Bloomberg Professional Services

This article was written by the Bloomberg Enterprise Investment Research Data team: Lewang Lei, Frances Shi and Maris Serzans.

Welcome to Data Spotlight, our series showcasing insights derived from Bloomberg’s 8,000+ enterprise datasets available on data.bloomberg.com via Data License.

As markets become more data driven, investors are looking for signals that offer an edge across research, pricing and execution. In this edition, we explore how short-interest dynamics can enhance fundamental factor investing, evaluate how dividend forecasts improve both derivatives pricing and dividend-growth strategies, and examine how intraday tick-history analytics can refine rebalancing execution by accounting for intraday liquidity and volatility patterns.

Looking for our other data-related findings? Explore these recent articles from the Data Spotlight series:

- Navigating tariffs

- Impact of lower AI costs & more

- Broader industry analysis & more

- Supply chain data & AI-based news insights

For more articles in this series, click here.

1. Short interest data to enhance fundamental signal

Factor investing can be strengthened by looking beyond traditional fundamentals to gain a clearer understanding of market trends. In this analysis, we explore how factor investing can be strengthened by looking beyond traditional fundamentals to gain a clearer understanding of market behavior. To do so, we incorporate short-interest data from S3 Partners, delivered through its collaboration with Bloomberg Enterprise Data. This dataset provides point-in-time coverage back to 2015 for more than 62,000 companies globally across a range of proprietary metrics.

Our analysis begins with a standard quality factor—consensus estimates for Return on Equity (ROE)—to identify high-quality companies. We then combine this with S3 short-interest metrics to highlight companies with more favorable market positioning. The study universe is the Bloomberg B500 Index over the past 10 years.

Each S3 variable is transformed into a daily-change factor, with bearish movements defined according to financial intuition: negative changes for Short Interest Availability and positive changes for all other measures. These bearish signals are intersected with the sector-level bottom quintile of ROE to construct the short-leg screen, applied point-in-time to the B500 constituents.

The long side maintains full, unfiltered exposure to the index. A standalone ROE backtest serves as a benchmark, allowing us to assess whether short-interest dynamics offer incremental value beyond fundamentals alone.

Chart 1 illustrates how combining Short-Interest Borrowing Cost with ROE can help uncover potential market opportunities.

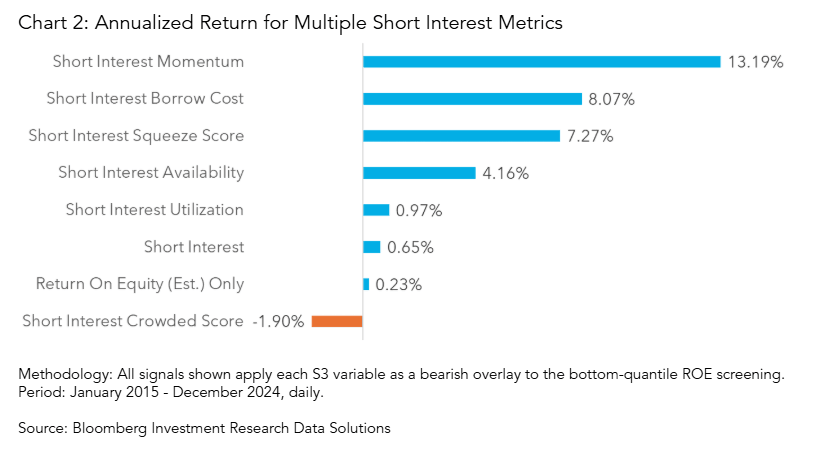

Building on the results from the Borrow Cost + ROE signal shown in the Chart 1, the second chart broadens the perspective to evaluate all seven short-interest overlays within the same framework. While the initial analysis illustrated how a single signal can influence cumulative performance over time, this cross-sectional view compares the end-of-period outcomes for each combined factor as of 31 December 2024.

Applying the same long-index/short-screen methodology—where a bearish short-interest move is added on top of the bottom-quantile ROE filter—reveals a consistent pattern: six of the seven short-interest dynamics generated higher cumulative returns than the ROE-only benchmark.

