ARTICLE

The integration gap: Can your tech keep up with Asia’s private wealth boom?

Bloomberg Professional Services

Private capital has become one of the most powerful forces reshaping global wealth, and Asia is rapidly moving to the center of that story.

To understand how the region’s leading wealth managers are preparing for this shift, Bloomberg Intelligence conducted the 2025 Asia Private Wealth Survey in September 2025, polling 100 senior private wealth management professionals across Hong Kong and Singapore. Nearly 80% represented firms managing over US$5 billion in AUM, and more than a third managed above US$30 billion.

Asia’s private wealth surge

The survey results reveal an unambiguously bullish outlook. 61% of respondents expect AUM to grow 6–10% annually, while 85% expect net new money to rise 6% or more each year. Behind this optimism lies a powerful mix of structural forces — rising regional affluence, intergenerational wealth transfers, cross-border inflows, and China’s increasing access to overseas markets.

According to Bloomberg Intelligence estimates, Hong Kong could manage US$2.9 trillion in cross-border wealth by year-end 2025, overtaking Switzerland, while combined cross-border assets in Hong Kong and Singapore are projected to climb 12% annually over the next five years, outpacing the global average of 10%.

The operational gaps

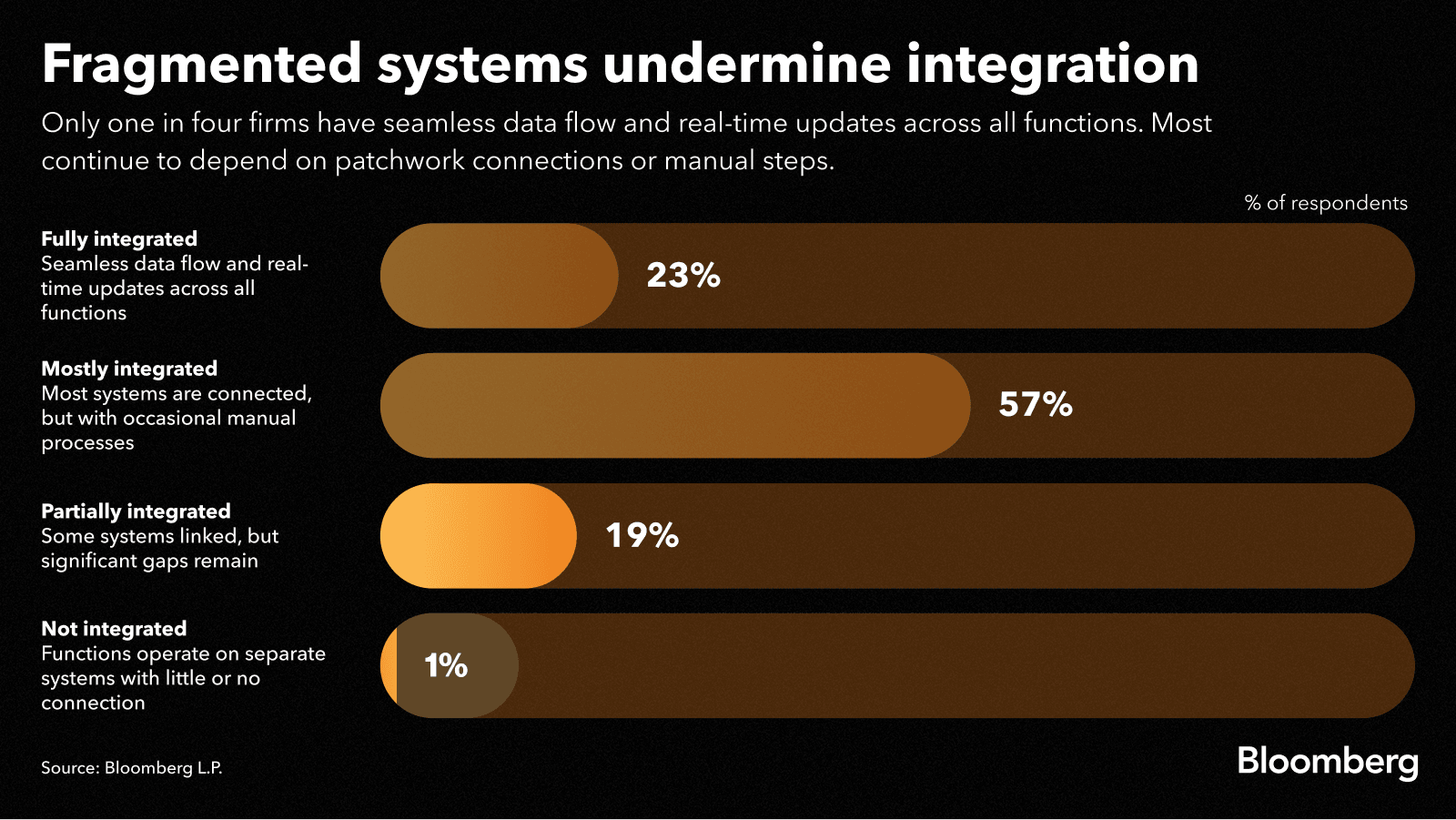

Despite the massive growth opportunity ahead, most private banks and family offices aren’t structurally ready to capture it. Their workflows, data systems, and technology platforms remain fragmented, creating silos, manual workarounds, and slower decision-making. Only 23% of surveyed firms say they are fully integrated across front, middle and back offices, while 57% describe themselves as partially integrated.

Much of this stems from accidental data architectures: systems built piecemeal over decades, each powered by its own datasets. The result is duplication, inconsistency and “noise” when leaders need a single enterprise view.

