Tencent doesn’t need a name change to become a metaverse leader

This analysis is by Bloomberg Intelligence Senior Industry Analyst Matthew Kanterman and Senior Associate Analyst Tiffany Tam. It appeared first on the Bloomberg Terminal.

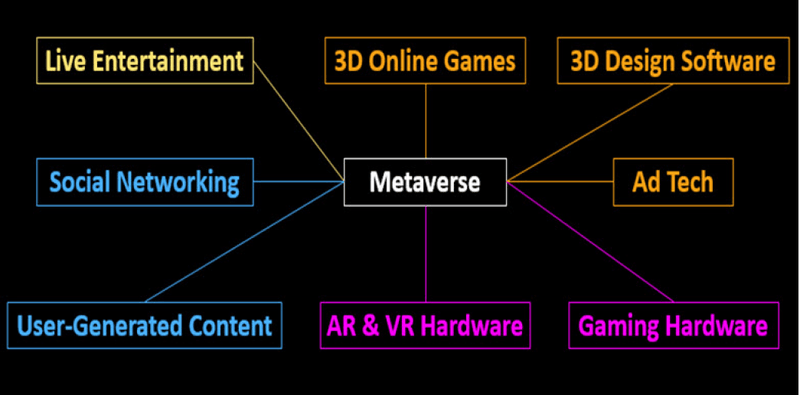

Tencent is well positioned to emerge as a leader as the metaverse develops over the next decade, fueled by its deep expertise in online games and real-time 3D development, online entertainment, social platforms and its investments in Epic Games, Roblox and others. Near-term opportunities appear incremental to increase sales from proto-metaverse gaming experiences and virtual concerts, an $800 billion addressable market globally. Longer-term, we expect Tencent to remain a dominant force in China but its overseas opportunities remain murkier amid lingering geopolitical challenges.

Tencent’s gaming, entertainment expertise power metaverse edge

Tencent’s leadership in online games and social networks positions it well to retain strength as the metaverse emerges over the next decade, combining its expertise with real-time 3D software development with social experiences. Subsidiaries such as Tencent Music Entertainment provide ample means for monetization through content and live events.

Gaming leader provides 3D expertise

Tencent’s leadership of the domestic and global video game markets gives it a leg up on social peers entering the space, providing it decades of experience developing real-time 3D software-powered virtual worlds. Just 2% of internet-based experiences are powered by real-time 3D software today, the bulk of which are within gaming, but the metaverse may push this over 50% over the next decade, according to Unity CEO John Riccitello. Tencent has deep expertise utilizing both Unity and Epic Games’ Unreal Engine for gaming and can lean on that to build metaverse experiences.

Tencent commands nearly 50% of the domestic $46 billion gaming market and about 5% of the $134.3 billion global ex-China game market, based on Newzoo data, consensus estimates and Bloomberg Intelligence analysis.

Epic’s Marc Petit discusses games’ metaverse edge

Social leader brings users, rapid scale

Tencent’s leading social and gaming user bases give it a strong foundation from which to build metaverse leadership vs. upstarts that are building metaverse-native platforms and lack user scale. New platforms, including those built on blockchain technology such as the Sandbox, are garnering lots of attention as competitors to incumbent social platforms in the metaverse era. But the Sandbox has only 30,000 monthly active users compared with WeChat’s 1.27 billion, and Honor of King’s over 100 million daily active users.

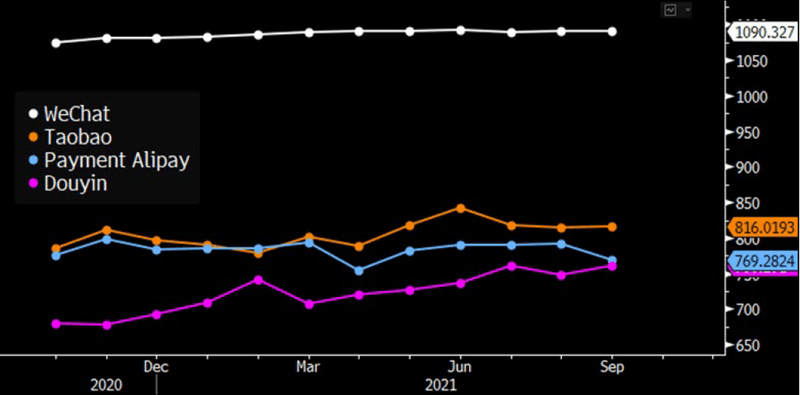

WeChat’s monthly active users exceeds Douyin’s 760 million, AliPay’s 769 million and Taobao’s 816 million, according to iResearch data, while it’s behind Meta’s 2.9 billion but ahead of TikTok’s nearly 475 million global ex-China monthly active users, according to Sensor Tower.

Monthly active users (millions) by application

Pan-entertainment breadth provides monetization avenues

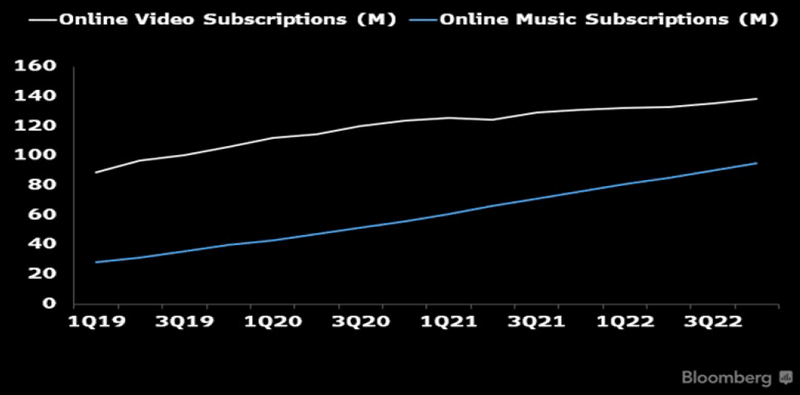

Tencent’s breadth across online entertainment businesses including online games, music and video, gives it ample monetization avenues for future metaverse experiences. Tencent Music Entertainment is already a leader in the virtual concerts business in China and we view the 97 concerts hosted on the platform so far as just the tip of the iceberg. Live music is booming amid high consumer demand and artists seeking to maximize income, and virtual metaverse concerts are emerging as an opportunity to enhance these opportunities further.

Tencent online video & music subscription outlook

Black Shark could provide VR integration

The rumored acquisition of gaming peripheral and device maker Black Shark, as reported by Bloomberg News, would provide Tencent with the necessary technology and intellectual capital to build out a suite of hardware products, especially AR and VR devices, to enhance its metaverse ambitions. An AR or VR device alone doesn’t make a metaverse, but having tighter control of the software and hardware integration of these experiences can help build a more powerful walled garden, similar to Apple’s success integrating iOS, App Store and the iPhone. This would help round out Tencent’s asset mix vs. rivals such as Meta, with its Occulus and Reality Labs assets, Microsoft and its Hololens and ByteDance after it acquired VR headset maker Pico.

Select key technologies for building the metaverse