2022 Outlook: Global asset managers

This analysis is by Bloomberg Intelligence Senior Industry Analyst Alison Williams and Senior Associate Analyst Neil Sipes. It appeared first on the Bloomberg Terminal.

Global asset managers’ revenue run-rate is bolstered by elevated asset prices entering 2022, and BI’s strategy team view is supportive for next year, though we note volatility that bears watching. A sustained slide in stock prices could add fuel to M&A, while cryptocurrency’s merit as an asset class could face a litmus test. Managers are buying into growth opportunities, such as private markets and ESG, while mutual fund traction in China keeps the region in focus, and ETFs show cost is still a key demand driver, though funds with volatility opportunity are also attracting assets.

Powerful fundraising and asset additions may enable private equity firms to post double-digit asset growth next year, putting managers on pace to meet five-year goals ahead of schedule.

Multiples drop from five-year average, volatility rises

Our large-cap asset-manager peer group’s forward P/E multiple has moderated almost 10% in 2021, essentially all since early November with rising volatility and weaker equities. Valuation, at 10.3x, is less than one standard deviation below its five-year average, after benefiting earlier in the year from solid fundamentals, with M&A optimism still helping to provide a floor after boosting multiples in 2020. The BI large-cap asset manager multiple looks even lower compared to its 10-year average. Manager stocks have traded at a widening discount to the MSCI ACWI over the past several years after generally maintaining a premium in 2010 through mid-2014, using forward earning multiples of the BI index. This reflects broad fee and margin pressure.

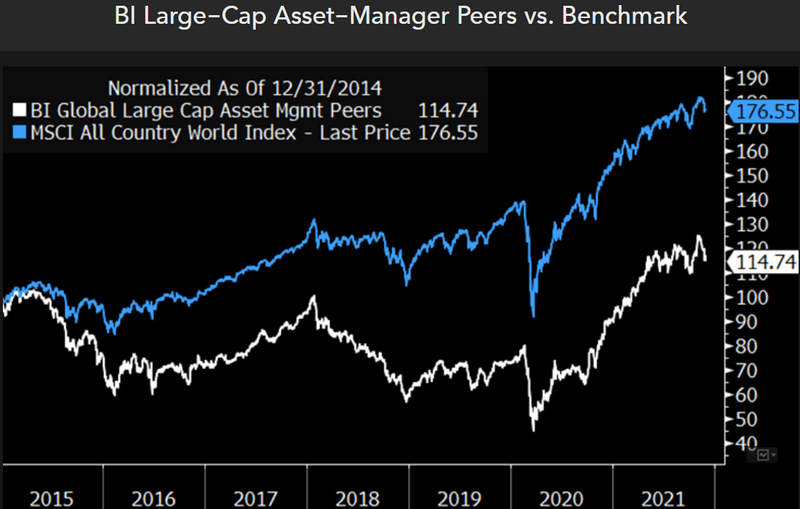

Recent underperformance narrows 2021 manager gains

Global large-cap asset-manager returns and outperformance in 2021 have been fueled by healthy flows and markets-driven support — especially for equities — in turn in supporting a better fee and margin outlook. Stocks in the BI large-capitalization global asset-management index have gained 27.3%, driving outperformance of 13.1 percentage points vs. the MSCI ACWI Index’s 14.1% return. This follows a 13.2-percentage-point outperformance in 2020, driven by a 4Q M&A-driven rally in asset-manager stocks. Through 3Q of last year, stocks underperformed global equities by 7.4 percentage points.

Outperformance vs. the broader market was front-half loaded this year, with about flat performance in 2H through early December modestly underperforming the global market.

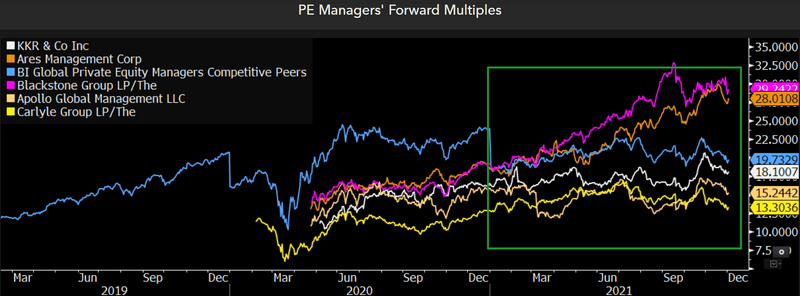

PE manager performance shines on growth, adoption

Shares of Blackstone, Apollo, KKR, Carlyle and Ares are showing significant P/E multiple growth due to wider investor adoption, and strong growth across fundamental factors. They have achieved about 2-3 turns of expansion since the start of 2019, more than offsetting tax effect on earnings. Taxes from C-corp. conversions stepped up in 2021, as most private equity managers have estimated an eventual 10-20% earnings compression due to switching, yet expanding operating margins help.

While investor acceptance of C-Corp conversions has been positive, the next multiple-expansion catalyst could lie in further index inclusion and growing passive ownership. Multi-tier share structures at Blackstone and Ares could preclude major index inclusions. Carlyle has adopted a one-share-one-vote structure and KKR and Apollo plan to do so.

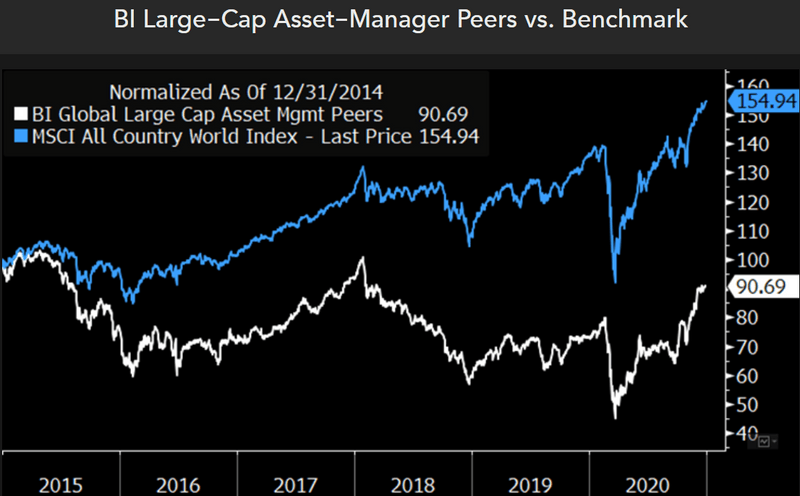

Late-year rally drove manager outperformance in 2020

M&A helped support a year-end boost to stocks in the BI large-capitalization global asset-management index, driving outperformance in 2020 of 13.2 percentage points over the 16.8% return for the MSCI ACWI Index. Through 3Q, stocks underperformed global equities by 7.4 percentage points, as measured by the return differential to the MSCI ACWI index.

Morgan Stanley’s Eaton Vance announcement and Trian’s disclosed positions in Invesco and Janus Henderson helped drive an October jump that moderated ahead of U.S. elections, but was enough to close the year-to-date performance gap by month-end. The stocks participated in the broad global financially rally in November and then jumped in early December with Macquarie’s announced purchase of Waddell & Reed.