Does sustainable investing have a future in the U.S. market? Introduction

This article was written by Chris Hackel, Head of Sustainable Indices at Bloomberg.

In this series, Bloomberg’s Sustainable Indices team takes account of current market sentiment and conditions surrounding sustainable and ESG investing in the U.S. market and explores opportunities for 2023.

Earlier this month, the Bloomberg Sustainable Indices team attended the ETF Exchange conference in Florida. There we spent two days meeting with our clients – including leading asset managers and large asset owners – discussing their priorities for 2023 and beyond. Particularly, we were interested in finding answers to the following question:

What does the future of sustainable investing look like in the U.S. market?

Approach with caution

For many of the clients we met, sustainable and ESG investing has been at the top of agendas in recent years. But 2022 brought on a wealth of challenges. To name just a few: rocky markets, sustainable fund outflows, ESG as an increasingly politically charged topic, and market scrutiny of sustainable funds around greenwashing.

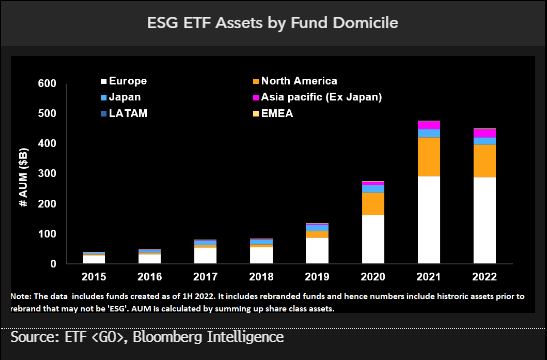

So we weren’t surprised to hear from clients that their enthusiasm for sustainable and ESG funds in the U.S. has somewhat tempered this year (while remaining an area of heavy focus in European markets, where 86% of ETF asset flows in 2022 went into sustainable funds, according to Bloomberg Intelligence). Many clients expressed being wary of launching new sustainable funds into an uncertain U.S. market.

No passing fad

However, the asset managers and asset owners we met didn’t consider sustainable investing as a passing fad. Far from it.

In recent years, they’ve seen investor demand clearly demonstrated by the considerable asset growth in this area. The challenge in US markets is the current lack of regulatory and cultural drivers that have produced wide consensus in Europe on confronting issues such as climate change.

Bloomberg Sustainable Indices sees these challenges as an opportunity to innovate. And to that end, we are seeing three key trends emerge:

- to create new indices and funds that align to specific and targeted sustainable objectives; or

- that seek to incorporate and mitigate emerging risks (including physical/environmental as well as reputational); or

- that invest in the new markets being created as the world diversifies its energy sources (e.g. renewables) and embraces new low-impact technologies (e.g. electric vehicles).

While the ESG “brand” may currently have mixed appeal to U.S. investors, many of the themes underlying it still resonate across the political spectrum.

An opportunity mindset

Below are four potential near-term trends in the sustainability investment sector in the U.S.

1. Using ESG without using “ESG”

Some of our clients are using approaches where ESG is a secondary consideration in a more targeted theme. Others are considering “de-aggregating” ESG scores to use only factors that are most relevant to an investor or fund objective.

2. Opportunity in the low-carbon transition

Bloomberg has launched various broad and thematic indices that include markets or companies most benefitting from the global shift to a low-carbon economy.

As more countries, including the U.S., introduce related regulations, opportunities are being created for funds and investment vehicles to align with these initiatives and effectively be “long regulation.”

4. Investing as usual, but with an impact

Finally, indices that achieve specific, targeted sustainable impact but provide an alternative to ESG score integration, where impact can be less clear or recognized.

We will be covering these in more detail in the coming months.