Stable Fed policy may be supportive for MBS

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence MBS Strategist Erica Adelberg Kakuda with contributing analysis by Ira F Jersey. It appeared first on the Bloomberg Terminal.

Mortgage technicals may improve with Fed on hold for longer

The Federal Reserve’s suggestion this week that it may keep the funds rate steady for longer may provide room for volatility to decline, and given relatively high yields, this could improve demand for mortgage-backed securities (MBS). Mortgage rates still near multi-decade highs should also continue to limit MBS supply.

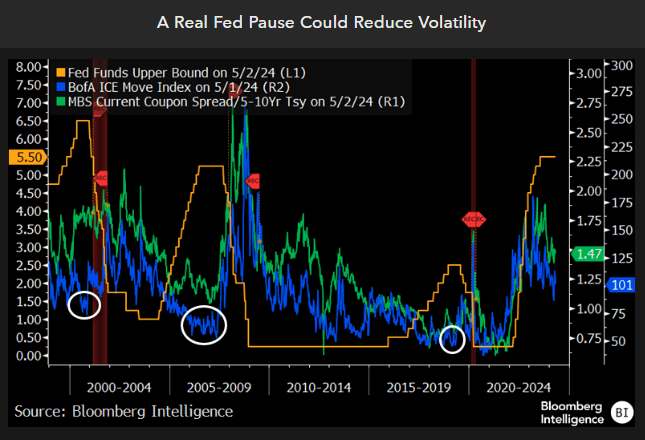

Range-bound rates could reduce volatility, benefit MBS

With inflation showing signs of reaccelerating in April, markets were concerned that the Fed may be forced to pivot to a more-hawkish stance. In response, both Treasury and mortgage yields rose to their highest since last November, and volatility also surged, accompanied by a widening in MBS yields and spreads.

The pause between Fed hikes and easing historically has given room for volatility to decline. Almost a year ago, we anticipated that could happen as the Fed pivoted from tightening mode. But with the data-dependent Fed keeping markets guessing about its next move, volatility remained relatively high, keeping pressure on MBS spreads. The Fed’s reiteration that it will remain patient may keep yields range bound and provide room for falling volatility, which may allow MBS spreads to tighten.

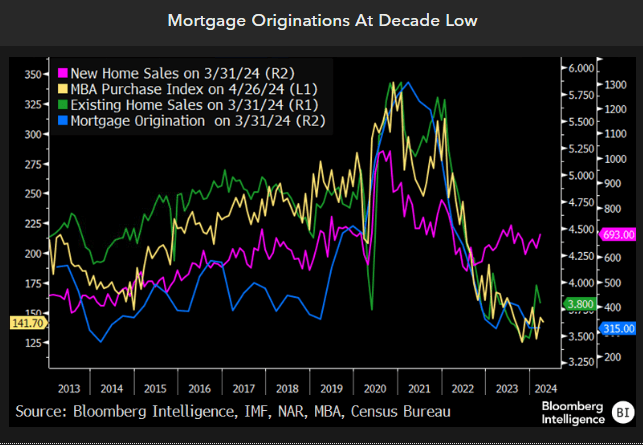

Elevated rates are likely to keep MBS supply extremely low

The Fed’s on-hold-for-longer stance has lifted primary mortgage rates for 30-year-fixed conventionals back up into the mid-7% area, a level that challenges affordability for new borrowers and also keeps borrowers currently paying much lower rates on their mortgages chained to their current homes. New construction is contributing some new net mortgage supply, but a rise in all-cash borrowers and extremely low refinancings have detracted some as well.

Rising home prices also at the margin are increasing supply, but the number of loan applications for both purchases are near their lowest levels in more nearly three decades. Taken as a whole, this has depressed mortgage originations to the lowest volume in a decade. Elevated rates, in response to Fed’s policy hold, should continue to limit new MBS supply.

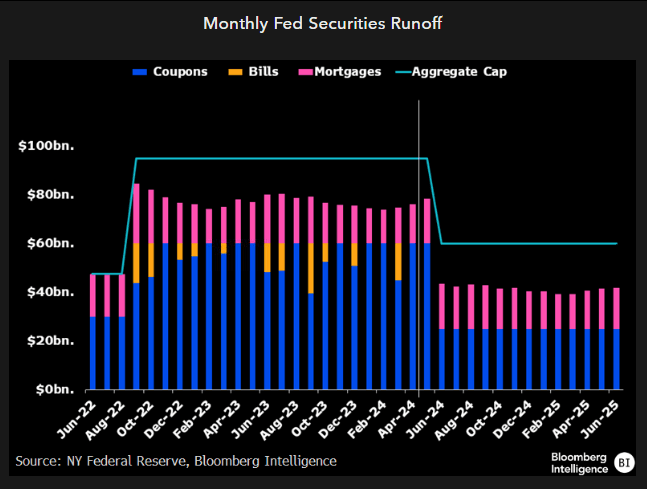

Fed QT taper for Treasuries could support bank demand

Treasury runoff will slow to $25 billion as of June 1 from the current $60 billion, the Fed announced May 1. MBS runoff will remain subject to a $35 billion cap. The Fed further announced that any MBS runoff above the $35 billion cap would be invested in Treasuries rather than reinvested back into MBS, supporting the Fed’s goal of shifting toward a Treasury-only portfolio.

Taken as a whole, this shift in the Fed’s quantitative tightening (QT) program could be a negative for MBS spreads relative to Treasuries. But it seems unlikely that MBS paydowns will ever top the Fed’s $35 billion cap, so the Fed would have to lower that threshold if MBS paydowns were to be used to buy Treasuries. Furthermore, the QT taper will effectively add more cash to bank balance sheets, which may support more bank buying of MBS.

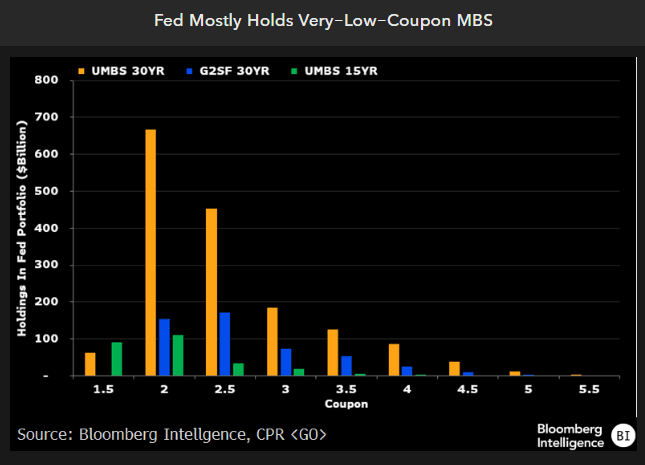

Fed’s very-low-coupon MBS holdings keep runoff slow

Treasury runoff will slow to $25 billion as of June 1 from the current $60 billion, the Fed announced May 1. MBS runoff will remain subject to a $35 billion cap. The Fed further announced that any MBS runoff above the $35 billion cap would be invested in Treasuries rather than reinvested back into MBS, supporting the Fed’s goal of shifting toward a Treasury-only portfolio.

Taken as a whole, this shift in the Fed’s quantitative tightening (QT) program could be a negative for MBS spreads relative to Treasuries. But it seems unlikely that MBS paydowns will ever top the Fed’s $35 billion cap, so the Fed would have to lower that threshold if MBS paydowns were to be used to buy Treasuries. Furthermore, the QT taper will effectively add more cash to bank balance sheets, which may support more bank buying of MBS.