Cost of fragmentation

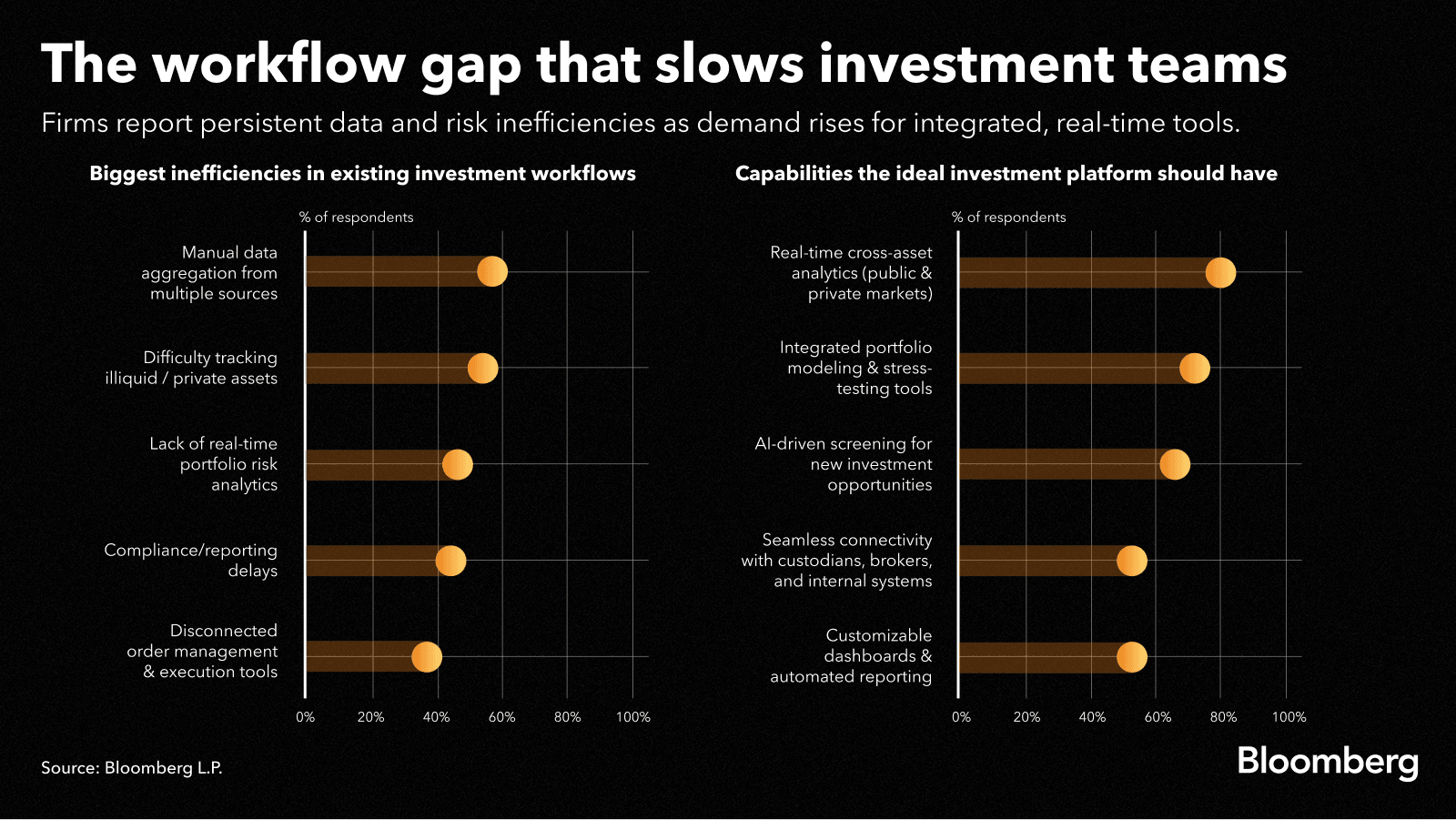

The operational gaps show up most clearly in day-to-day workflows. 57% of respondents report spending significant time manually aggregating data from multiple sources. Teams spend valuable hours reconciling numbers instead of analyzing them. Without centralized, high-quality data flowing through the organization, reporting cycles lengthen, control weakens, and agility suffers.

The problem deepens as portfolios expand across asset classes. 55% of respondents struggle to track illiquid or private assets, with data often trapped in unstructured formats outside core systems. These assets — now 30–80% of some portfolios — rarely fit standard classifications, making it difficult to assess exposures, valuations or performance alongside public holdings.

Fragmented systems also weaken oversight, with 47% of respondents lacking real-time portfolio risk analytics to track exposures or perform stress tests. These operational inefficiencies are daily pain points for wealth managers, draining efficiency, obscuring risk and limiting scalability.

What firms are doing

Against this backdrop, firms are remarkably aligned on what “good” looks like. 80% of respondents want real-time, cross-asset analytics that bring public and private assets together, giving managers a single, integrated view of exposures, valuations, and risks. 72% seek integrated portfolio modeling and stress-testing tools to simulate how assets interact under different market or macro conditions — from inflation shocks to liquidity squeezes. And 53% highlight seamless connectivity with custodians, brokers, and internal systems as a critical priority.

In short, wealth managers envision a connected environment that combines accurate data, holistic analytics, and fluid connectivity — one that delivers transparency, agility and control as portfolios grow more complex.

