Bloomberg Professional Services

Welcome to Data Spotlight, our series showcasing insights derived from Bloomberg’s 8,000+ enterprise datasets available on data.bloomberg.com via Data License.

In this edition, we focus on how investors can use AI to uncover insights from news feeds. We also look at supply chain data to see how it can be used by investors to understand risks and opportunities for companies, sectors and geographic areas.

Interested in our other data-related findings? Dive into these recent articles from the Data Spotlight series:

1. Using AI to extract insights from headlines

News feed provides timely information which drives markets and it has become increasingly important for quantitative investors to extract insights from news for their investment strategies. News Headlines and Story Bodies is Bloomberg’s flagship news feed product to help clients with that. The headlines cover over 10,000 topics, all regions and most companies. In addition, the product features a wide range of tagged topics, tickers and people mentioned in the headlines.

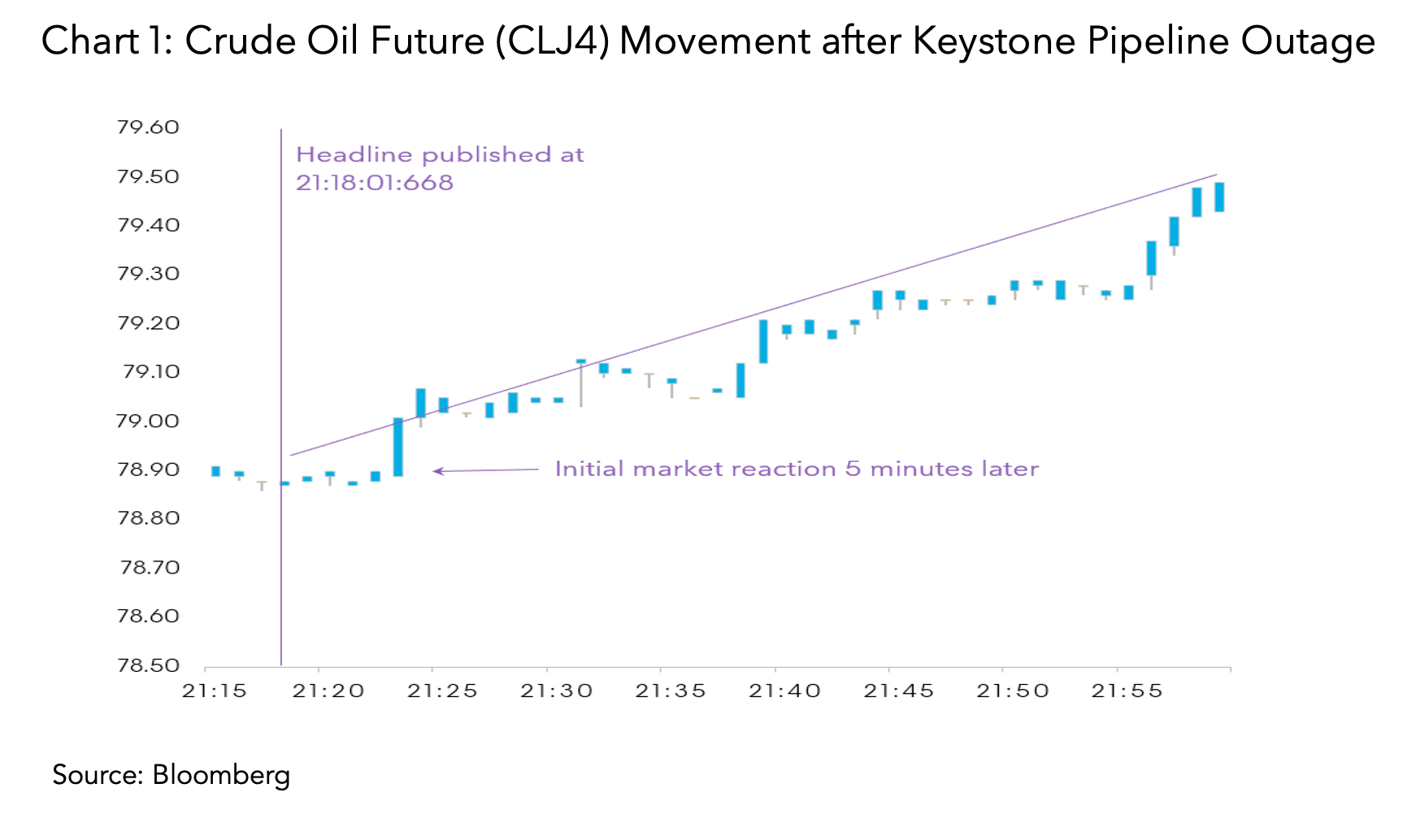

Even with our extensive tagging, a structured news feed will need to be interpreted and can have duplicated information. Let’s consider an example: the Keystone oil pipeline in the US was unexpectedly shut down on March 7, 2024, which resulted in a spike of oil price just minutes after the first headline (Chart 1). To accurately track this event, we want to follow news headlines with the same topic code.

