Data-warehousing sales forecasts look lofty as hyperscalers lurk

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analyst Mandeep Singh and Senior Industry Analyst Sunil Rajgopal. It appeared first on the Bloomberg Terminal.

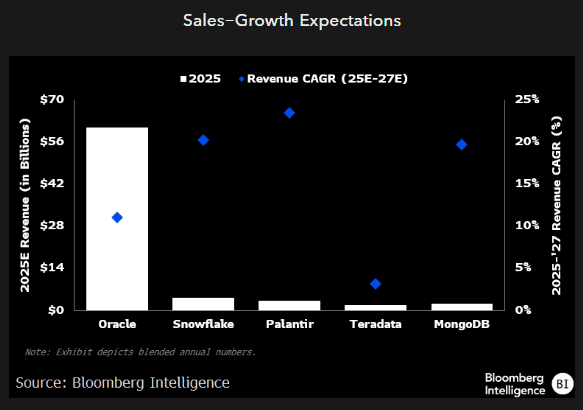

Growth prospects for Snowflake, MongoDB and Palantir should get help from enterprises moving past cloud optimization, but sales upgrades may be limited by customers spreading spending over longer periods and muted workload growth. Bundling cloud and database offerings to train and deploy LLMs gives hyperscale cloud providers and edge over pure-play peers.

Hyperscale positioning aided by generative AI

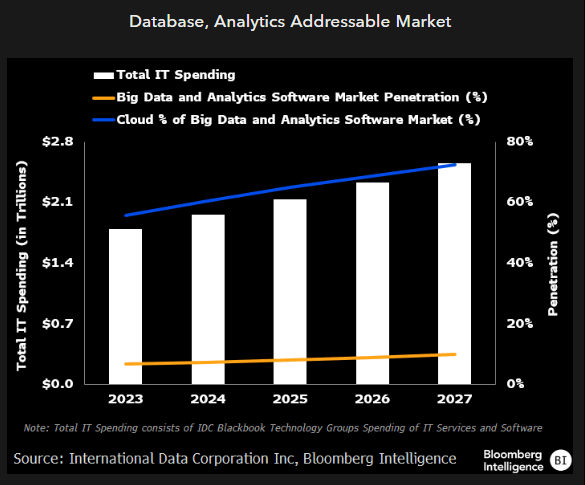

Rising interest in generative AI may be a near-term headwind for stand-alone spending on big data and analytics software, with many companies still early in the pivot to generative AI and training large language models. Though fine-tuning LLMs using customers’ structured and unstructured data could be an opportunity for increasing consumption, hyperscalers are still best positioned to bundle their infrastructure and database offerings.

Demand for vector databases has been aided by customization of LLMs for specific use cases, but most pure-play analytics providers—including Snowflake and Palantir—don’t have much exposure so far in that segment.

