A look into PAB optimization approaches for Fixed Income Investors

In this blog, the Bloomberg Sustainable Indices team discusses the rise in popularity of Paris-Aligned Benchmarks and provides an overview of certain optimization approaches for fixed income investors. An in-depth study of those approaches is available in our latest ESG quantitative strategies publication: Understanding the Bloomberg MSCI Euro Corporate Climate Paris Aligned ESG Select Index.

The Paris Agreement and the Rise of Paris Aligned Benchmarks (PABs)

The Paris Agreement, an unprecedented legal framework for global action on climate change, was adopted by 196 countries in December 2015. Its goal is to limit global warming to 1.5 degrees Celsius or less by the end of this century. Following its enactment, and to address increasing demands on institutional investors to address climate change, the European Commission formed a Technical Expert Group (TEG) to develop minimum standards that investment products must meet to be designated as “Paris-Aligned” or “Climate Transition”. This led to the rise of Paris-Aligned Benchmarks (PABs) which offer investors an opportunity to align their investments with the Paris Agreement’s goal.

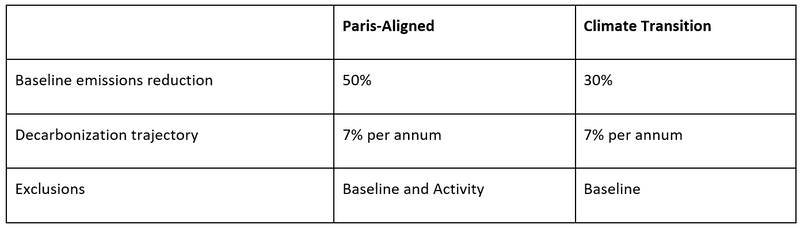

Minimum requirements for Paris-Aligned Benchmarks and Climate Transition Benchmarks

PABs require portfolios to decarbonize along a prescribed pathway, with the goal of achieving net zero portfolio emissions by 2050. Because of their regulatory origin, PABs have gained significant attention in the financial industry, with many asset owners and managers recognizing that without sufficient climate-related analysis, portfolios are likely to be exposed to increased risk and may miss opportunities arising from a world in transition.

An Optimized PAB Approach for Fixed Income Investors

Fixed income indices are typically constructed using explicit rules that define what firms can be included in an index. While a PAB index can be implemented using a rules-based approach to define the greenhouse gas (GHG) emissions trajectory, it is difficult to include any other measures upon which to determine individual security weights. An optimized approach allows for the introduction of additional measures to re-weight firms and still meet the required decarbonization pathways.

For fixed income investors, rigorous controls for managing low tracking error while satisfying the dynamic net-zero path are of particular interest. An optimized PAB approach incorporates risk management techniques into index construction to manage risk and achieve ambitious goals. The Bloomberg MSCI Euro Corporate Climate Paris Aligned ESG Select Index is a good example of how an optimized approach can bring risk management techniques into index construction.

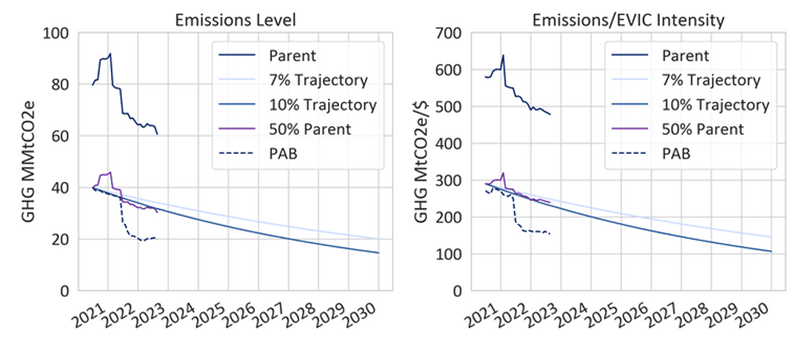

Fixed Income indices are permitted to set decarbonization trajectories using GHG emissions calculated on an absolute basis. This results in the highest emitters being held at lower relative weights, however the implementation of this measure does not consider the size of the firm. An optimized PAB approach allows the index to set a dual decarbonization trajectory across both absolute GHG and GHG intensity. GHG intensity is the emissions level divided by a financial metric, in this case enterprise value including cash, thereby controlling for firm size when used as a decarbonization measure.

De-carbonization Trajectories

Optimization also allows the index to ensure that the ESG score is at least 15% greater than the score of the parent, while also increasing the weighted average Green Revenue and the Green-to-Fossil-Fuel ratio versus the parent benchmark. Additionally, optimization helps manage a comprehensive array of goals, including turnover, sector, country of risk, yield, and duration requirements.

To manage risk in PABs, the Bloomberg Fixed Income Multi-Factor Risk Model sets the objective function such that the ex-ante tracking error of the PAB index is minimized versus the parent benchmark. As of 28 February 2023, the monthly tracking error was 5.1bps with an annual tracking error of 16.3bps.

Aligning Fixed Income PABs with Your Objectives

While there are many approaches to implementing the Paris-Aligned objectives in fixed income benchmarks, an optimized approach provides specific controls around ex-ante tracking error while also having the ability to include a wide variety of additional objectives.

The Bloomberg Sustainable Indices team can work with you to align PABs to your objectives, ensuring that you manage risk while achieving your desired outcomes. To read more about these approaches, consult our latest ESG quantitative strategies publication: Understanding the Bloomberg MSCI Euro Corporate Climate Paris Aligned ESG Select Index.