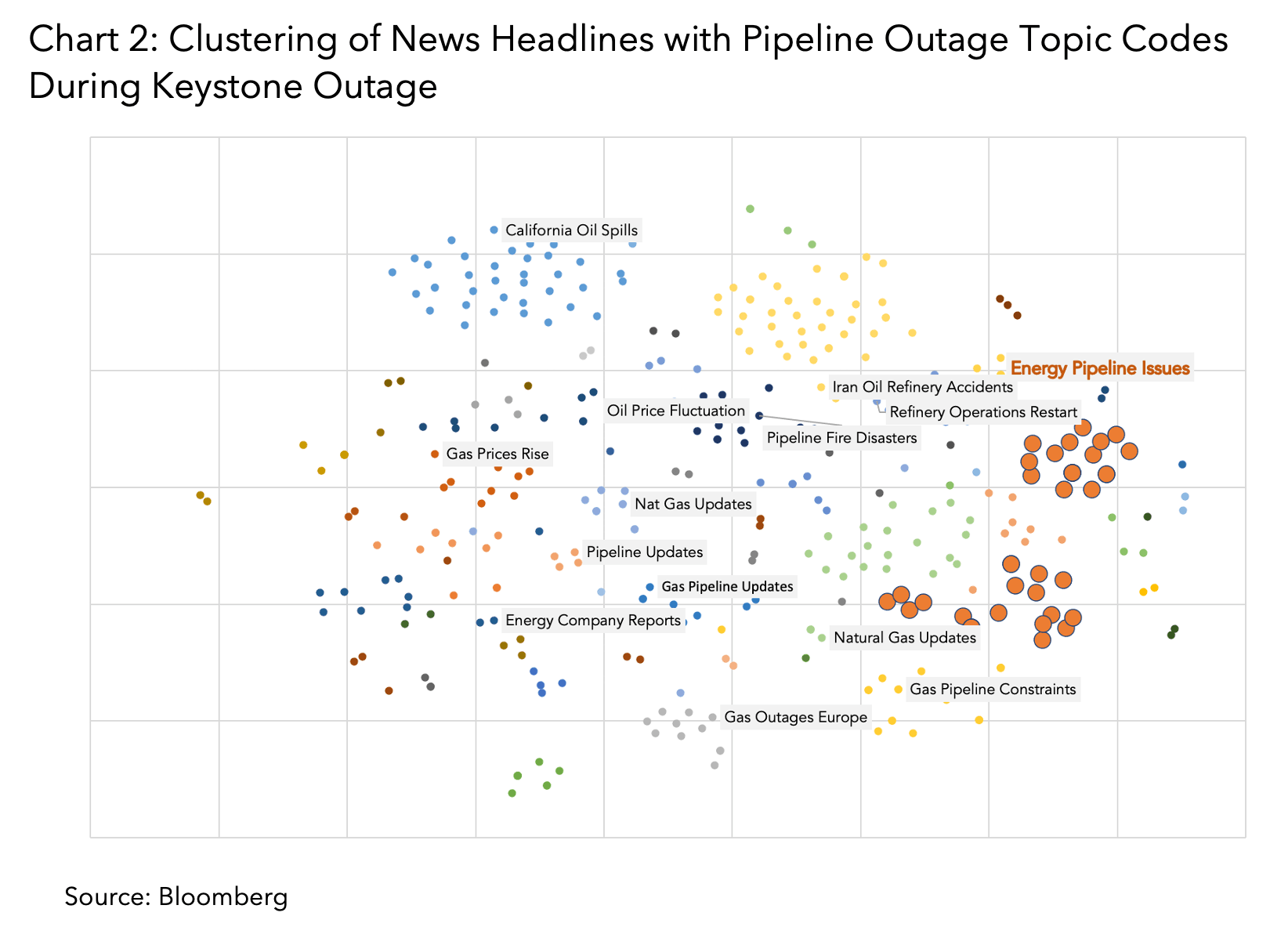

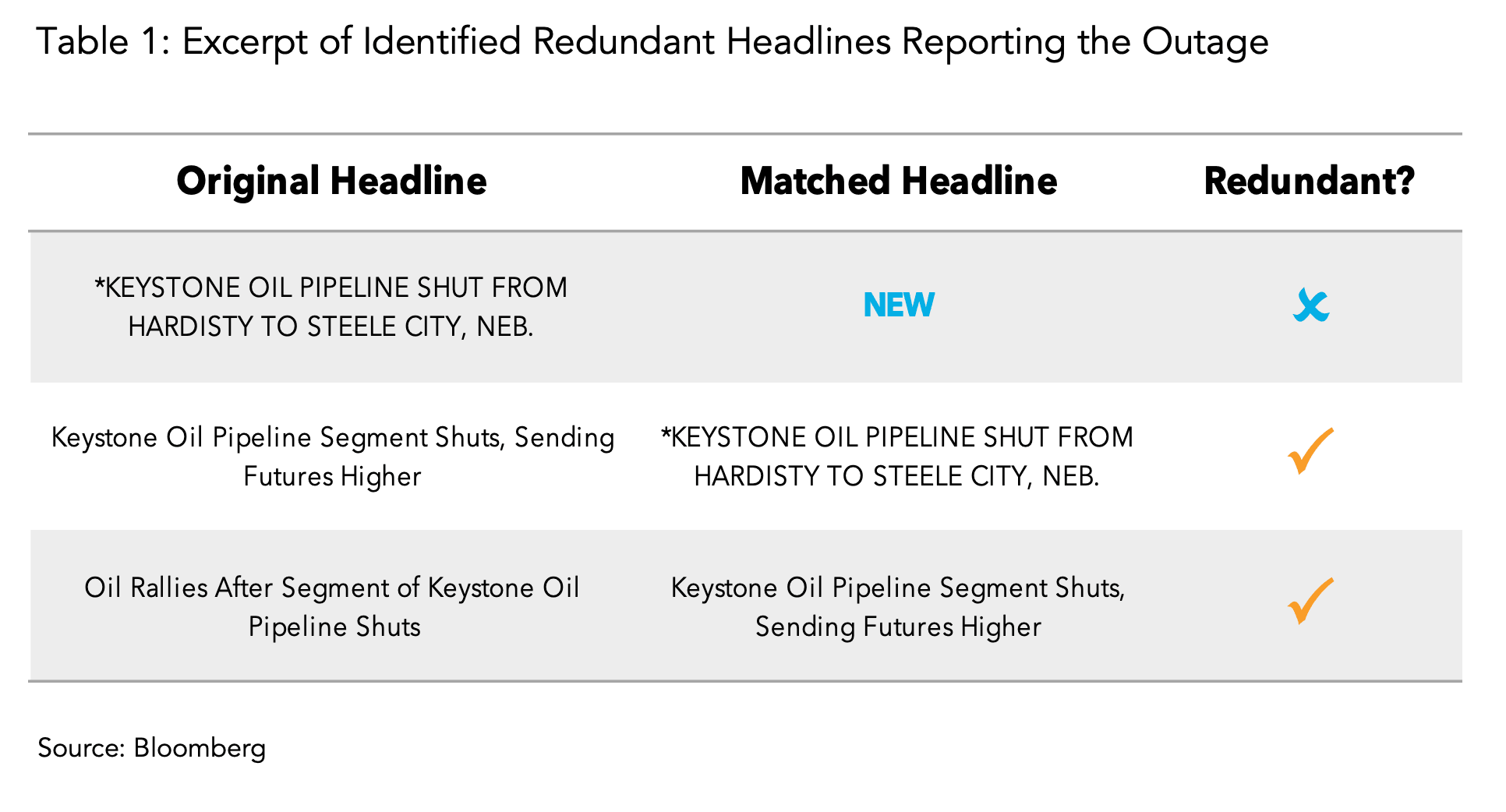

Based on Bloomberg News, users can apply large language models (LLMs) as a versatile tool for NLP (Natural Language Processing) analysis of these headlines. Using LLMs and embedding techniques, they can compute similarity between different headlines (Chart 2) and therefore identify duplicated information (Table 1). The number of headlines in a cluster can indicate the significance of the event being reported.