Themes: Short Interest, Investment

Roles: Equity Portfolio Managers, Quants, Strategists

Bloomberg Datasets: S3 Partners Short Interest Data, Company Financials, Estimates and Pricing Point-in-Time

2. The value of dividend forecasts in modern investment decisions

Dividends, especially dividend forecasts, have long played a vital role in trading strategies, portfolio management and risk management practices in both sell-side and buy-side institutions. This has become even more relevant for institutional investors seeking to invest in markets that have been recently supported by dividend distribution policies, such as China.

A robust, forward-looking dividend forecast model with regulatory overlays to anticipate how companies are likely to adjust their dividend payouts could provide an edge in navigating today’s fast-changing financial markets and help investors make well-informed investment decisions.

In this study, we first look at how Bloomberg’s Dividend Forecast (BDVD) data can help with derivatives pricing. For derivatives desks, accurate dividend forecasts are essential because dividends directly affect option pricing, index futures, and structured products. Derivatives traders can adjust option fair values based on forecasted dividends rather than flat or assumed yields.

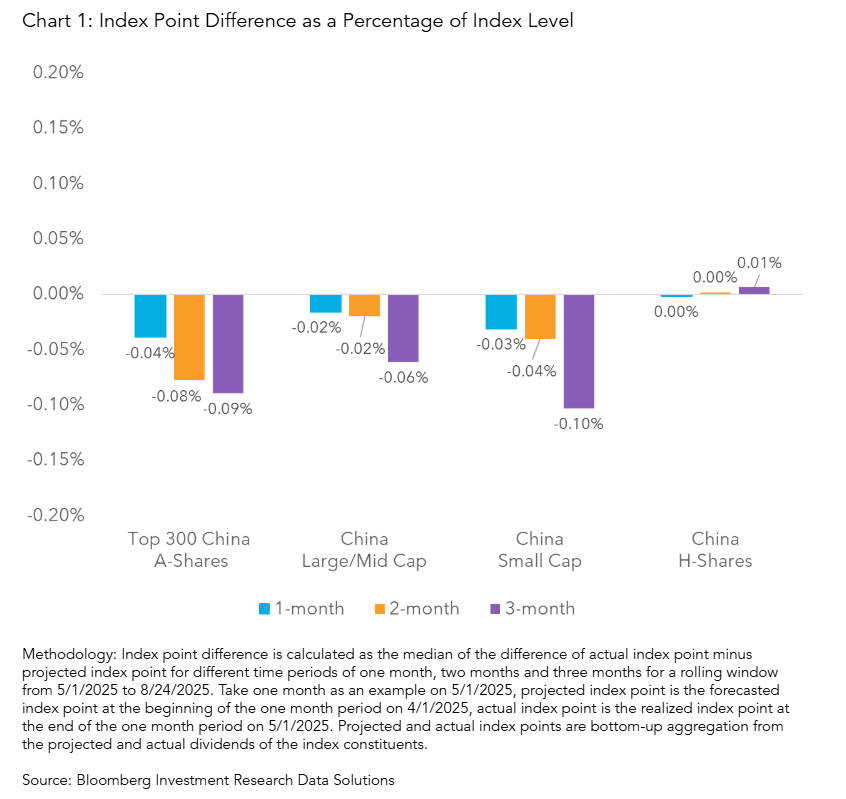

Chart 1 shows the index points difference for various A share and H share indices, representing the difference between projected and realized dividend. Our results show that Bloomberg dividend forecast could maintain an accuracy within roughly 10 basis points of the index level for a variety of China Indices.

