Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analyst Philip Richards and Associate Analyst Uzair Kundi. It appeared first on the Bloomberg Terminal.

South Africa’s presidential elections on May 29 add political uncertainty to the list of headwinds facing local lenders such as FirstRand and Standard Bank, which already includes a weak economy and stalled revenue prospects as lending growth slumps. Consensus EPS is at risk of being trimmed further, with rising impairments an additional threat.

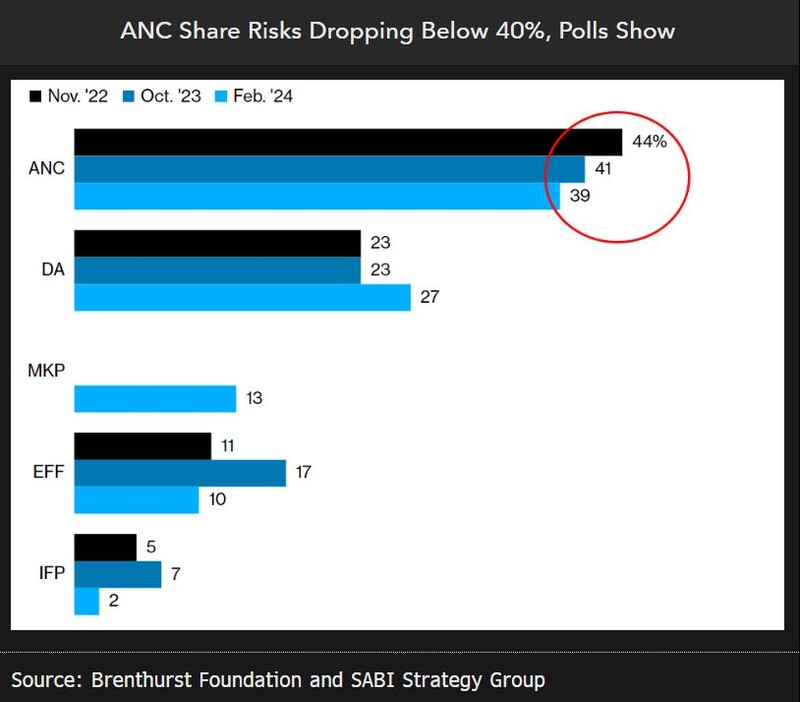

Upcoming presidential elections may be a watershed moment in South Africa, with the African National Congress (ANC) potentially losing its majority for the first time since coming to power in 1994. Corruption, poverty, a weak economy and the dire state of public enterprises all ire the electorate. Opinion polls suggest the ANC’s vote share could slide to 40-50%, forcing the party to enter a coalition with one or more smaller parties. The risk for local banks from this outcome would likely be limited.

If the ANC share drops to the extent that it’s forced into a coalition with Julius Malema’s far-left Economic Freedom Fighter’s Party, higher taxes, expropriations of white-owned property and even nationalizations would become a risk.

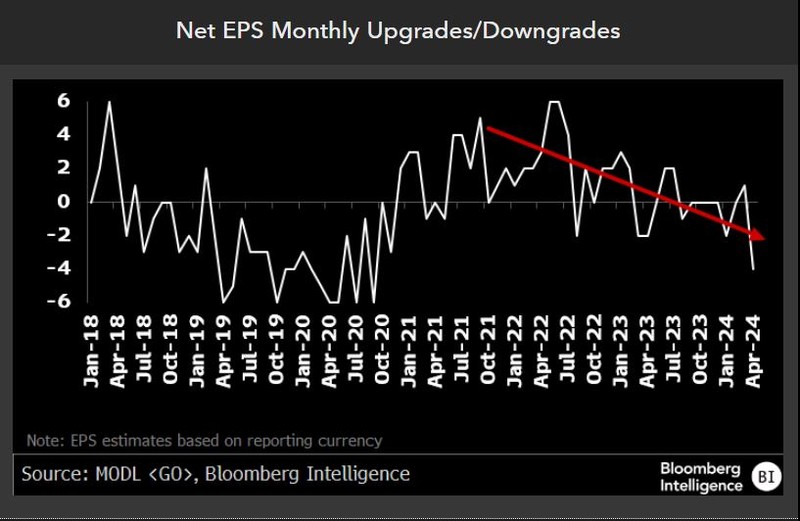

EPS estimates stall on economic slowdown, charges

Weak economic conditions and rising 2024 impairments — based on consensus — suggest a weak EPS outlook for South Africa’s leading banks, with modest downward revisions possible. We expect the cost of risk to climb from below-normalized levels for most. The prospect of an interest-rate cut has receded, providing an offset, with market-implied rates indicating no reductions from the current 8.25% this year or next. That supports lenders’ net interest margin, underpinning revenue. Combined, these factors could drive net downgrades.