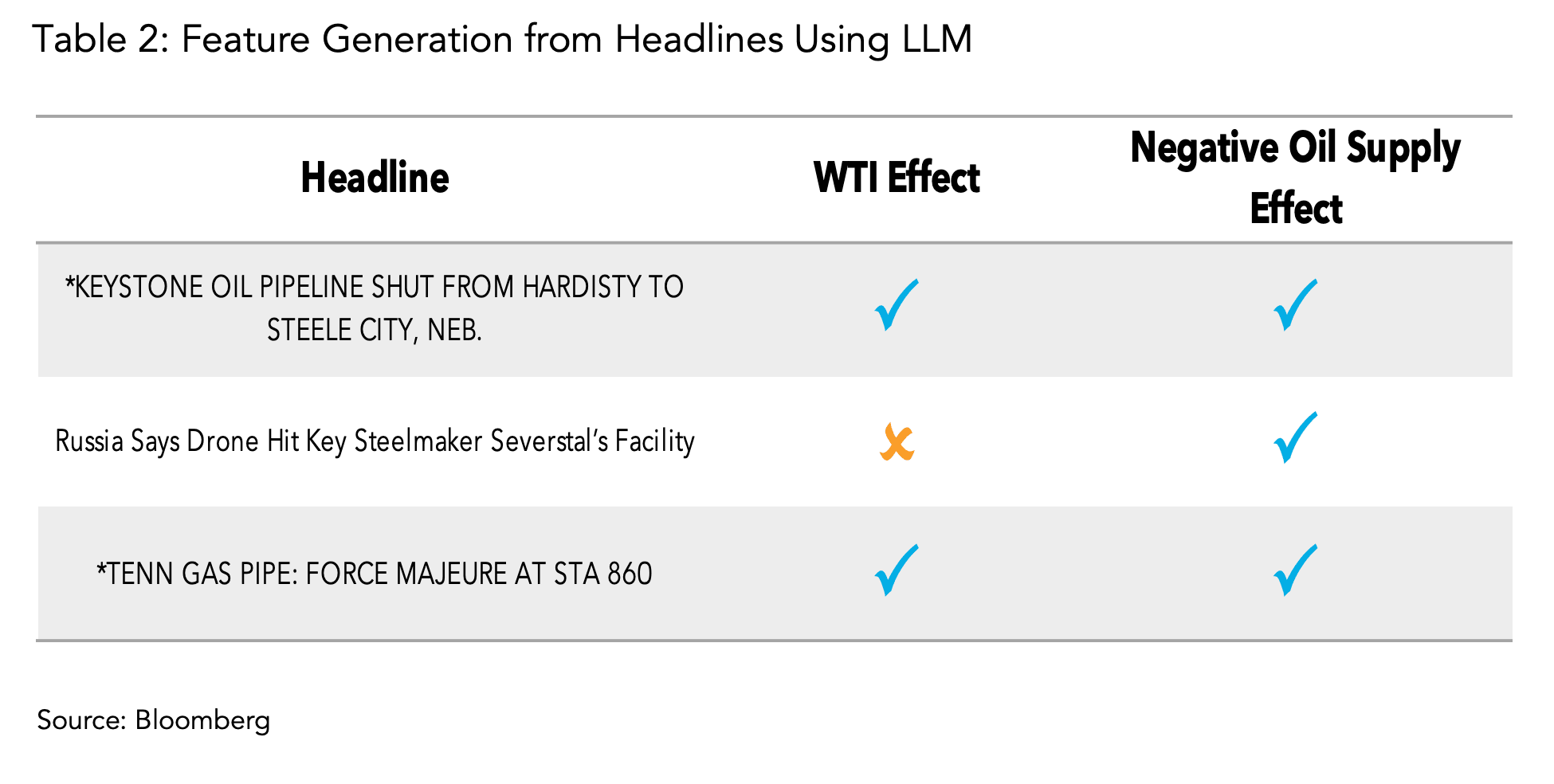

Once duplicates have been identified, prompt engineering is used to extract features such as ‘Is the WTI oil market affected by the event?’ or ‘Is the event likely to affect oil supply?’ (Table 2). Note that the LLM will be able to answer these questions much faster and in more volume than a human would. These features can then be used to generate market and volatility signals.

Themes: Macro Investing, Commodities

Roles: Quants, Global Macro Portfolio Managers, Hedge Funds, Strategists

Bloomberg Dataset: News Headlines and Story Bodies

2. Understanding full biodiversity risks through the supply chain

In September 2023, Taskforce on Nature-related Financial Disclosures (TNFD), published its recommendations aiming to help companies and financial institutions with a risk management and disclosure framework to assess and disclose their nature-related dependencies, impacts, risks and opportunities. Notably, this framework aims to help organizations assess and disclose their dependencies, impacts, risks, and opportunities related to nature, many of which may occur within their upstream and downstream value chains.

Understanding these nature-related dependencies is crucial for investors and corporations, as they can significantly impact market performance, brand reputation, or regulatory standing.