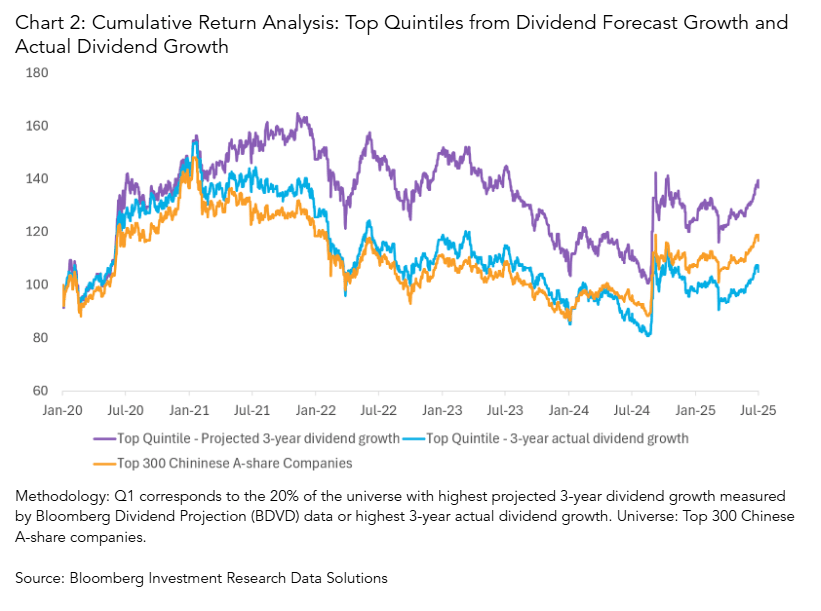

For Buy-Side investors, Bloomberg’s Dividend Forecast (BDVD) data can provide additional insight to support dividend-focused strategies. In our analysis of a monthly-rebalance backtest from 2020 to 2025, companies in the top quintile of forecasted three year dividend growth exhibited higher cumulative returns than those ranked by three-year actual dividend growth.

This suggests that the market may place greater emphasis on the potential for dividend growth than on realized dividend payouts. Bloomberg’s dividend forecast data can offer portfolio managers deeper visibility into expected dividend trends, supporting more informed portfolio management decisions.

Themes: Quantitative Trading, Alpha Generation

Roles: Portfolio Managers, Quantitative Researchers, Derivatives Traders

Bloomberg Datasets: Dividend Forecast

Intraday liquidity for accurate backtests

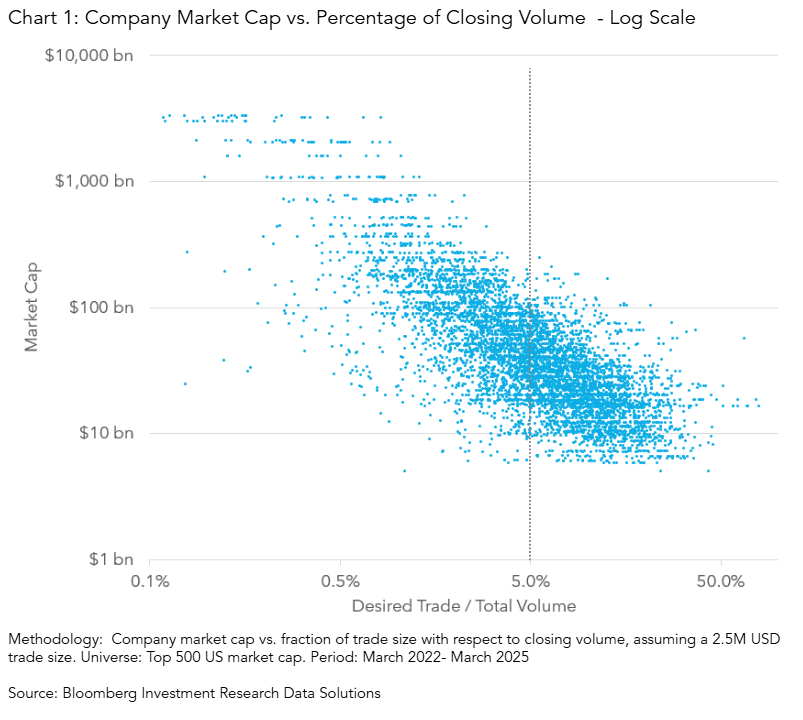

When performing backtests, quantitative researchers often treat the closing auction price as an executable level. This approach implicitly assumes that sufficient liquidity is available in the auction to support execution at that price. There is extensive evidence that market impact cannot be ignored, as it varies significantly with trade size, market capitalization, and time of day, for example, see Direct Estimation of Equity Market Impact (Almgren et al). In practice, trading with minimal market impact during the closing auction typically requires that the order size represent less than 5% of the auction’s total volume.

As illustrated in Chart 1, smaller-cap companies may exhibit closing auction volumes that are insufficient to support execution without market impact. More realistic backtesting results may be achieved by incorporating pricing from different intraday windows, particularly those characterized by higher volume and lower volatility. For this purpose, we consider the volume-weighted average price (VWAP) observed during each selected session.

