Bloomberg Professional Services

How can traders make best use of quote data across global credit markets? This analysis looks at IBVAL, CBBT, and median quote benchmarks across U.S. and European markets to show pricing coverage, trading consistency, and actionable pre-trade insights.

This article was written by David Krein, Head of Real-Time Pricing Research at Bloomberg.

As global credit markets become more electronic and data-driven, traders are challenged to quickly interpret quote levels in relation to where bonds are actually trading. In a previous blog in this series, we discussed the distinction between quote reference prices (represented by individual quotes as well as composites such as CBBT) and trade reference prices (represented by IBVAL) as pre-trade information sources.

Our analysis included a case study with benchmarked results for a specific segment of the US High Yield market as well. Those results illustrated the clear difference in quote vs. trade reference prices, which makes their consideration and selection a critical step in any pre-trade workflow.

PRODUCT MENTIONS

However, the relevance of quote and trade reference prices extends beyond the US High Yield market. Electronification, data availability, and pre-trade workflows have increasingly become the worldwide standard, so traders could benefit from expanding that initial approach to more broadly assess quote reference prices and trade reference prices across global credit markets.

Measuring quote and trade reference differences

To address this, we looked at 4 markets – U.S. Investment Grade, U.S. High Yield, EUR Investment Grade, and GBP Investment Grade, as they are among the most liquid credit markets in the world.

For the U.S. markets, we used TRACE as our trade source. For EUR and GBP markets, we used Bloomberg data as our source. We considered trades that are >250,000 (local currency) from August 2025, and after applying certain other filters and simplifying assumptions to keep the analysis succinct and viable, the remaining trades served as our collective “ground truth” for benchmarking.

Next, we calculated the difference between three benchmarks that were observable just prior to each trade, and the trade level itself:

- IBVAL – pricing source available on the Bloomberg Terminal via PCS (IBVL) and for delivery through Bloomberg’s real-time market data feed, B-PIPE. It makes use of both quote and recent trade data to produce a trade level reference price and to help answer the question: If this bond were to trade right now, where would it most likely trade? It is explicitly targeting trade expectations.

- CBBT – rules-based composite price which filters available executable quote levels in real-time to produce context for trading. It does not take trade information into account.

- Median quote – a simple quote-based composite that reflects the median of available quote levels, without applying additional filters or weighting.