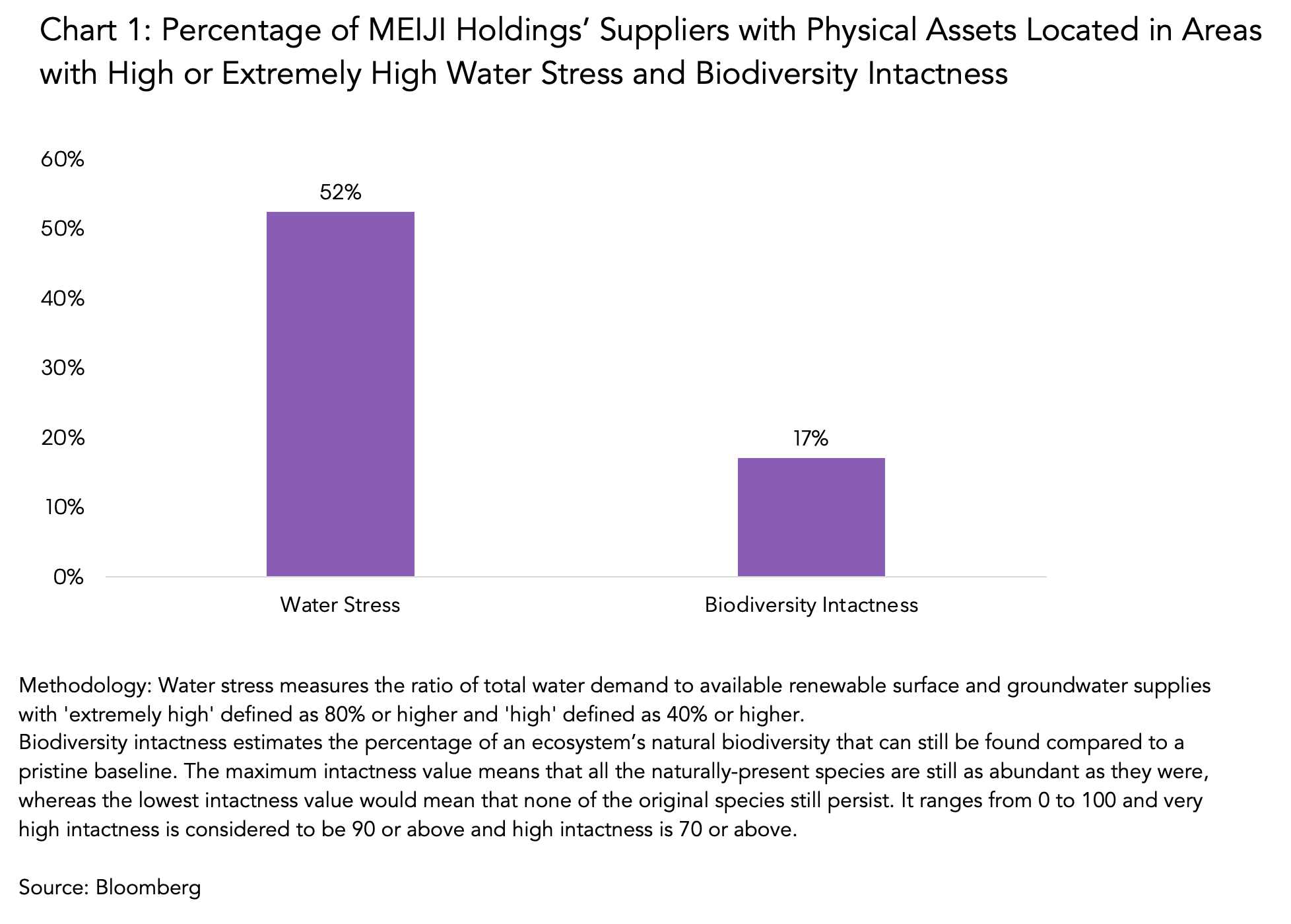

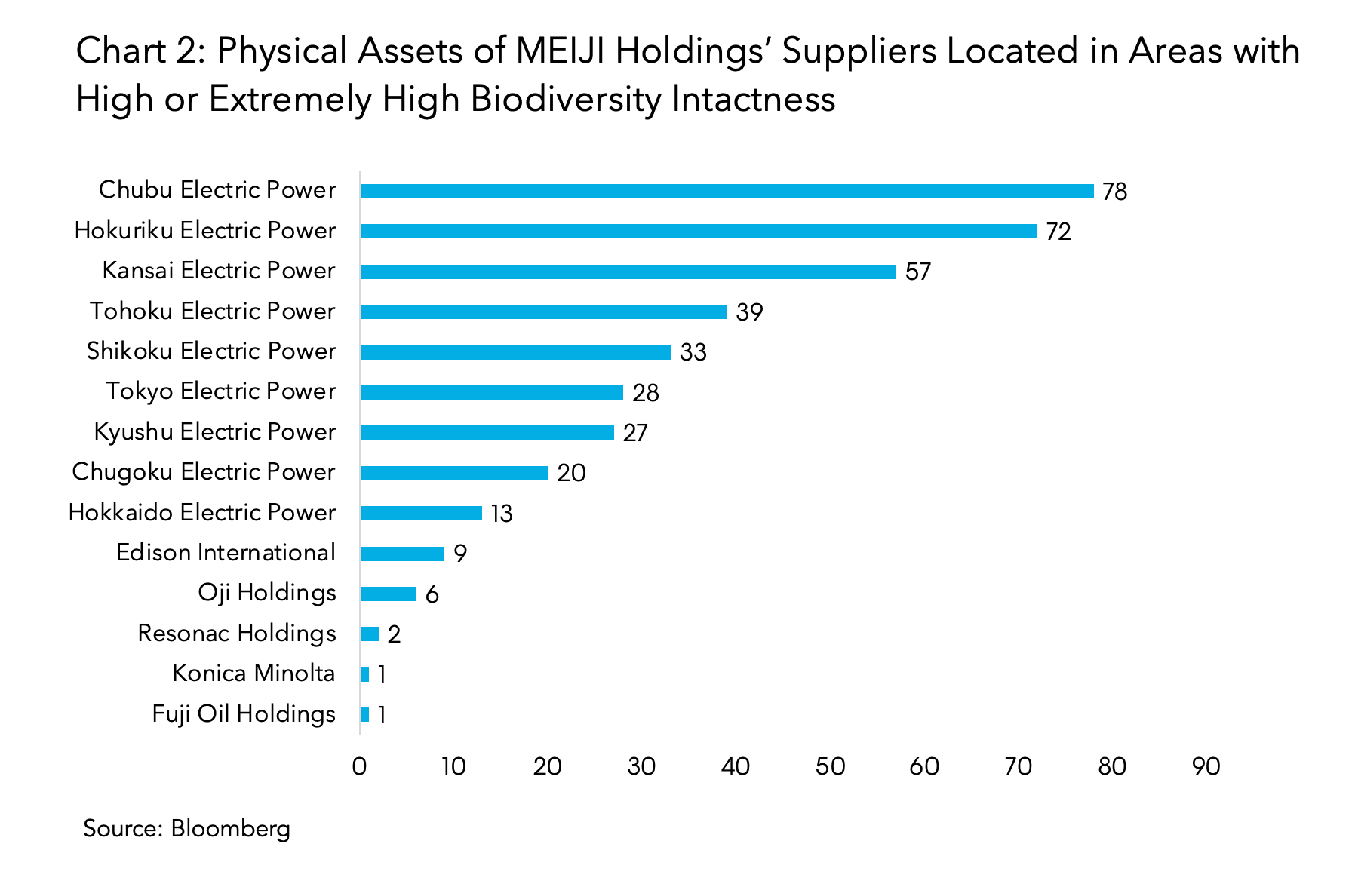

As an example, let’s look at MEIJI Holdings, a large Japanese food and pharmaceutical company that operates within a diverse supply chain that supports its extensive range of products. By utilizing supply chain data combined with biodiversity data, we can determine if any companies within its network have physical assets located in or near areas of high water stress or significant biodiversity intactness enabling users to get a better understanding of the company’s ecosystem with regards to those issues (Chart 1). Additionally, users can get a picture of individual suppliers’ contributions (Chart 2), providing a better understanding of the breakdown of the company profile.

Bloomberg Biodiversity data also provides statistics around the number of physical assets and the percentage of total physical assets facing such risks (Chart 2). Investors can also leverage Bloomberg’s Facilities data and overlay geospatial data layers, such as the Natural History Museum’s Biodiversity Intactness Index and the World Resources Institute’s Aqueduct water stress dataset, to gain an even greater understanding of the exact location of the physical asset.

Theme: Biodiversity, Risk Management

Roles: ESG Analysts, Portfolio Managers, Researchers, Corporates

Bloomberg Datasets: Biodiversity, Supply Chain

3. European auto sector: Warning signs of a bumpy road

Supply chain data serves as a crucial dataset for identifying risks and opportunities for companies, sectors and geographic areas.

To illustrate its value, we performed an analysis that integrated company financials with supply chain data, to generate new insights related to the European automotive industry.

