Harvard’s bet on alternative assets could pay off on a rainy day

This analysis is by Bloomberg Intelligence Head-EM Equity Strategy Gaurav Patankar and Equity Strategist Kumar Gautam. It appeared first on the Bloomberg Terminal.

Harvard’s overhaul of its endowment’s asset-allocation model in the past four years could pay off in 2022 amid higher market volatility. A reduction in correlated public equity and real estate investment lowers the drawdown risk, while a bigger move into private equity and hedge funds improves chances of outperformance when the market corrects.

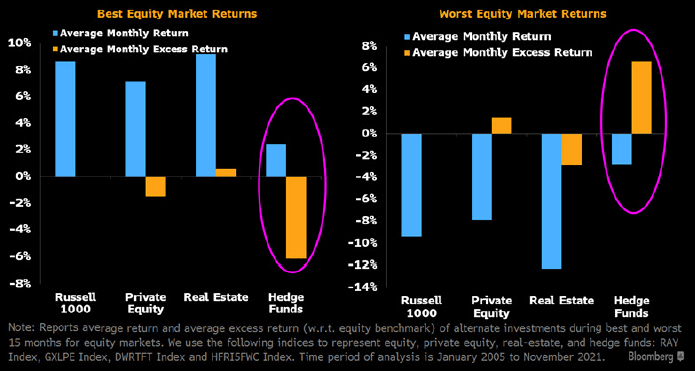

Hedge funds, PE the place when markets get bumpy

Harvard’s endowment performance may be poised to shine in 2022 after recent struggles. Our analysis of alternative asset classes shows hedge funds and private equity have negative excess returns in the best months for the equity market, and the opposite when stocks turn sour. Real estate investments show the reverse: positive excess returns when stocks do well, negative when they don’t. Over the past 15 years, hedge funds returned minus 6.2% in the 15 best months for the market, and plus 6.6% in the 15 worst. Real estate returned plus 0.6% when stocks had their best month, and minus 2.9% when equities faltered.

In the past four years, while Harvard has increased allocation to hedge funds and private equity, it has reduced exposure to public equity and real estate, positioning it well for a volatile market.

Hedge fund’s hedging property

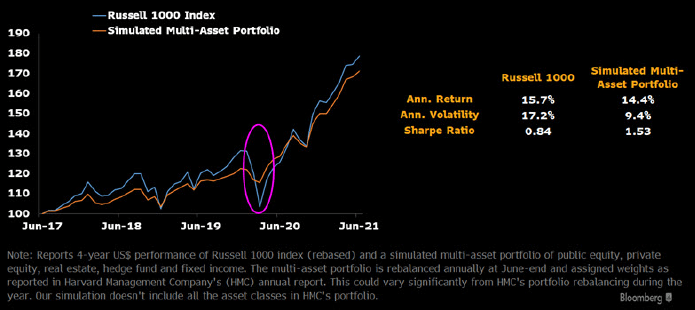

Endowment overhaul for better risk-reward tradeoff

Reducing equity exposure during the past few years’ bull market may have shaved a few points off Harvard’s annualized return, but the endowment still gained in terms of return per unit of risk (Sharpe ratio). From June 2017-June 2021, a simulated multi-asset portfolio mimicking Harvard’s allocation returned 14.4% annually vs. 15.7% for the Russell 1000. However, the portfolio’s volatility was roughly half that of the index, so it showed about an 83% advantage over the Russell 1000’s Sharpe ratio.

The March 2020 drawdown of the portfolio was also limited to 1% vs. 14% in the index. Managing drawdowns is important for endowments to meet fixed costs, and Harvard is thinking ahead.

Improved risk-reward tradeoff

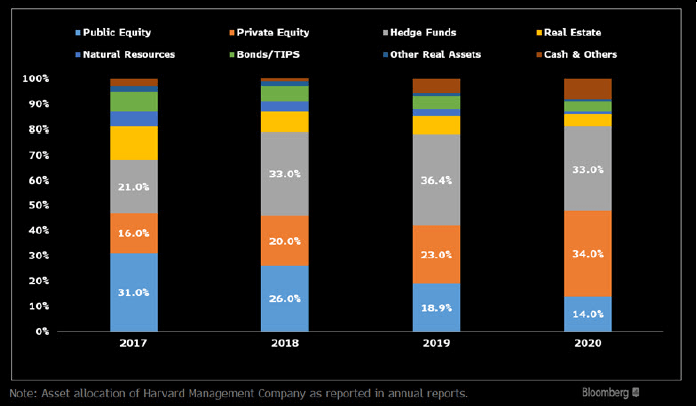

Changing allocations for a correlated world

Harvard’s increased focus on hedge funds provides a buffer at a time when cross-asset correlations have increased, reducing the diversification potential of multi-asset portfolios. The average pairwise correlation at around 60% is close to the 90th percentile value in the past 30 years and only below levels during the global financial crisis of 2008. Among the high yielding asset classes, hedge funds have the lowest average correlation with others.

In the past four years, Harvard’s endowment has increased hedge-fund allocation to 33% from 21%. That’s second only to private equity, which more than doubled to 34% from 16%. We consider eight asset classes: U.S. equity, developed markets ex-U.S. equity, emerging-market equity, U.S. fixed income, non-U.S. fixed income, real estate, private equity and hedge funds.

Changing asset allocation

Returns for U.S. college endowments get high marks

U.S. college endowments have reported strong performances in fiscal 2021, outpacing benchmarks by a large margin. According to Bloomberg’s ENDO <GO> function, the average one-year return of the 15 endowments that reported performance as of June is 48% vs. 34% on the ENDOW Index, a multi-asset benchmark for the sector. The Russell 1000 Index returned 43% during this period. Washington University in St. Louis reported a 65% return, the highest of all college endowments.

Harvard (34%), Yale (40%) and Princeton (47%), are the top three by assets under management; all were below the median return of 48%.

ENDO <GO>, endowment performance