Slower pace of legacy displacements

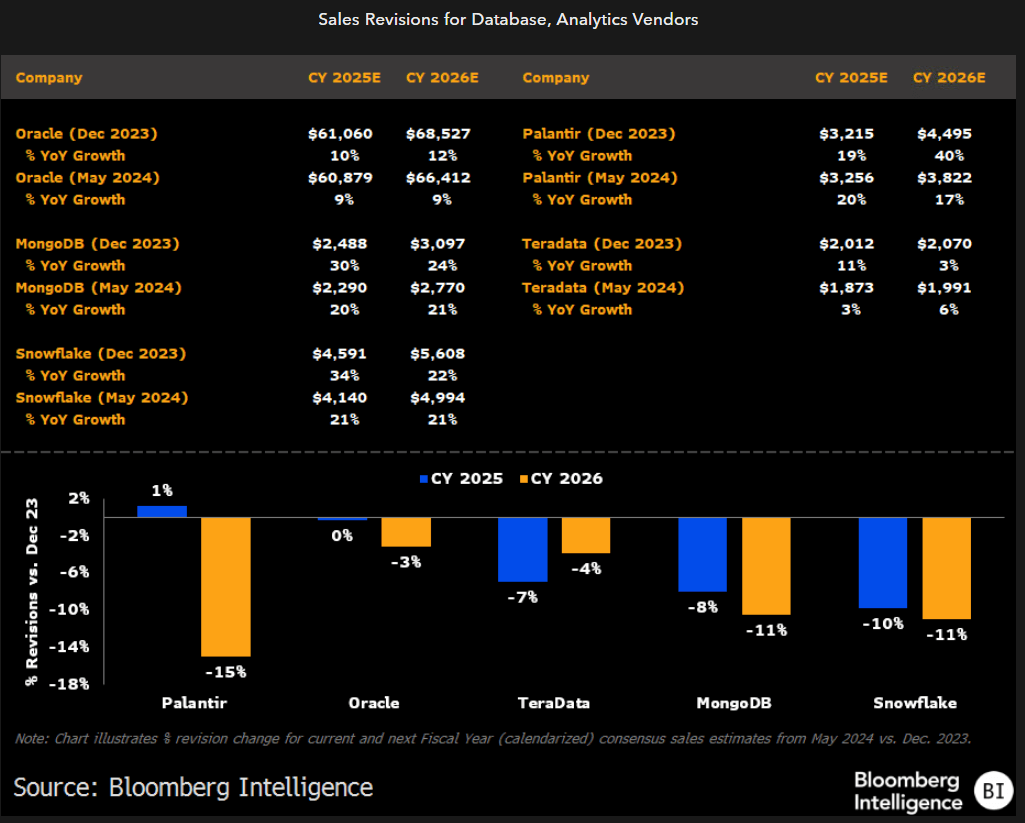

The recent outlook downgrade for MongoDB likely denotes the narrowing of challengers’ product edge against incumbents like Oracle that continue to ramp up investments in AI. Though hyperscalers have seen a resumption of growth in workload, the benefits haven’t been uniform. Sales projections for providers such as Snowflake, MongoDB and Palantir could face downward pressure amid lengthening sales cycles and muted workload gains.

Pressure on contract duration, net retention

Net retention rates remain pressured at most pure-play cloud-database and analytics providers, including Snowflake, Palantir and MongoDB. Additionally, new-customer growth has slowed for most of these companies as clients take longer to sign multiyear deals. Legacy relational-database providers like Oracle, whose sales estimates weren’t as elevated, have had modest negative consensus revisions, even as most new applications and workloads continue to be deployed on the cloud.

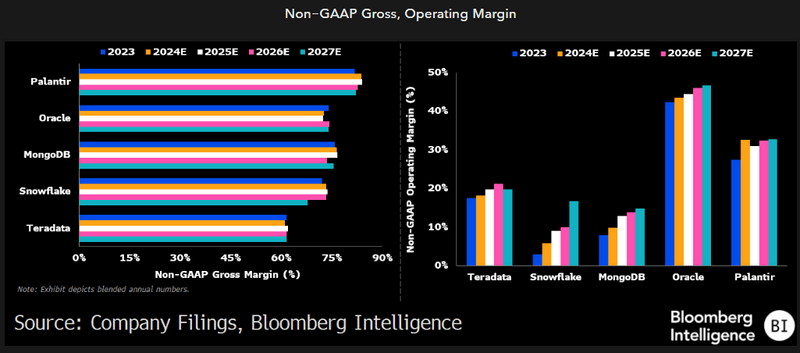

Margin limited by cost pressures, AI investments

Smaller deployments, a decline in net retention rates and growing infrastructure costs for generative AI could be drags on gross margins of pure-play cloud analytics peers such as Snowflake and MongoDB. Most of these businesses have signed multiyear deals with hyperscale providers to lower their cloud-infrastructure costs. Higher R&D expenses related to large language models, coupled with growing customer-acquisition outlays, may weigh on operating margins. The companies might try to trim their high direct-sales and marketing costs to improve operating leverage.

Competition from hyperscale cloud providers including Google, Amazon.com, Microsoft and Oracle that are bundling databases with their infrastructure-as-a-service offerings could further slow new customer additions.