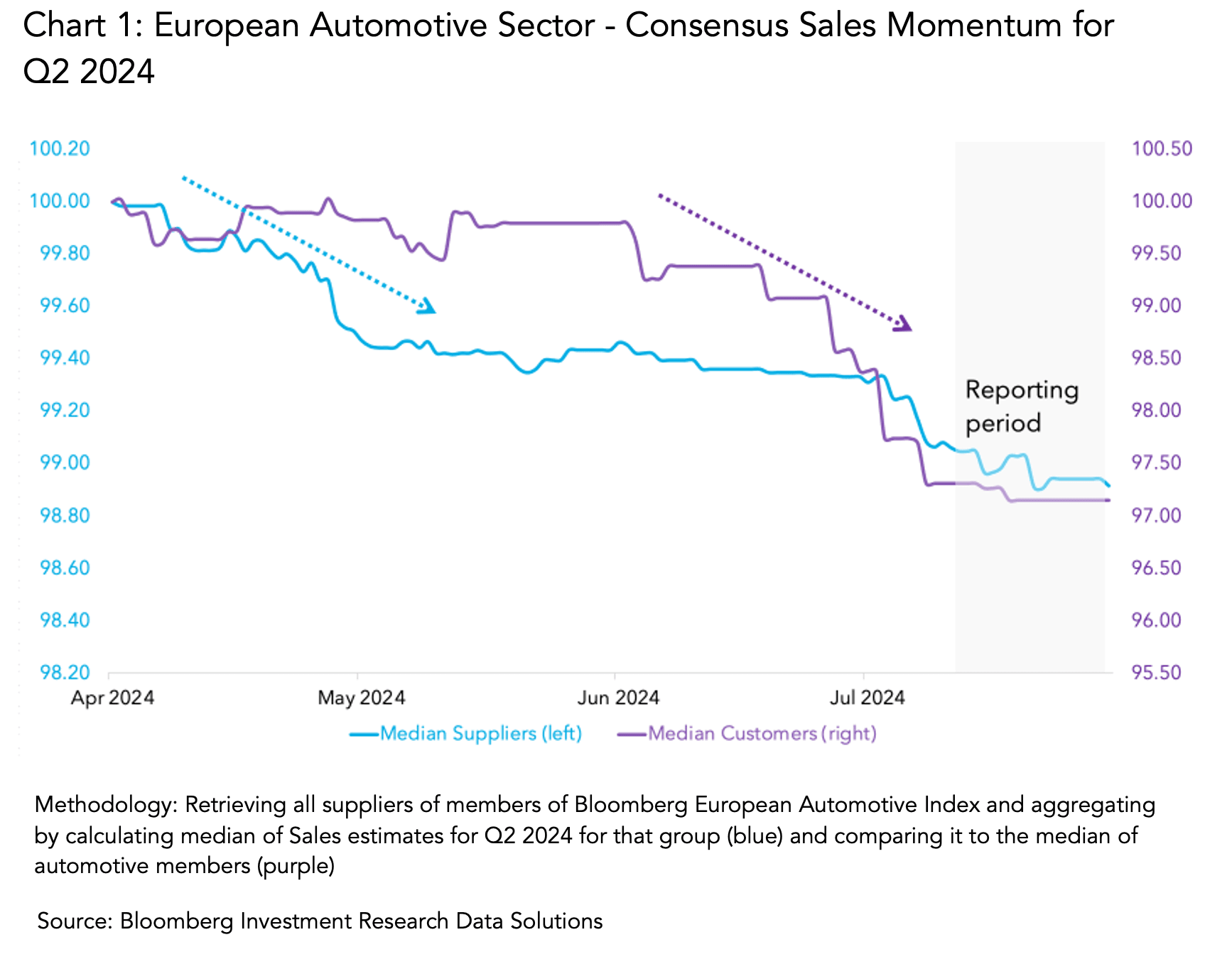

European automakers have seen a decline in sales momentum this year. Analyzing the performance of their suppliers reveals that this negative trend started before it became widely noticed.

As our analysis shows, suppliers to European automakers showed signs of slowing demand, foreshadowing the decline in sales momentum. This finding highlights the potential of integrating financial and supply chain data to get early warnings of industry trends and inform decision-making.

