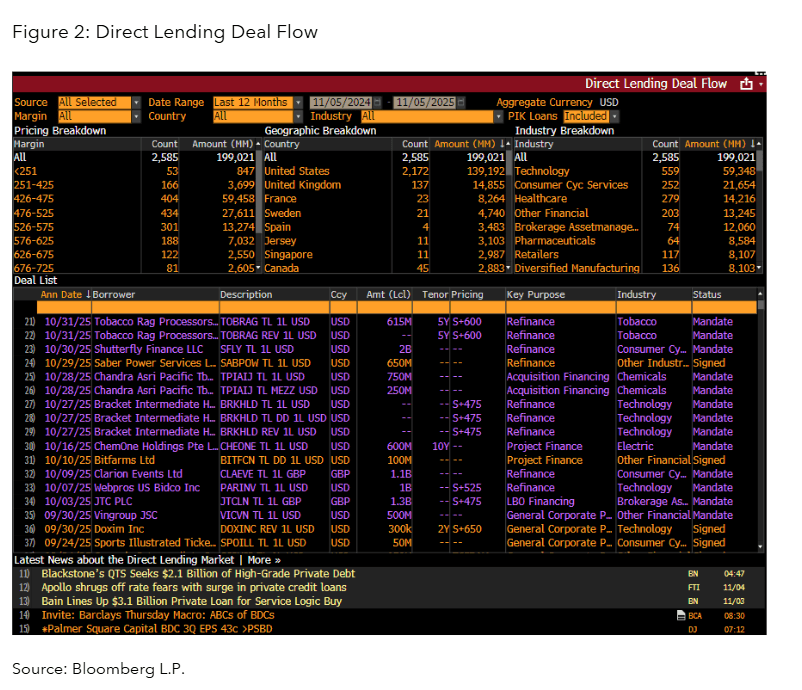

- Diversified private credit exposure, given BDCs lend across sectors, geographies, and sponsors. BDCs lend across countries, from United States, to France and Sweden, to India, as well as across industries from Technology to Retailers and Chemicals. Note, Bloomberg Terminal subscribers can track these via DLEN tool on the Terminal.

- Transparency into the BDC issuer’s portfolio and risk through quarterly reporting of loan holdings. Given BDCs are registered under the Investment Company Act of 1940, they are required to provide certain public disclosures. This, combined with additional sources of information allows insights into private credit from BDCs.

We discuss these characteristics of BDCs in more detail below.

Tracking BDC bond market historical performance

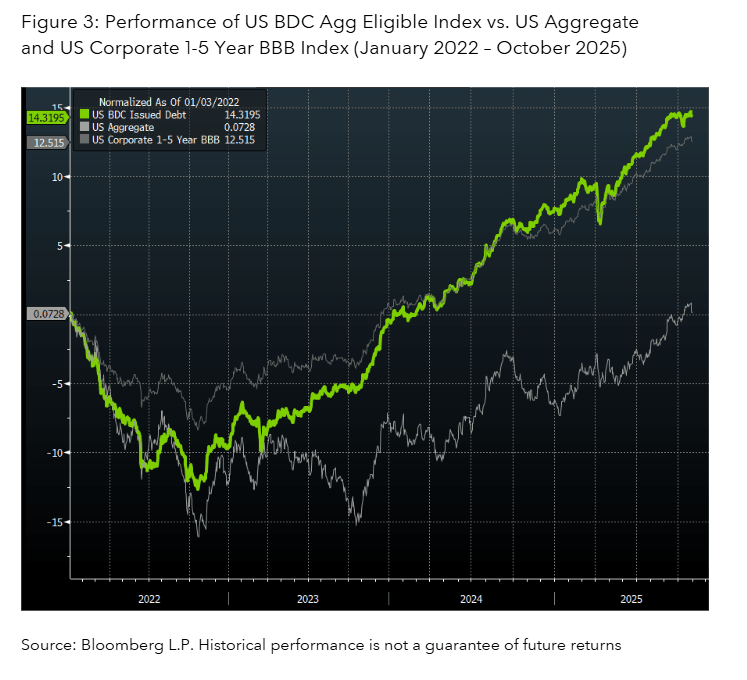

Using the BDCUSAGG as an example, we can see how indices help track the performance of the BDC debt segment relative to broader bond markets and comparable credit tiers. Performance of the BDCUAGG is notable when compared to its base index, the (US Aggregate), and the US Corporate 1-5 Year BBB Indices (see Figure 3). The BDCUSAGG Index is comparable to the US Corporate 1-5 Year BBB Index, from both duration and quality standpoint.