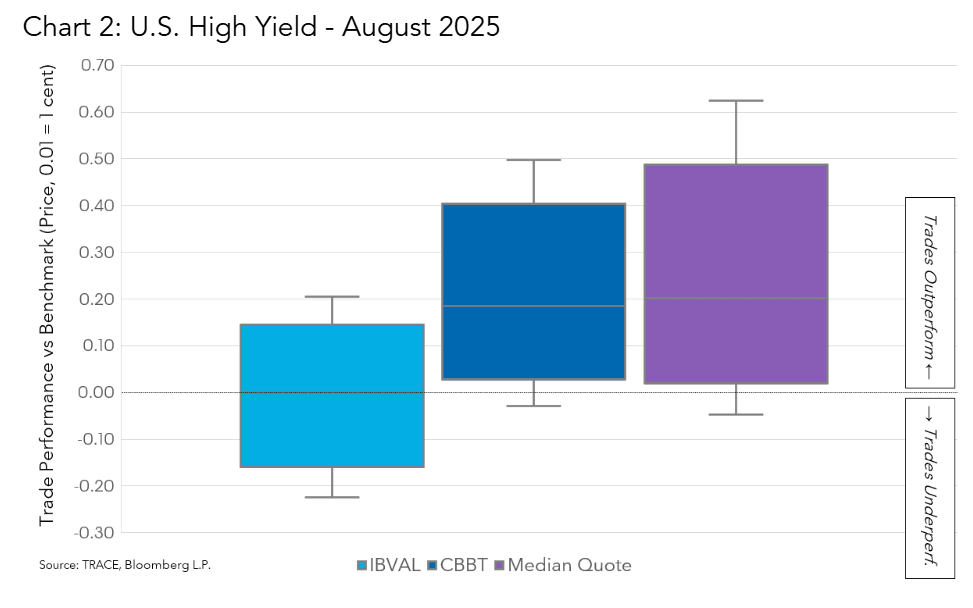

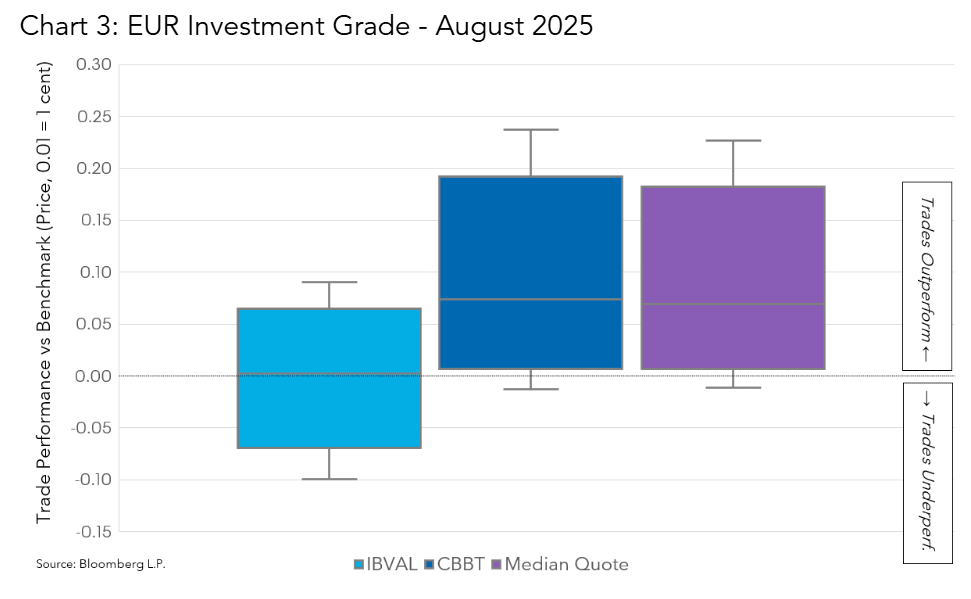

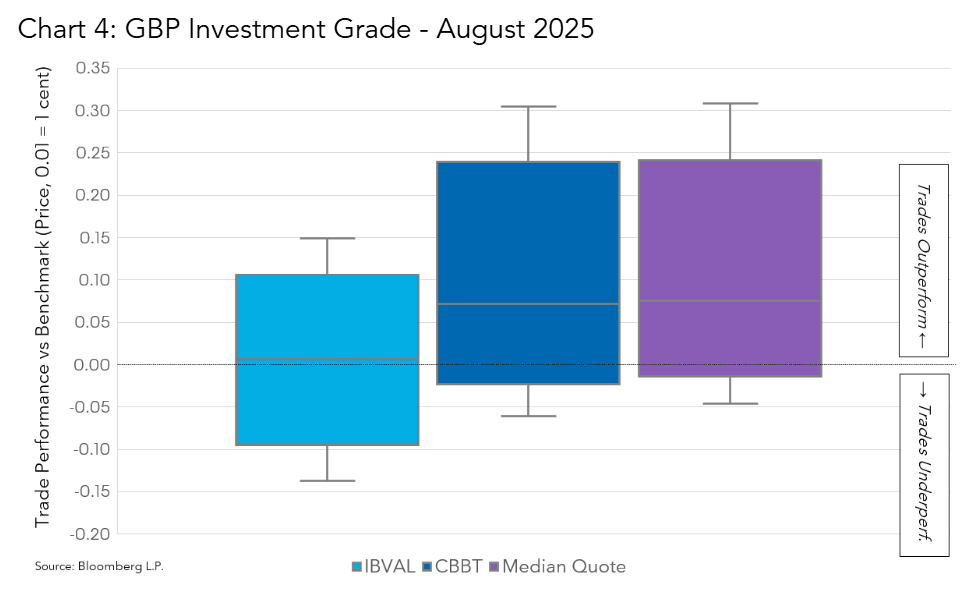

At charts presented below (Charts 1-4) those differences are aggregated and displayed as distributions (boxplots) by market. The Y-Axis is a measure of that difference in price. Positive results (the upper half of the chart) suggest that a trade was tighter than (inside, or better than) the benchmark level, or conversely, the benchmark level was wider than the trade level.

Negative numbers (the lower half of the chart) suggest that the trade was wider than (outside, or worse than) the benchmark, or conversely, the benchmark level was tighter than the trade level. The 0 line means that a trade level and benchmark level were the same.

The boxplot itself captures the distribution of differences, shown as the 25th and 75th percentiles (box), as well as the 10th and 90th percentiles (whiskers). The 50th percentile (median) is shown as a light gray line through the box.

How quote and trade benchmarks perform across global credit markets

Based on the U.S. Investment Grade results shown in Chart 1, we can observe how each benchmark performs versus traded levels. We can see IBVAL’s 50th percentile difference falls almost exactly on the 0 line, suggesting that its performance is tightly coupled with trade levels. This is by design, as IBVAL is intended to be a trade reference price for pre-trade workflows. Analogous values for CBBT (13.5 cents) and Median Quote (9 cents) are consistent with expectations for quote composites, which are away from traded levels.

Viewed slightly differently, since IBVAL’s light blue box is right on top of the 0 line, it is considered centered on the traded market; trades are as likely to be slightly too tight as too wide. For CBBT, its dark blue box is fully above the 0 line and we see 92% of trades occur inside (tighter than) this benchmark’s bid/ask. For the Median Quote, its purple box is also fully above the 0 line and we see 82% of trades occur inside (tighter than) this benchmark’s bid/ask.

Chart 2 (U.S. High Yield), Chart 3 (EUR Investment Grade), and Chart 4 (GBP Investment Grade) tell similar stories. Though the specifics match their respective market dynamics, in each case, we see IBVAL centered on the traded market and quote composites shifted away from traded levels.

How Bloomberg solutions can help with price discovery

Quote data and reference prices remain critical tools for traders to access real-time information on far more bonds than might trade in any period of time. The availability of a trade reference price such as IBVAL helps strengthen the pre-trade process, even if local dynamics might vary across markets. This enables traders to make use of a consistent set of tools across their global credit portfolio.

Interested to learn more about using IBVAL for your pricing needs? Click here.