Bloomberg Market Specialists Eziz Jumayev, Adam Cohen and Takuya Nagasawa. contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

Investors need to track the media hype and clinical trials for obesity drugs after Novo Nordisk A/S topped LVMH SE as Europe’s largest stock and Eli Lilly & Co.’s market value surpassed half a trillion dollars.

The stocks rallied in early August as executives highlighted research showing the drugs reduce not just weight but also cardiovascular disease risk. Bloomberg Intelligence predicts an 18-fold jump in the global obesity drug market by 2030, to at least $44 billion, adding that the findings could encourage broader insurance reimbursement.

The issue

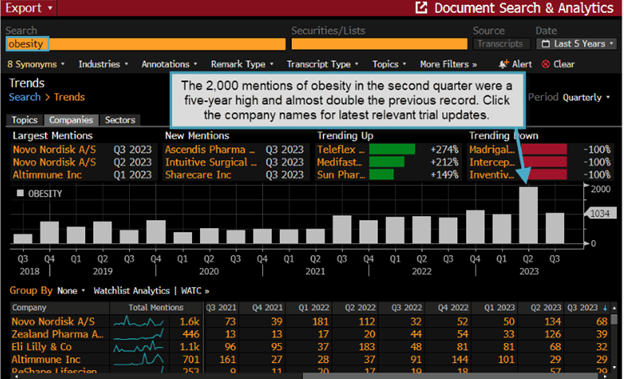

Searches across 200 million documents found 2,000 mentions of obesity in the second quarter, the highest in at least five years and almost double the previous record.

Novo Nordisk’s mentions focused on the impact of obesity drugs on blood pressure, lipid lowering and inflammation. Eli Lilly’s mentions focused on the results of its tirzepatide Phase III trial and an emphasis on alleviating obesity-related health complications. The company has raced to a market cap of $557 billion.

Novo Nordisk’s market cap, meanwhile, has reached $440 billion, surpassing LVMH’s $399 billion. The success of Ozemic and Wegovy has propelled Novo Nordisk’s fortunes even while creating demand challenges.

After a wave of news and announcements, analysis shows strong positive sentiment for Novo Nordisk, as trials suggest obesity drugs reduce cardiovascular disease.

The market for new weight-loss drugs like Ozempic and Wegovy is expected to reach $100 billion by 2035 as patients realize the efficacy of the medications. Ozempic leads in drugs that imitate the GLP-1 satiety hormone, with $3.2 billion in second-quarter sales versus $1.8 billion for Trulicity. Meanwhile, Eli Lilly’s Wegovy rival, Mounjaro, is also nearing approval for weight loss and will soon be available for U.K. patients.

Other key announcements in recent weeks include Zealand Pharma A/S, which said Aug. 17 that it is advancing survodutide into three global Phase III clinical trials. Altimmune released the 24-week results of Phase II trials of pemvidutide, which is aiming for class-leading liver fat reduction. Meanwhile, Pfizer is developing an oral drug, danuglipron.

In the U.S., obesity drugs will be in focus as the Inflation Reduction Act seeks to lower Medicare costs. Drug manufacturers are already shifting development research to get ahead of U.S. drug-pricing laws, negotiate with Medicare and avoid massive tax implications. Commercial prescriptions for Ozempic have surged ahead of those under Medicare, though the bills are also rising. About 19% of the 63 million Medicare beneficiaries are obese, BI notes.

Tracking

Use DS, NT, GT and NCAT to analyze trends in obesity drug news. Turn to BI for in-depth research.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.