BYD-Tesla battle to go global, with margins at risk

Bloomberg Market Specialist Grant Gordon, Andrew Kaminski and Rowan Daiksel contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

After displacing Tesla Inc. as the world’s biggest electric vehicle maker, the next big challenge for China’s BYD Co. will be spreading its wings overseas.

BYD’s profit more than quintupled last year after it sold a record number of EVs. However, BYD stock has stalled in the past three months despite the surge in sales and profits. With Tesla slashing prices to target the mass market, concerns over profitability have grown for BYD. Analysts expect a moderation in gross margin and sales growth as the EV maker enters new markets.

The issue

Berkshire Hathaway Inc.’s recent sale of BYD shares underscored growing challenges in the Chinese EV market.

“BYD’s higher sales could be at the cost of lower vehicle prices. Investors are concerned about profits,” said Bloomberg Intelligence analyst Steve Man, who added that he doesn’t see significant price reductions coming from BYD.

Tesla has been aggressive in cutting prices, though steep markdowns took a toll on profitability, leading to price increases for Model S and X vehicles in the U.S. Meanwhile, BYD recently unveiled an $11,450 electric hatchback in China’s already crowded entry-level vehicle market.

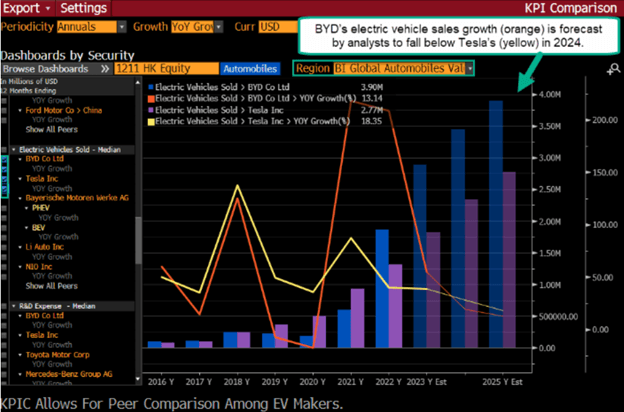

Annual sales growth at BYD and Tesla is expected to slow until it falls below 20% by 2025. This is due in part to a maturing market, rising borrowing costs and a growing number of traditional car makers entering the EV market.

BYD investors want to ensure continued growth and expansion even after the home market becomes saturated. Bloomberg Intelligence said spending on R&D and marketing could rise amid tougher competition and as BYD makes a global sales push.

BYD is set to build its first overseas passenger vehicle plant in Thailand and is considering additional manufacturing opportunities in the Philippines, Vietnam and Indonesia. However, BYD is off to a slower start in terms of exports than competitors, with Hyundai Motor Securities Co. marking exports at 7.4% of total sales during January and February 2023. In contrast, Tesla made about half of total sales overseas in 2022, while Hyundai Motor exported about 65%.

Brazil, France, Italy, and five more countries, including the U.S., have BYD facilities, with its suppliers also mostly domiciled in China. While BYD’s global expansion is becoming a key part of its rivalry with Tesla, it seems stuck on its rival’s home turf amid tense Sino-U.S. relations.

Tracking

Use Bloomberg’s KPIC, DS and SPLC tools to analyze the auto industry. Run NSUB FFMSTORY to subscribe to functions-focused stories. KPIC allows for peer comparison among EV makers. Run DS to track discussion of BYD’s overseas plans in transcripts. Run 1211 HK Equity SPLC to check BYD facilities.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.