Our basket, comprising the six leading South African banks, shows whether EPS estimates were raised or lowered each month, based on 12-month forward consensus. The net balance each month ranges from six (all upgrades) to minus six (all downgrades).

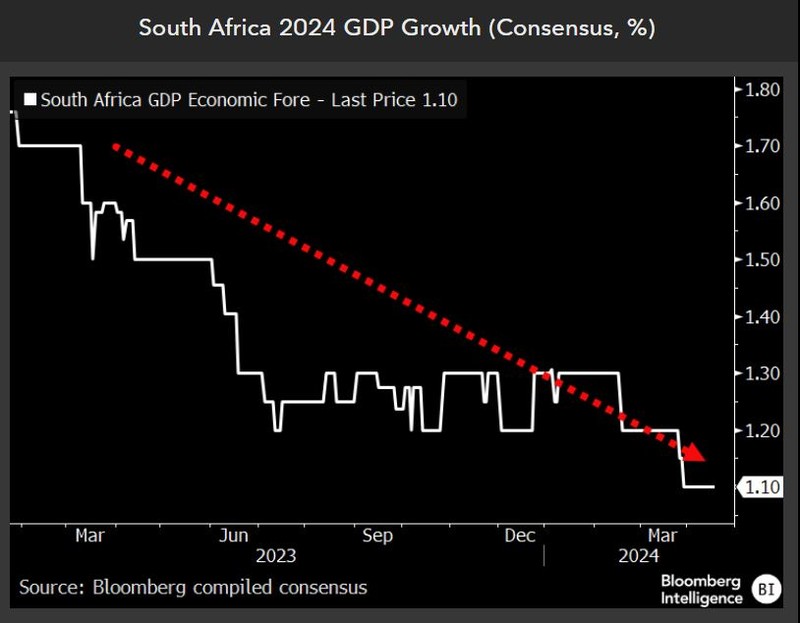

Stalled growth weighs on lending prospects

A key drag on local banks, including FirstRand and Standard Bank, from the electricity crisis in South Africa is a collapse in business confidence and a slowdown in economic growth. Economists have slashed 2024 economic growth estimates to just 1.1%, down from an already weak 1.7% expected at the start of last year. Combined with inflation of 5-6%, that implies nominal GDP growth of about 7% per annum. While banks may be able to tread water with lending growth at about that level, political uncertainty into the Presidential elections are likely to weigh, meaning banks are unlikely to deliver higher lending growth than that.

Longer-term opportunity exists for local lenders as corporates and households invest in renewable energy sources, but coal-based electricity generation is likely to remain the primary source near-term.

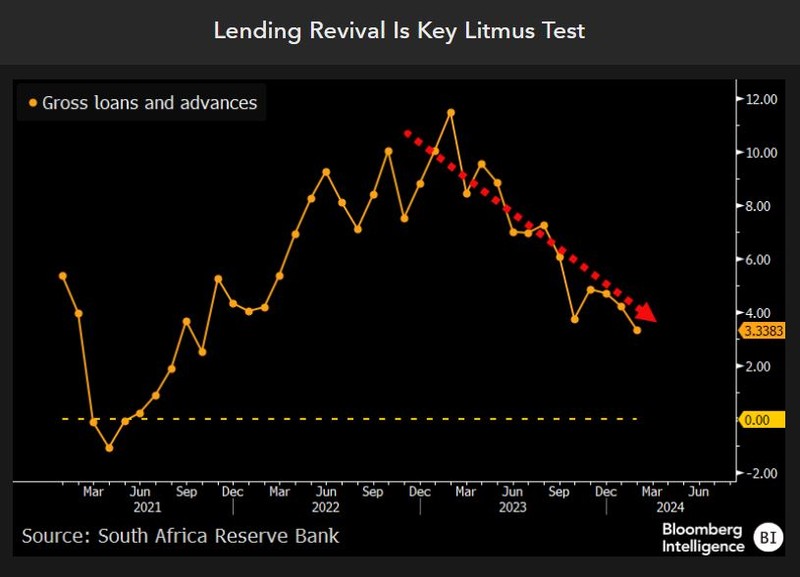

Lending growth to remain subdued

South Africa lending growth had weakened in the face of a challenging and deteriorating economic environment, weighing on local banks’ revenue outlook, slowing to just 3% recently from above 10% in early 2023. A weak housing market, political uncertainty ahead of the Presidential elections, low corporate confidence and elevated unemployment could combine to keep lending growth within a subdued 3-6% range through 2024, which would imply zero or negative growth in real terms compared with an inflation rate of 5-6%.