$80-$90 oil, OPEC+ stays whole, peak demand not close

This analysis is by Bloomberg Intelligence Senior Analysts Salih Yilmaz and Will Hares. It appeared first on the Bloomberg Terminal.

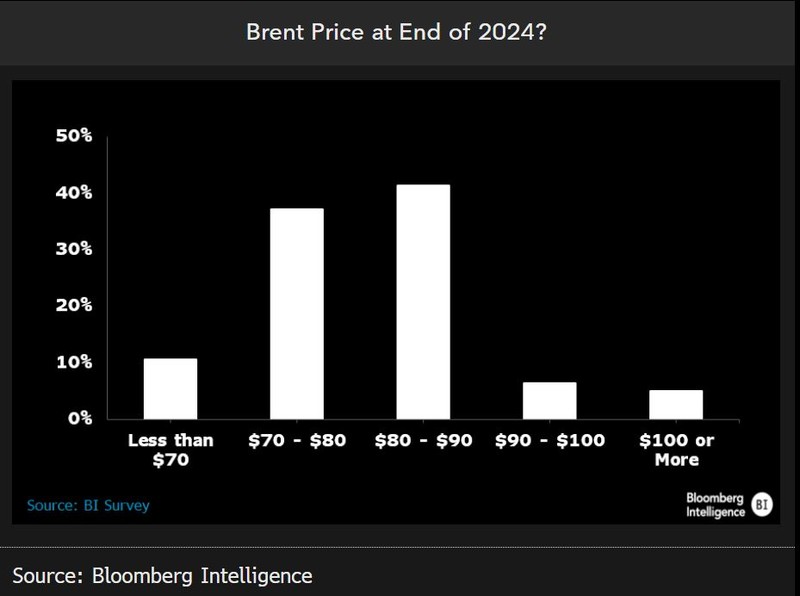

Brent oil is expected to be above $80 a barrel — the price OPEC+ seems to be targeting as a floor — at the end of 2024, according to 53% of the 143 respondents to Bloomberg Intelligence’s February oil-price survey, while only 5% see prices surpassing $100. OPEC+’s alliance is widely expected to remain, though most respondents believe the group will have to keep supply management — at least sporadically — to help balance the market and support prices. Only 24% of those responding expect peak oil demand before 2030 — compared with almost 50% in the 2022 survey — as sentiment shifts around the resilience of demand and the outlook for continued consumption growth.

Majority sees oil price rangebound in $70-$90 a barrel

Brent oil is expected to be above $80 a barrel at the end of 2024, according to 53% of survey participants — in line with our scenario analysis — while 37% say it’ll be between $70-$80 a barrel. 78% think that prices will be between $70-$90 a barrel. OPEC+’s extension of its voluntary output cuts into 2Q is supporting prices above $80, though worries around demand and an outlook for ample supply may keep prices in check through this year. Meanwhile, the backwardation in the oil curve suggests a relatively tight physical market.

Brent’s fair value is slightly above current levels at just over $85 a barrel, based on BI’s proprietary scenario analyzer, though any escalation of the Middle East conflict could push the price above $100.

Geopolitical risk premium on oil may be lower than $5 a barrel

92% of the 143 respondents to BI’s oil survey say that there’s a less than $5 a barrel geopolitical risk premium attached to oil prices by the market. The turmoil in the Red Sea and the Israel-Hamas conflict has arguably had a limited effect on prices, given there hasn’t been any substantial disruption to oil flows, and OPEC+ has a meaningful amount of spare capacity. However, the Middle East tensions and the geopolitical risk premium — as Houthi militants continue to attack ships in the Red Sea — may be slowly starting to become more baked into oil prices. That’s after they were outweighed by weak economic prospects and a bleak demand picture in the past few months, as Brent oil price tests $85 a barrel.

Key driver of oil prices? Wide disparity of views in BI survey

There’s a wide disparity of opinion around what the biggest driver will be for oil prices over the next two years. 27% of the 143 respondents to BI’s oil survey said it will be OPEC+ policy, while another 27% said it’ll be the China demand story. 22% believe it will be the non-OPEC+ supply growth, and another 14% think it’ll be the Fed policy and interest rate outlook.

Geopolitical developments have been one of the key drivers of crude in the past few months — especially since Oct. 7 — though only 10% of the respondents think this will be the biggest driver of oil prices over the next two years.