This analysis is by Bloomberg Intelligence Strategist Eric Kazatsky. It appeared first on the Bloomberg Terminal.

At first glance, municipals appear to be at little immediate risk from a US default scenario if politicians fail to reach an agreement to raise the debt ceiling. However, there may be knock-on effects — including on housing — that could deal a further blow to some aspects of state and local credits.

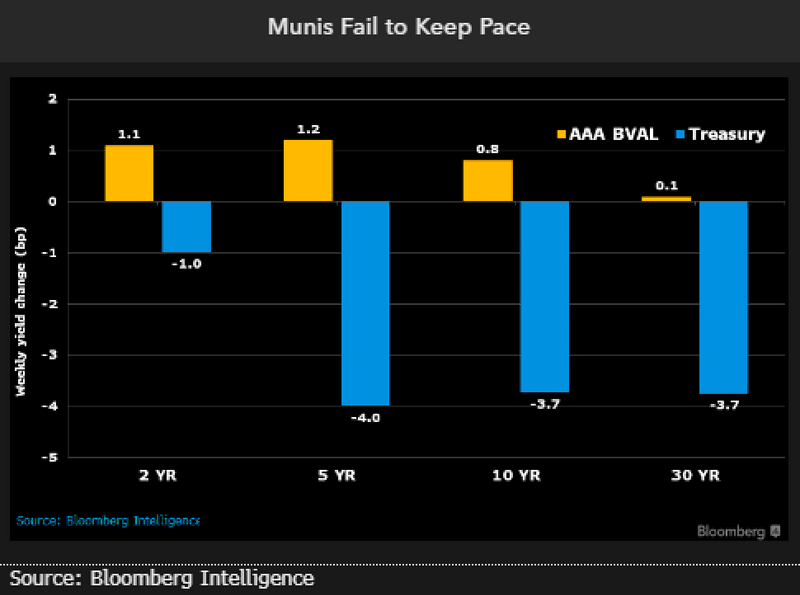

Munis slip into familiar patterns

US Treasury rates appear to have declined over the past several trading days, and munis followed familiar patterns in failing to stay in lockstep. In fact, munis in some tenors made opposite moves, at least through the first 10 years of the curve. Overall, the moves for both Treasuries and munis appear somewhat insignificant, amounting to only a few basis points in either direction. However, the rate drop may be somewhat of a head fake.

With only a few weeks to go for US lawmakers to reach a deal on the debt ceiling, rates should rise as so-called X date approaches.

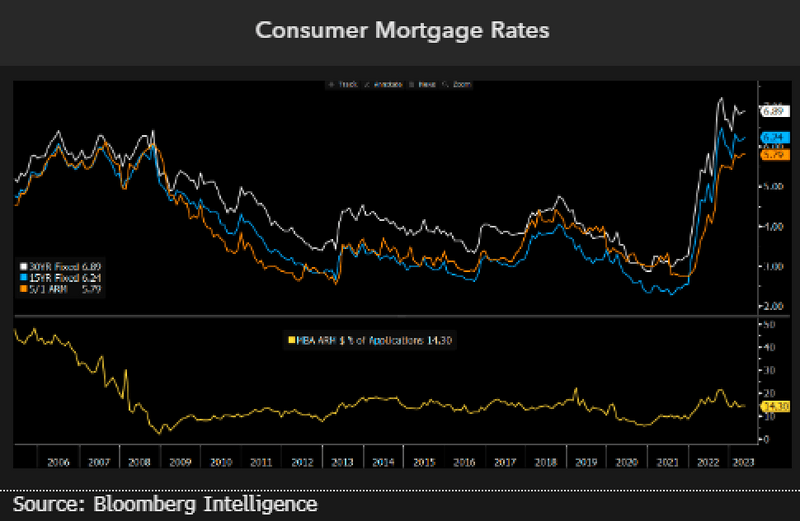

Mortgage rates could throw cold water on munis

Despite macroeconomic headwinds, munis appear to have been relatively resilient, based on spreads and overall demand. Some of that may be due to lower overall supply, but ratings actions suggest favorable sentiments also are still at play. Yet one area that could see some knock-on effects from a US government default is housing, and in turn local credits. In the unlikely scenario that the US defaults, longer-term rates — and mortgages — could face upward pressure.

Higher mortgage rates haven’t completely cooled home buying, but another leg up in borrowing costs could test the limits of buyer demand. This might fuel a negative feedback loop, forcing prices to drop to find buyers.