How Bloomberg helps

Bloomberg delivers the integrated suite of solutions wealth managers are asking for — anchored by a consistent, high-quality data foundation. Its enterprise data layer decouples information from legacy systems, unifies it across datasets, and enriches it with comprehensive internal and third-party sources. The result is a single, trusted source of truth — an authoritative investment book of record ready for the cloud.

On that foundation sits a unified analytics environment for total-portfolio decisions. Factor-based and full-revaluation risk models, performance attribution, portfolio optimization, liquidity analysis, and scenario testing all operate within a single framework, giving managers a clear, real-time view of exposures and drivers of risk change across asset classes.

Bloomberg’s API-first architecture connects research, portfolio management, trading, and compliance — integrating seamlessly with custodians, brokers, and third-party systems to keep data consistent end-to-end across applications. As private holdings expand, Bloomberg applies public‑market discipline to private data. Managers can capture granular positions, link bespoke structures with listed securities, and support LP/GP workflows from fund discovery through ongoing monitoring. That creates a true total‑portfolio view across public and private assets, improving transparency, control, and speed.

Asia’s wealth will keep compounding. Firms that unify their data, analytics, and connectivity can scale with precision, shorten reporting cycles, and strengthen risk oversight while client assets grow more complex.

Foresight. Insight. Oversight.

Data, analytics & execution – connected seamlessly for private wealth.