Bloomberg Intelligence

This analysis is by Bloomberg Intelligence E-commerce & Retail Analyst Poonam Goyal. It appeared first on the Bloomberg Terminal.

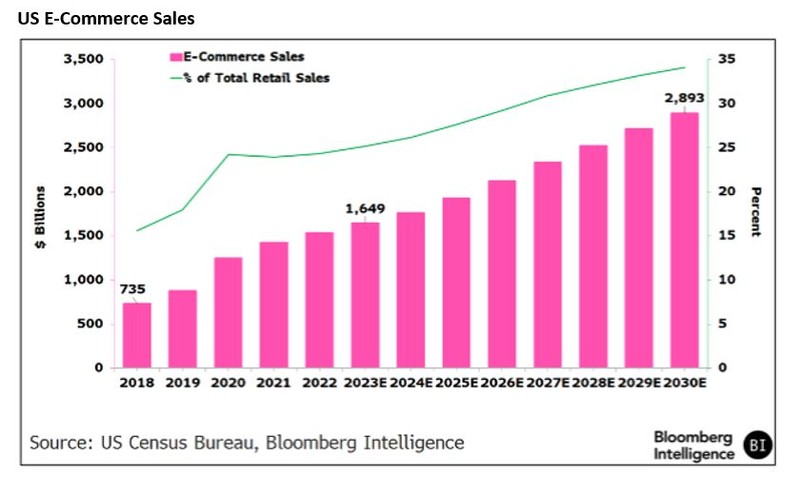

The convenience of being able to access an array of products in seconds; AI-driven advances in search, customer experience and checkout; and the influence of social media are likely to push US e-commerce revenue to nearly $2.9 trillion in 2030 from $1.65 trillion last year. Brick-and-mortar stores are leaning into digital channels to expand their reach, with Walmart now second to Amazon.com in US e-commerce. Meanwhile, newer Chinese marketplaces Shein and Temu are expanding rapidly in the US, and as digitally native retailers like Wayfair and eBay lean into AI to enhance their capabilities, they may continue to draw sales away from physical stores. Electronics is the most heavily weighted sector to e-commerce, at 47%. Apparel also is a leader, online can reach half that industry’s sales by 2030 from 28% last year, and home furnishings is growing, largely thanks to virtual- and augmented-reality tools.

Key research takeaways

- Steady Growth: The move to online shopping from physical stores continues to accelerate as people spend more time on smart devices, putting digital on track to reach 34% of US retail sales in 2030 from 25% in 2023. The shift should favor companies that invest in technologies to improve digital shopping.

- Leveraging AI: The embrace of new technology like generative AI by companies including Amazon and eBay is making shopping more efficient and stemming mounting costs. Conversion from shopping to purchasing online is in the low- to mid-single digits but likely to increase because of AI.

- Social Capital: Influencer- and celebrity-led shopping through social commerce may drive the next leg of acceleration, with TikTok, Instagram, YouTube and others commercializing their feeds with easy, one-click purchasing.

- Barriers Fall: E-commerce growth comes on the back of low barriers to entry, traditional brick-and-mortar retailers expanding online, and consumers who are more willing to try new brands and platforms. Walmart’s global digital revenue has surged nearly tenfold from a decade ago, to more than $100 billion.

- A Resale Tailwind: The need to counter inflation and a desire for sustainability should push up the global secondhand apparel market at a 12% CAGR, to $350 billion by 2028, according to GlobalData. The trend gets support from resale platforms like RealReal, Depop and Poshmark, as well as re-commerce sections at big players like Amazon and Walmart.

Already a customer? Access the full report here.

Not a terminal user? Click here to learn more.