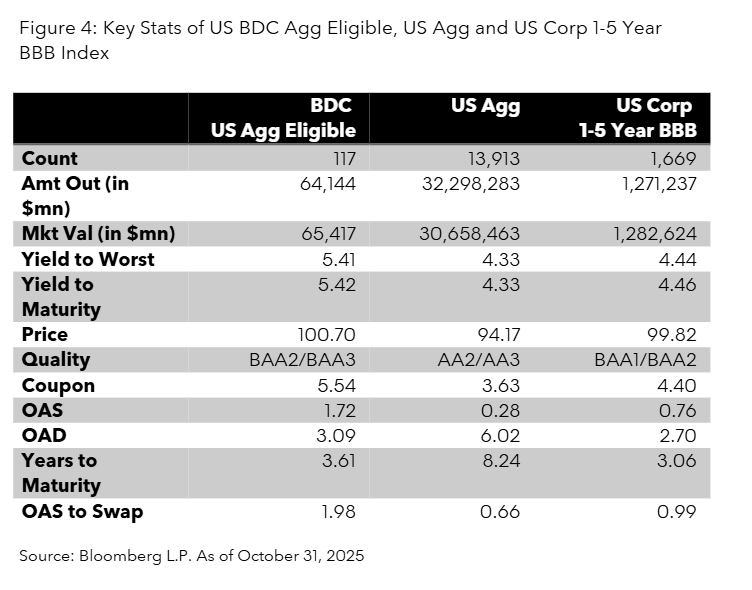

- From its inception in January 2022 to October 2025 month-end, the BDCUSAGG posted returns of 14.32%. During this period, the US Aggregate and the US Corporate 1-5 Year BBB Index returned 0.07% and 12.51% respectively.

- Yields (as measured by yield to worst) of the BDCUSAGG climbed to 5.41% at the month-end. The US Aggregate and the US Corporate 1-5 Year BBB Index posted 4.33% and 4.44%.

- Option Adjusted Duration (OAD) of the BDCUSAGG, the US Aggregate, and the US Corporate 1-5 Year BBB Index were 3.09, 6.02 and 2.70 respectively.

- There were 33 issuers in the BDCUSAGG Index as of the October month-end. Blackstone Private Credit Fund (12.46%), Ares Capital (11.64%), and Ares Strategic Income Fund (8.39%) were the top issuers, and make up nearly a third of the BDCUSAGG universe.

- See Figure 4 for certain additional statistics related to these indices.

Using BDCs to diversify private credit exposure

Notably, using the index approach enables consistent monitoring of pricing trends, spreads, and funding dynamics among BDCs, providing insight into how private credit lenders access and price public capital. Investors can combine this with Bloomberg’s direct lending tooling such as DLEN to gain insights into direct lending market activity.

This function captures BDC holdings data alongside deals sourced through M&A disclosures, Bloomberg News and direct lender submissions, resulting in an aggregated view of private credit deal flow. As DLEN tool outlines, BDC debt spans across industries, geographies, and borrowers (see Figure 2).

Gaining transparency into the BDC issuer’s portfolio

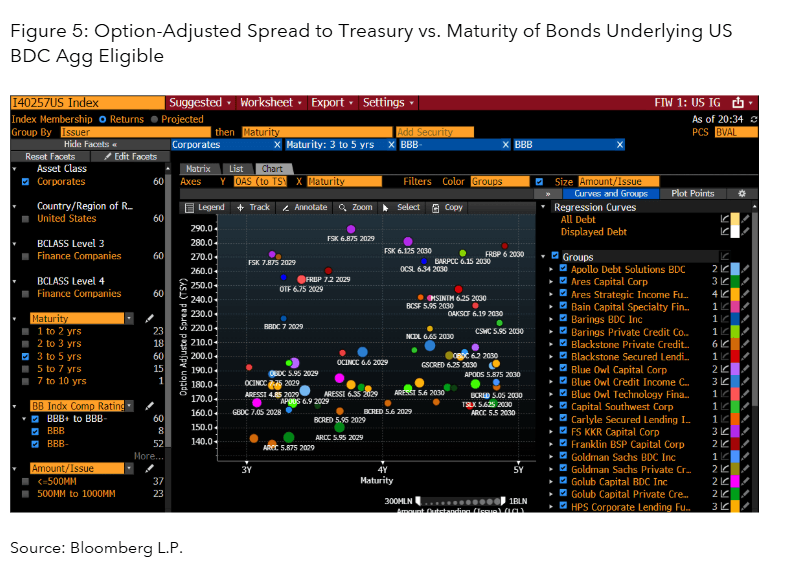

The index approach allows research and portfolio analytics capabilities by offering a trackable representation of the market segment. This includes integration of the index constituents into relative value tooling such as the fixed income worksheet via FIW tool on the Bloomberg Terminal, enabling analysis of the pricing, performance, relative value, and liquidity of the index constituents (see Figure 5). BDCUSAGG data is also available to Bloomberg Terminal users in Bloomberg Query Language (BQL), enabling analysis through (BQL <GO>}, Microsoft® Excel, BQuant Desktop, and BQuant Enterprise.

Expanding opportunities in fixed income with BDC debt indices

While past performance is no guarantee of future returns, the last three years highlight the role of BDC debt as a potential compelling diversifier in fixed income portfolios. Its combination of yield and potential diversification have allowed it to outperform at a time when core bond benchmarks have lagged (as referenced in the key performance highlights above). BDC-issued debt may bridge the gap between traditional fixed income and private markets.

Indices tracking BDC-issued debt provide a structured framework for analyzing performance, risk, and liquidity across this emerging asset class supporting greater transparency and integration of private credit exposure into broader fixed income analysis.

The launch of BDCUSAGG index marks the latest addition to Bloomberg’s suite of private market solutions, which enable investors to screen for private funds, monitor deal flow, consume research, assess risk, evaluate performance, benchmark strategies, and track breaking news.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator. © 2025 Bloomberg. All rights reserved.