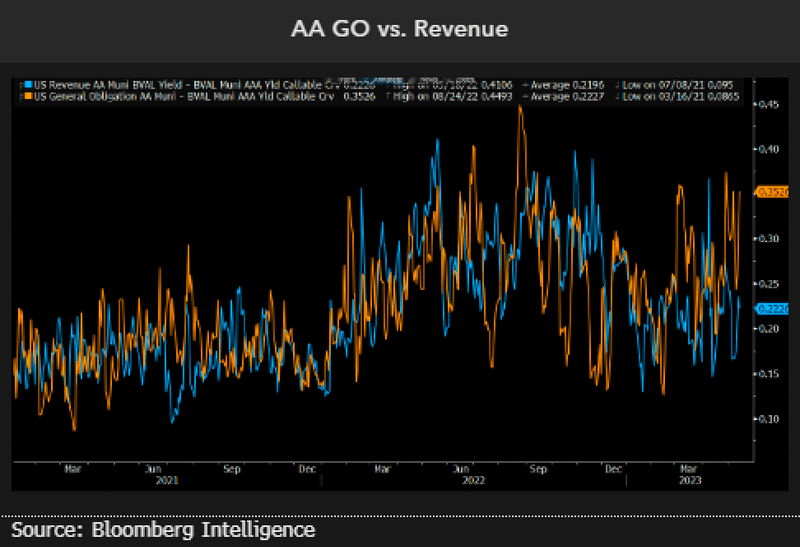

Broader default could pressure GO sector

There’s no clear pattern indicating that if the housing market meaningfully slows, muni credits will be imperiled. Yet during the last correction in housing, we noted a trend of appeals for both residential and commercial properties that lasted for several fiscal periods after the initial housing shock. Commercial real estate is already having issues, which could affect local muni credits with a heavy commercial base. Given that a broader slowdown could be another area of weakness for local GO credits, the current 13-bp spread over similarly rated revenue bonds may be too small a cushion.

The delta between AA GO and revenue 10-year spreads is the widest it’s been in over a year.

Virginia College program leads average calendar

New-issue muni supply is still low, which will likely result in some revised outlooks for year-ahead volume. Exempt sales are down 20% from a year ago, while taxable muni volumes are off close to 53%. This week’s muni calendar could reach about $6.5 billion, less than the typical week’s primary sales volume. The largest issues on tap include $615 million for the Virginia College Building Authority and $277 million for the California Housing Finance Agency.

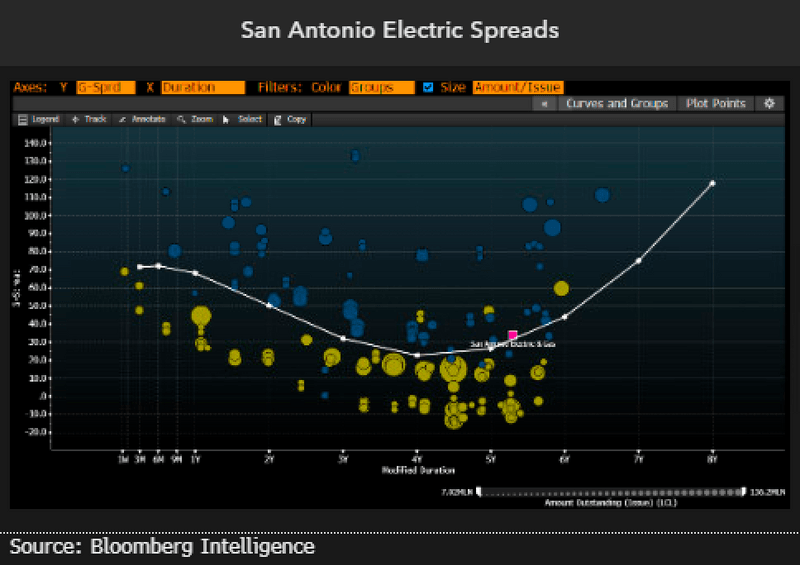

We highlight a $590 million electric-and-gas system revenue-refunding bond sale on behalf of San Antonio City Public Service. The AA- rated utility has a weaker financial profile in recent years and is semi-dependent on proposed rate hikes in 2025 and 2027.

May activity builds for distress and defaults

In one of the biggest volume weeks in several months, the Bloomberg default and distress tracker added almost $345 million of activity during the week ended May 11, all on the distress side. Defaults for 2023 total $846 million, with Legacy Cares Inc. and Georgia ProtonCare Center Inc. combining for close to $500 million.

The largest addition on the distress side was a $285 million loan for the Catholic Health System Obligated Group, which entered into a forbearance agreement related to CUSIP 649906J47. Also added were loans of $24 million for the Trinity-Eagle’s Pointe LLC project and $33 million for the Wisconsin Illinois Senior Housing Inc. project.