Africa luxury goods market: Full of untapped promise

This analysis is by Bloomberg Intelligence analysts Deborah Aitken, Maja Rakic, and Sonia Baldeira. It appeared first on the Bloomberg Terminal.

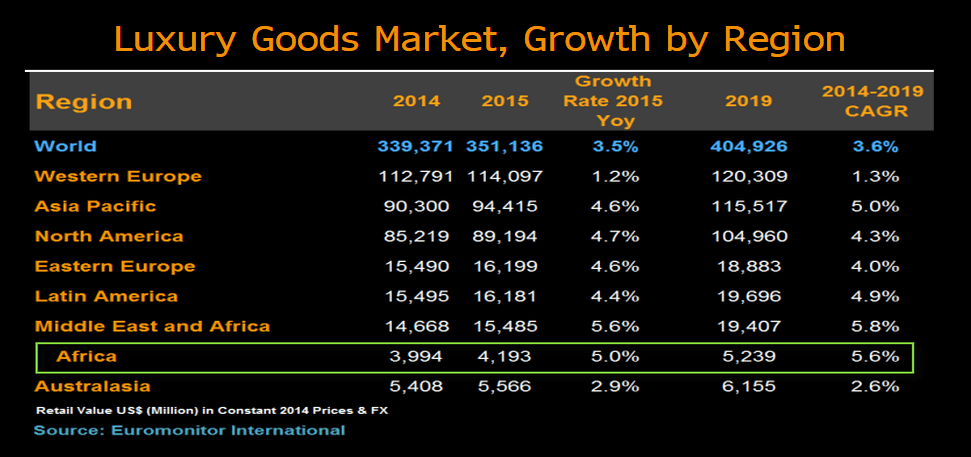

Middle East, Africa to lead global luxury-market growth to 2019

As Asian economic growth rates slow, luxury goods companies may accelerate their presence in Africa to capture untapped demand. This is a region where local government investment in infrastructure and retail space is buoyed by solid GDP forecasts. Sub-Saharan GDP will rise 4.6% on average a year until 2017, The World Bank estimates. Global luxury-goods sales may reach $405 billion by 2019, up 3.6% annually, according to Euromonitor. Africa, the smallest region for luxury goods, is expected to grow at 5.6% a year.

Luxury potential as Africa’s millionaires grow at fastest pace

Spending on luxury goods in Africa should rise in-line with the expansion of wealth. Knight Frank estimates the number of African millionaires will rise 53% to 258,000 by 2024, the highest growth rate of all regions globally. About 50% of Bloomberg Intelligence’s luxury peers have directly operated stores in Africa, albeit in limited locations. This suggests a still under-penetrated retail environment for most luxury brands. Ivory Coast is forecast to have the fastest growth of ultra high-net-worth individuals.

LVMH, Richemont dominate Africa’s young $4 billion luxury market

There is a growing consumer appetite for luxury goods in the underpenetrated African market. Luxury-goods retail sales reached $4 billion in 2014, and the market may expand 31.2% by 2019, according to Euromonitor. Africa has about 50 directly operated global luxury single-brand stores, with LVMH and Richemont accounting for 60%. Morocco and South Africa are the region’s luxury oases, with 80% of luxury monobrand stores operating there, and attracting higher luxury spenders.

Watches, men’s clothing, leather are prominent in African luxury

Demand for luxury watches, men’s clothing and leather goods in Africa is driven by the higher spending power of men. In South Africa, women have just 60% of the disposable income of men, according to Euromonitor. This means men’s clothing and leather accessories stores are already the second-most visible in the luxury segment. Fine watches and jewelry make up 25% of luxury stores. Gucci, Dior and Sergio Rossi are rare among luxury brands, in that they also operate single-brand female-collection only stores.

Cartier says local franchise is leverage for success in Africa

Building brand awareness through a well-known local partner in emerging markets is the key to long-term profitable investments, says Alessandro Patti, Cartier’s director for Central Africa. He says big brands should first assess demand for luxury goods and build awareness through reputable local businesses that are trusted by customers. Only five high-end watch and jewelry brands tracked by BI have directly operated stores in Africa. The majority have some presence through authorized multi-brand retailers.

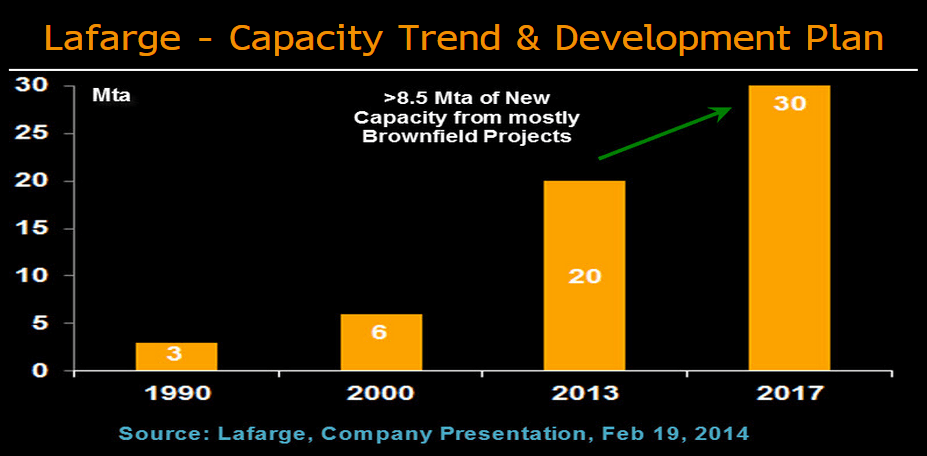

Rising African demand drives expanded cement capacity investment

Sub-Saharan African countries are attracting increased cement industry investment, due to rapid population growth and reduced country and political risk assessments compared with other countries on the continent. The need for cement reflects rapid urbanization and infrastructure that needs to be modernized. Lafarge and Dangote are among cement operators to have invested most in the region’s capacity buildup. Lafarge has 17 plants with 20 million tons of cement capacity, with another 10 million tons expected by 2017.