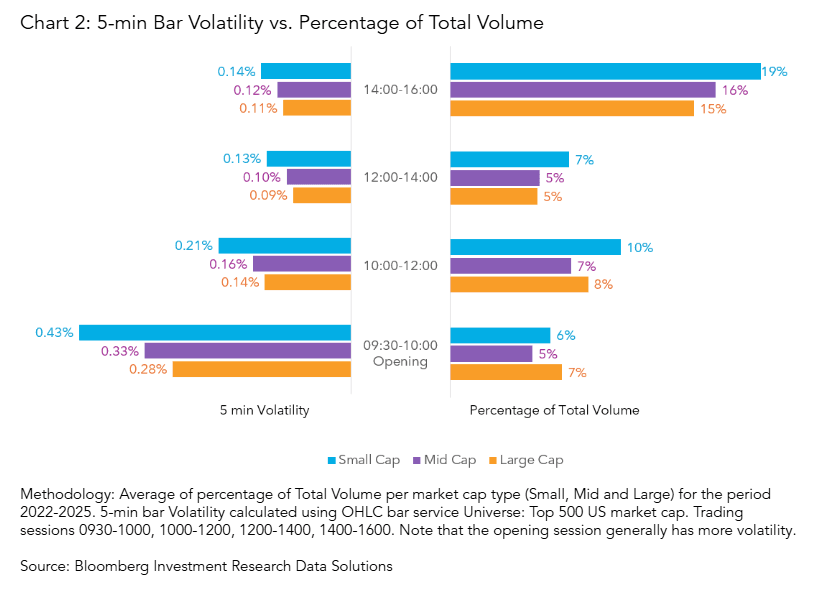

To support more effective execution, traders should take into account the available trading volume throughout the day, as this can also contribute to more realistic simulation results, especially in the context of trading smaller capitalizations. Chart 2 shows the distribution of available trading volume (right axis) across market-cap segments, alongside the realized 5-minute volatility (left axis) for each session. We observe that trading volume tends to be higher in the afternoon, while volatility is typically elevated in the morning around the market open. These patterns suggest that execution may be more favorable during the afternoon sessions.

This type of analysis enables tick-data users to conduct more granular assessments and can help refine the implementation aspects of their trading strategies, thereby supporting an improved risk-return balance.

Themes: Transaction Costs, Liquidity

Roles: Equity Portfolio Managers, Quantitative Researchers, Traders

Bloomberg Datasets: Tick History

How can we help?

Bloomberg’s Enterprise Investment Research Data product suite provides end-to-end solutions to power research workflows. Solutions include Company Financials, Estimates, Pricing and Point in Time Data, Operating Segment Fundamentals Data and Industry Specific Company KPIs and Estimates Data products, covering a broad universe of companies and providing deep actionable insights. This product suite also includes Quant Pricing with cross-asset Tick History and Bars. Additional solutions such as Geographic Segment Fundamentals Data, Company Segments and Deep Estimates Data and Pharma Products & Brands Data products will be available in 2025. All of these data solutions are interoperable and can be seamlessly connected with other datasets, including alternative data, and are available through a number of delivery mechanisms, including in the Cloud and via API. More information on these solutions can be found here.

Bloomberg Data License provides billions of data points daily spanning Reference, ESG, Pricing, Risk, Regulation, Fundamentals, Estimates, Historical data and more to help you streamline operations and discover new investment opportunities. Data License content aligns with the data on the Bloomberg Terminal to support investment workflows consistently and at scale across your enterprise.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 – Bloomberg. For each company, the predictive accuracy of Bloomberg Second Measure’s (“BBSM”) estimates will typically vary over time. BBSM does not guarantee that the accuracy levels, trends or correlations illustrated by the examples in this document will recur for any company in the future. The estimates have been generated by running a standard nonproprietary formula on analytical data about past consumer transactions. BBSM makes available information about this formula to Bloomberg Second Measure clients and the analytical data is also accessible to such clients. The Bloomberg Second Measure U.S. Consumer Spend Index is not administered by Bloomberg’s benchmark administration business and is not intended for use as a financial benchmark.