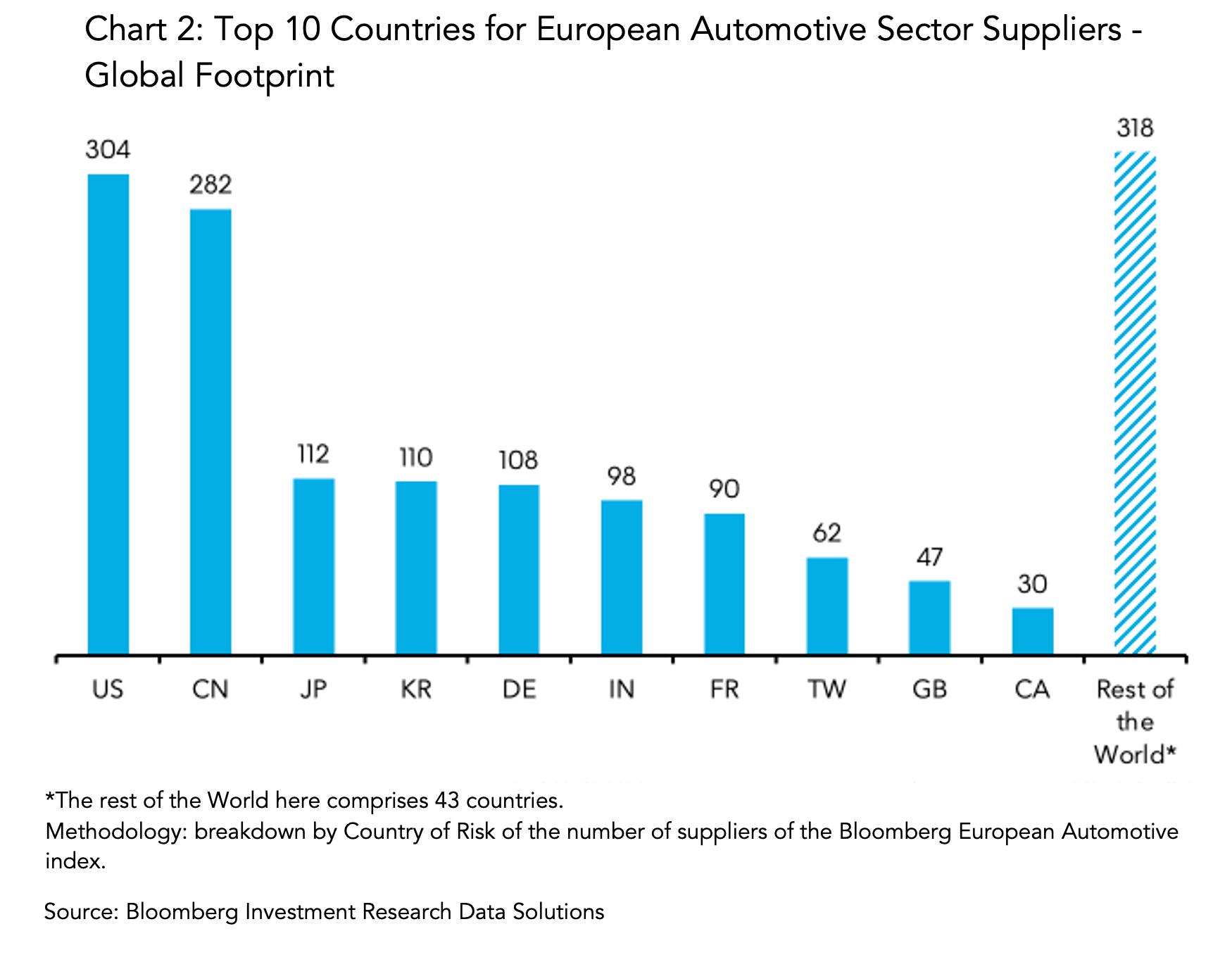

This type of research is made possible by a global and accurate supply chain coverage (more than 1500 suppliers for European Automotive sector, spread across 53 countries – see Chart 2) as well as timely availability of financial data, readily available in a research-ready format allowing users to seamlessly combine multiple data points types, accessible through Bloomberg Investment Research Data Solutions offerings.

Themes: Alpha generation, Risk management

Roles: Portfolio Managers, Analysts, Risk Managers

Bloomberg Dataset: Company Financials, Estimates and Pricing Point-in-Time, Supply Chain

Interested to learn more about our data offering? Bloomberg’s Investment Research Data Solutions business transforms the way customers extract value from data by providing the most comprehensive coverage and highest data quality in the industry.

Bloomberg Data License provides billions of data points daily spanning Reference, ESG, Pricing, Risk, Regulation, Fundamentals, Estimates, Historical data and more to help you streamline operations and discover new investment opportunities. Data License content aligns with the data on the Bloomberg Terminal to support investment workflows consistently and at scale across your enterprise.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.